New to American Express Serve? Here’s What You Need to Know

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

If you’re new to American Express Serve or are considering switching to Serve from a Bluebird account, you might have questions about how Serve works.

Serve is a prepaid card and is similar to Bluebird in many ways, but there are some differences. But many of the features will be familiar to you if you’ve had Bluebird before!

What Can You Do With Serve?

Link: American Express Serve

Link: Sign-Up for American Express Serve

American Express Serve has many of the features of an online bank account. You can add funds, direct deposit, pay bills, deposit checks, transfer money, and withdraw cash from ATMs. And you can create sub-accounts for your partner, kids, babysitter, or anyone you’d like.

1. Add Funds

Link: Add Funds to Serve

You can add money to your Serve account in several different ways. Most of us are looking for ways to add fund (to pay bills) that involve directly or indirectly using a miles and points credit card. The good news is, Serve lets you do both!

a) Cash, Debit, or Gift Cards Loads at a Store

If you want to reload your Serve account, you can do so at the following stores:

- CVS (cash only)

- 7-11 (cash only)

- Walmart (cash and debit only)

- Family Dollar (cash, debit, AND gift cards)

Many folks have been switching to Serve now that Family Dollar allows loading with PIN-enabled gift cards. But you’re limited to $500 per day.

Walmart also lets you load Serve with some gift cards (Vanilla Visa gift cards do not work).

You can buy gift cards with a miles-and-points earning debit card at places like office supply stores, malls, CVS, and online.

Note: You can also load Serve with Vanilla Reloads, but most stores will no longer sell them with a credit card.

The limit for loading Serve with cash, debit, gift cards, or Vanilla Reloads and MoneyPaks is $2,500 per day or $5,000 per month.

However, folks have reported that trying to load more than $500 in 1 day at Family Dollar with a gift card results in the 2nd transaction being declined! This Flyertalk thread has a lot of good information on the Family Dollar situation.

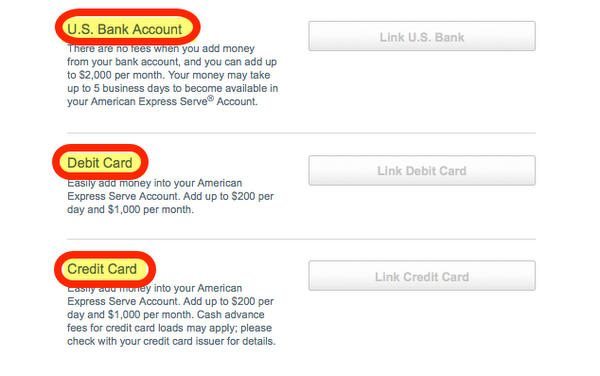

b) Load Serve Online From Your Bank Account, Debit Card, or AMEX Credit Card

You can also directly load your Serve account from your bank account, debit card, OR AMEX credit card online!

You’ll need to link your bank account, debit card, or AMEX credit card to your Serve account before you can add funds. Do NOT try loading a gift card online, because it will freeze your account!

The limits for adding funds in this way are as follows:

- From your checking or savings account: $2,000 per month

- From your debit card: $200 per day and $1,000 per month

- From your AMEX credit card: $200 per day and $1,000 per month

You must use your own credit or debit card to load your Serve account, not your partner’s.

c) Add Checks or Direct Deposit

You can deposit checks to your Serve account using their mobile app (for iOS and Android devices). You take a photo of the check using your phone and it deposits into your account!

You can also set up direct deposit, much like a normal bank account.

The limits for adding checks or making direct deposits to your Serve account are $2,000 per day and $10,000 per month.

Note: There is an add money limit of $10,000 per month TOTAL to your Serve account. This includes transfers, direct deposits, and adding money from your bank account.

2. Withdraw Funds

Link: Serve ATM Withdrawals

Link: Serve Bill Pay

Link: Serve Transfer Funds

You can remove funds from your Serve account by ATM withdrawals, bill pay, and transferring money to other folks with Serve accounts (or to your own bank account)! And remember, Serve is like a debit card, so you can make purchases in-store or online anywhere American Express cards are accepted.

a) ATM Withdrawals

You can withdraw cash at any ATM that accepts American Express cards. And in the US, if you use a MoneyPass ATM, there are NO fees. Otherwise, the fee is $2 at other ATMs.

Here’s the MoneyPass ATM locator if you want to see where the nearest 1 is to you. You’re limited to withdrawing $750 per day and $2,000 per month.

