How to Dispute a Charge on Your AMEX Credit Card

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Have you ever found a transaction on your credit card statement that you didn’t make?

A discovery like this can be unsettling! Thankfully, American Express makes it easy to dispute unfamiliar transactions.

I recently disputed a charge for ~$161 from Care.com I found on my Starwood Preferred Guest® Credit Card from American Express. The process was easy, and my account was reimbursed in just a few weeks!

I’ll show you the easy steps I took to get my issue resolved, and my money back!

Disputing a Credit Card Transaction With American Express

Last July I discovered a transaction I knew I hadn’t made. So I followed the quick instructions on my AMEX web page to fix the matter.

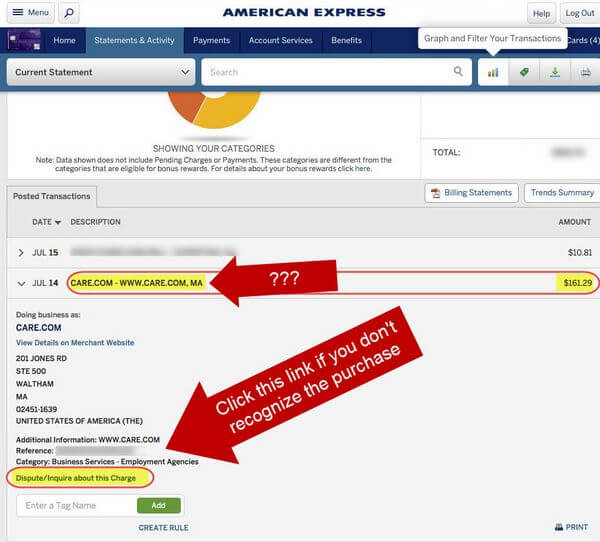

Step 1 – Click “Dispute / Inquire About This Charge”

When logged-in to your AMEX account, view your posted transactions and click on the transaction you’d like to dispute. Click the link at the bottom of the transaction information, called “Dispute / Inquire about this Charge“.

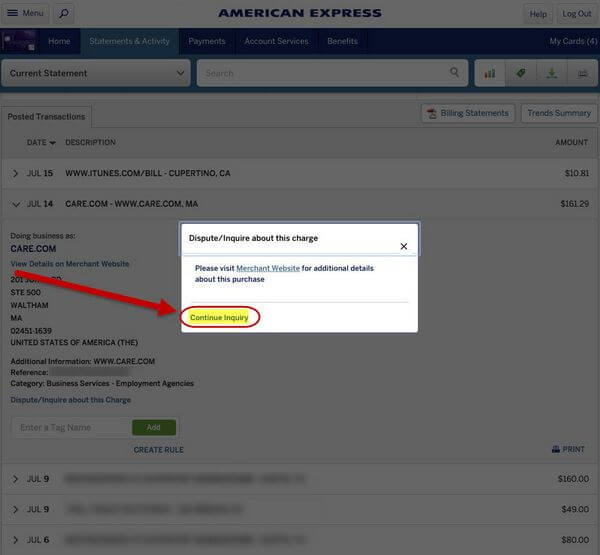

Step 2 – Continue the Inquiry

After initiating the dispute, a box will pop up asking you if you’d like to continue the process. Click “Continue Inquiry“

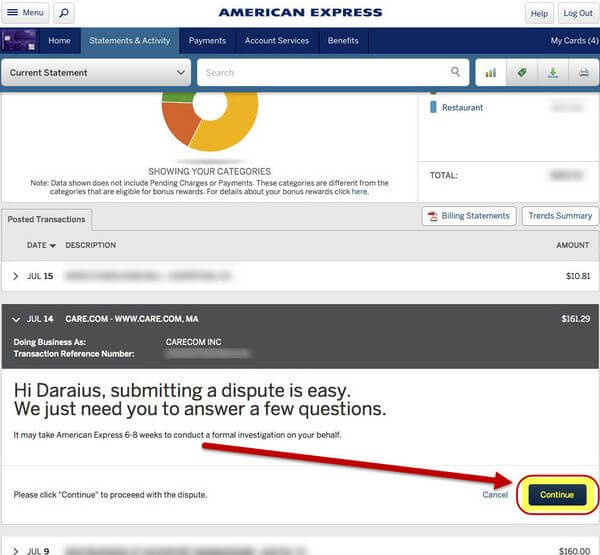

Step 3 – Verify You Wish to Pursue the Dispute

American Express will give you information on the estimated time it will take them to examine your dispute. Click the “Continue” button.

