I Got a Big Fat Nothing for a Retention Offer (but Kept This Card Anyway!)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Jasmin: My kids will report that I’m full of annoying “Mom-isms” which drive them crazy. One of their least favorites is “Just do it. It’s a life skill.“

So why can’t I take my own advice when it comes to calling credit card companies to ask for a retention bonus when a card’s annual fee is due? I put it off until the last minute and get a little anxious before picking up the phone.

It’s an easy call to make (just call the number on the back of your card) if you’re on the fence about canceling an annual-fee card. Often, the bank will sweeten the pot by giving you an incentive to keep the card and continue using it, like bonus points for spending or a rebate of the annual fee. But you have to ask.

After thinking “I’ll do it tomorrow” for weeks, I recently called AMEX to ask for a retention offer – and received exactly nothing. But I kept the card anyway. Here’s how it went down.

It’s Worth Calling for a Retention Offer

In the past, I’ve had great luck with American Express and Citi offering deals for keeping a card when the annual fee has come due. A couple of times they’ve waived all or part of the annual fee. Others, they’ve offered bonus points or an annual fee waiver for completing a certain amount of spending on the card.

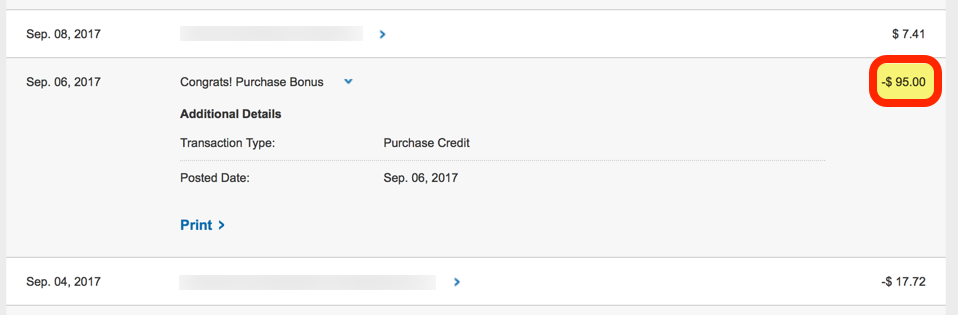

For example, Citi gave me a $95 statement credit the last time the annual fee on my Citi Premier Card came around. All I had to do was spend $95 in the next 3 billing statements, which was a no-brainer! Plus, they offered a bonus 500 Citi ThankYou points in each of the next 16 billing cycles so long as I spent $500+ per cycle.

AMEX has been similarly generous in previous years. And team member Keith got a bonus of 7,500 AMEX Membership Rewards points to keep The Business Platinum® Card from American Express card recently.

So when I finally got up off my behind and called them to ask for a retention bonus on my Starwood Preferred Guest® Business Credit Card from American Express card, I was hopeful.

Why I Considered Canceling the AMEX Starwood Business Credit Card

I’d put over $9,000 in purchases on my AMEX Starwood Business credit card in the past year, and paid off my balance in full and on time every month. But given the upcoming changes to the card, I wasn’t sure if it was worth paying the $95 annual fee again (See Rates & Fees).

This card’s been in my wallet for a few years now because Starwood points are otherwise hard to earn. And the kids and I have enjoyed free Sheraton Club Lounge access just by having the card, which has saved us money. But the Sheraton Club Lounge access perk is going away on August 1, 2018, which I’m not terribly happy about.

Online reports suggested lots of folks were getting retention offers when they called to cancel the card. But when I spoke to a rep, she actually tried to convince me the card wasn’t losing the perk (so I politely read her the email I’d received from AMEX). Regardless, she let me know there were no offers available on my account.

I asked her to check with a supervisor. Nothing. However, she did remind me of something I’d completely forgotten about…

Starting August 1, 2018, the AMEX Starwood personal and business credit cards will offer an annual free night award (at participating hotels costing 35,000 Marriott points or less) on your card anniversary. Remember, that’s also the time Starwood and Marriott will merge their loyalty program currencies.