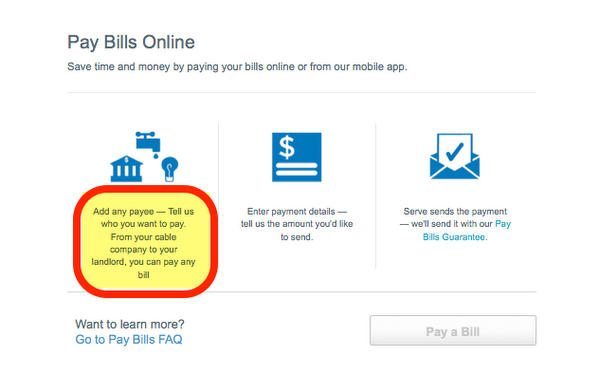

b) Bill Pay

You can pay almost any bill online (even things like rent, handymen, or babysitters) with Serve. Once you’ve added your payee details and the amount you’d like to send, Serve will process the payment and either send it electronically (for registered payees, like credit card companies) or by mail (like to your landlord).

This is a great way to pay bills!

Note: One of the disadvantages of Serve is that they do NOT issue paper checks like Bluebird does!

c) Transfer Money

You can transfer funds to other Serve account holders from your computer or mobile device. And if you wish, you can transfer funds back into your own bank account.

3. Create Sub-Accounts

Link: Create Serve Sub-Accounts

You can create sub-accounts for family members or other folks you need to pay on a regular basis. Perhaps your kids are at college and you’re giving them an allowance, or you have a regular babysitter you’d like to pay. Each sub-account comes with its own card, but you can see where the money’s being spent.

Serve also lets you create separate reserve accounts you can use for saving for a big purchase or a trip.

Are There Fees?

Link: American Express Serve Fees and Limits

You’ll pay minimal to no fees on your Serve account.

If you buy a temporary card at 1 of the following retailers, you’ll pay ~$4 for the card:

- CVS

- Duane Reade

- Family Dollar

- Fred’s Super Dollar

- Office Depot

- Sheetz

- Walgreens

- Walmart

Once you register your card online, you’ll get a permanent card in the mail in 7 to 10 days. You can use the temporary card, but you won’t have access to many Serve features like bill pay and credit card loading online.

If you choose to sign-up online without buying a temporary card, it costs nothing. You’ll still wait 7 to 10 days for your new card to come in the mail.

You’ll pay a monthly fee of $1 per month (except in New York, Texas, and Vermont). If you receive a direct deposit, add more than $500 to your account, or have your card in Softcard (a device that lets you pay with your phone), the fee is waived for that month.

Everything else is free, unless you withdraw cash from a non-MoneyPass ATM. In that case, you’ll pay $2 per withdrawal.

What About Softcard (formerly Isis Wallet)?

Link: Serve and Softcard (Isis Wallet)

Note: Isis Wallet has been renamed Softcard. American Express is in the process of updating their graphics and websites with the new name.

Softcard (formerly named Isis Wallet) is an app you can download to some smartphones that allows you to make contactless payments with your phone. If you have an iPhone, you’ll also have to buy a special case that allows you to use Softcard. Other phones have the technology built in.

When you register your Serve account with the Softcard app, you’ll be able to make contactless purchases directly from your Serve account using your phone. Not all retailers allow Softcard payments, so check their location finder 1st to see if it makes sense for you.

But most folks are interested in Softcard because it increases the online debit card and AMEX credit card load limits to your Serve account. Normally, you can only load $200 per day and $1,000 per month using a debit card or AMEX credit card.

Serve with Softcard allows you to load $500 per day and $1,500 a month using a debit or AMEX credit card. So if you need to meet a lot of minimum spending requirements, Serve with Softcard could be a better option for you.

Bottom Line

Serve is a prepaid card account, much like an online bank account, with many similar features to Bluebird. You can add and withdraw funds, pay bills, and transfer money to yourself or other Serve account holders.

You may find Serve useful because you can load it directly with an AMEX credit card online to help pay bills and to earn miles & points. And now you can use gift cards (bought with a miles and points earning credit card) to load Serve at Family Dollar stores.

There are no paper checks with Serve like there are with Bluebird. And you may pay a $1 monthly fee, or $2 for withdrawing cash at non-MoneyPass ATMs. But otherwise, there are no fees.

Have you used Serve or recently switched from Bluebird? How do you like it?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!