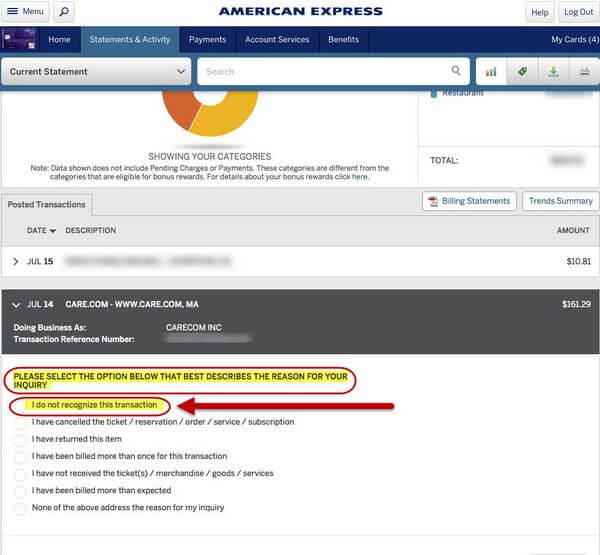

Step 4 – Answer Questions About Your Dispute

You will see a multiple choice menu. Tell AMEX the nature of your dispute by selecting the appropriate option (i.e. “I do not recognize this transaction“).

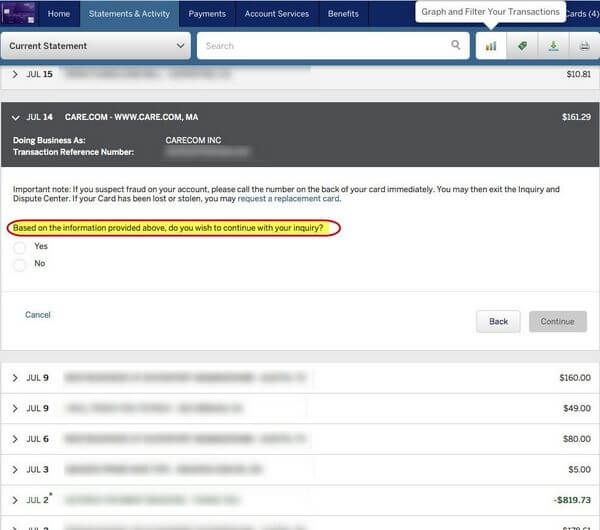

Step 5 – Confirm Your Inquiry

AMEX will ask you 1 more time if you really want to submit your inquiry. Click “Yes“.

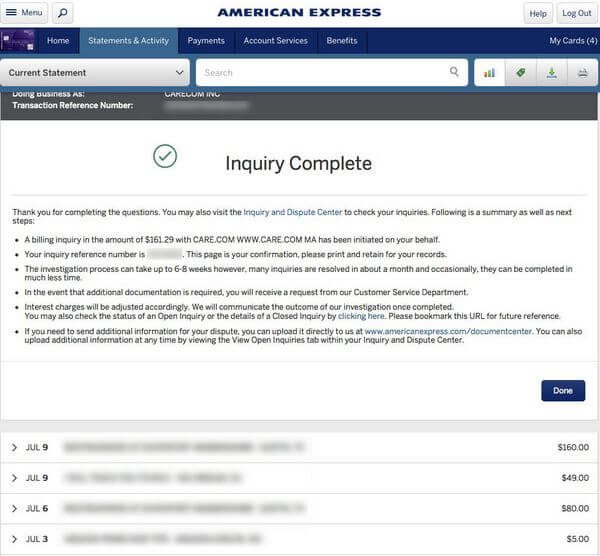

Your part is finished! American Express will take care of the rest, and will let you know if they need anything else from you. You will see a message giving you the details about your completed inquiry.