This new benefit is definitely worth more than $95 annual fee, especially if you use your free night at higher-category hotels or in expensive cities. For example, you’d pay over $225 per night with tax for a standard room at the Courtyard Waikiki Beach in Hawaii.

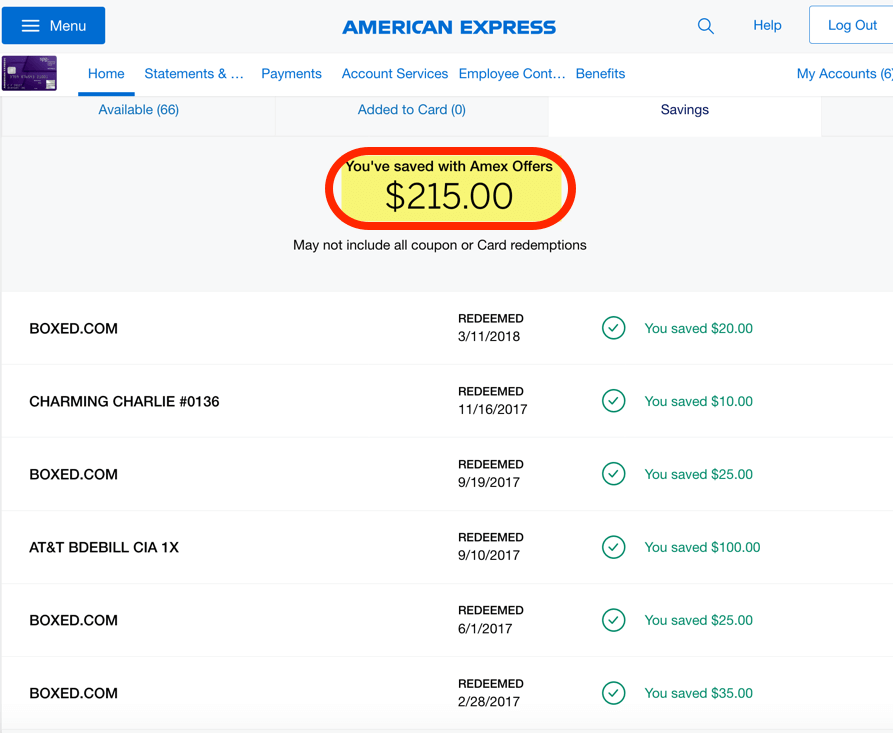

I also remembered all the AMEX Offers I’d taken advantage of over the past year with the card. A quick look at my account showed I’d saved $215 from AMEX Offers in just over a year. That’s more than double the annual fee.

It didn’t take much else to convince me to keep the AMEX Starwood Business credit card for another year. Paying the $95 annual fee is more than worth it between the new annual free night and savings from AMEX Offers. Even without a retention bonus!

Bottom Line

If your card’s annual fee is coming up and you’re not sure if you want to cancel, it’s worth calling the bank to see if there are any incentives for you to keep the card. This could include statement credits to offset the annual fee or bonus points for ongoing spending.

Even though I hate making retention calls (I don’t know why, because it’s super easy), I’ve had success in the past getting offers from Citi and AMEX. But this time, when I called to let them know I was thinking of canceling my AMEX Starwood Business credit card, there were no retention offers on my account. So while it’s always worth a shot, there’s no guarantee you’ll get an offer.

Despite not being successful this time, I kept the card anyway. Because starting in August 2018, the AMEX Starwood Business card will offer an anniversary free night at hotels costing 35,000 Marriott points or less, which will more than offset the annual fee. And I remembered I’d saved $215 in the past year or so with AMEX Offers from the card. So keeping it was actually an easy decision!

What about you? Let me know if you’ve recently gotten a good retention offer in the comments!

For rates and fees of the Starwood Preferred Guest Business Card, please click here.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!