AMEX Keeps You in the Loop

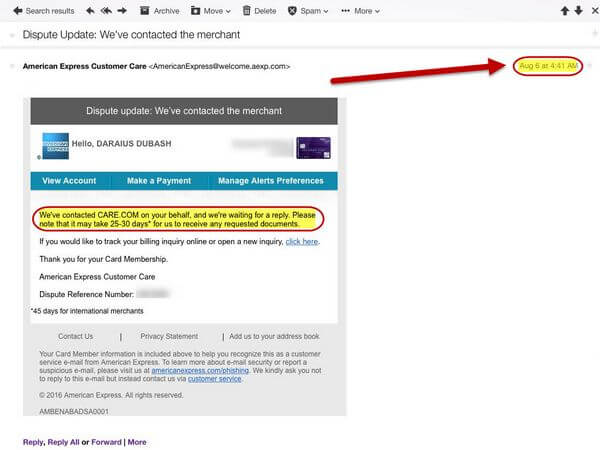

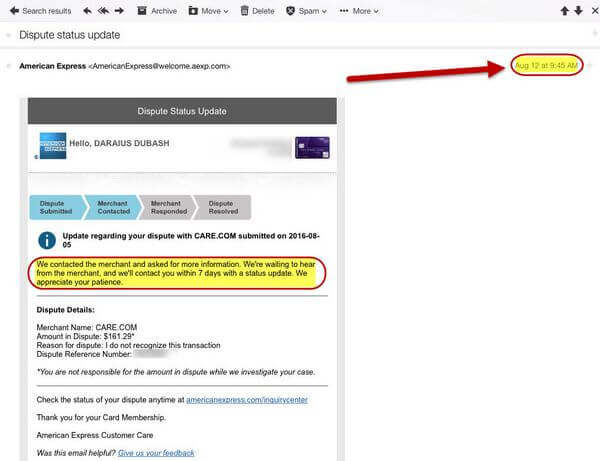

I was very impressed with how well American Express updated me with the status of my dispute! They sent several emails, which made me feel really involved.

I soon received an email update telling me they had contacted Care.com

Less than a week later, I received more information. AMEX had requested more information from Care.com, and was waiting on a response.

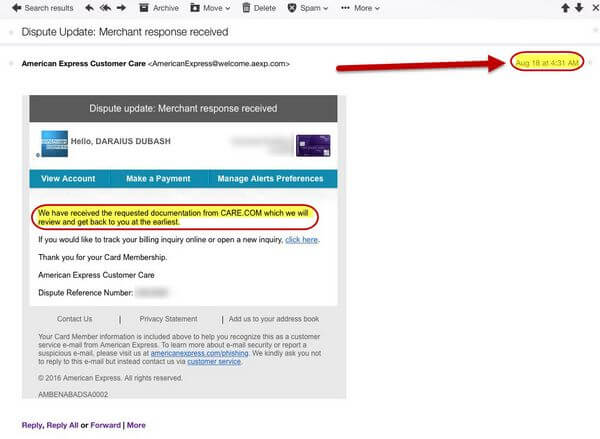

Less than 2 days later, AMEX sent a 3rd update. They said they would contact me when the investigation was finished. I was relieved that I didn’t have to go through the hassle of providing additional info!

Four days later, AMEX emailed to tell me they were waiting on documentation from the merchant. They would fill me in when they knew more.

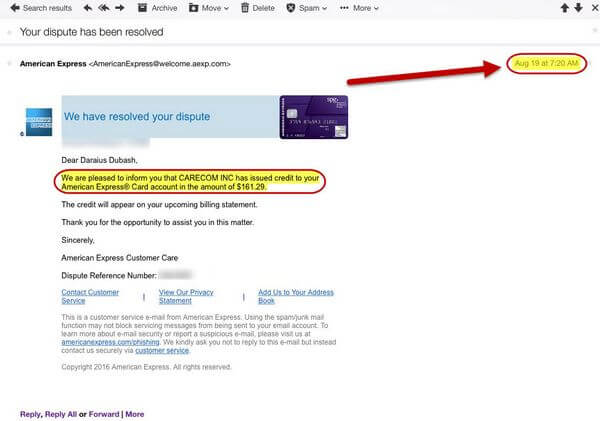

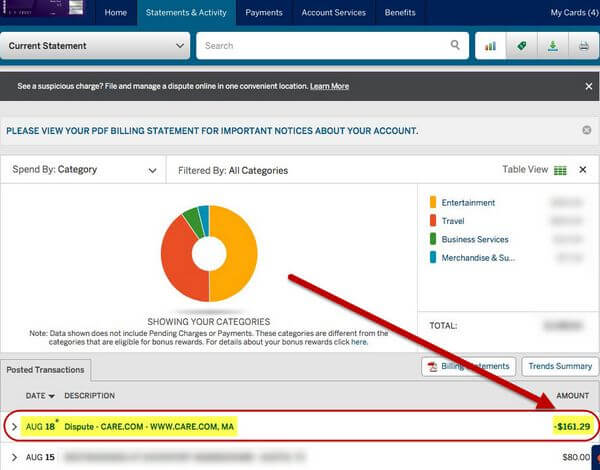

I was ecstatic! I signed-on to my American Express account, and sure enough, the charge had been refunded a day earlier.

My transaction was reimbursed within 3 weeks of filing my dispute!

Bottom Line

Hopefully y’all will never need to file a dispute with AMEX. But if you do, it’s a painless process. I’m very impressed with American Express customer service!

Filing a dispute was quick and easy. And I love how well they kept me in the loop with my inquiry! The updates weren’t exactly necessary, but it made me feel like I was a part of the action.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!