Change My Mind – This Is the MOST FREE 5-Star Vacation You Can Take

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

I’ve been flirting heavily with a trip to the Caribbean. It’s a trip that trends much differently than what I’d normally plan. But at the moment it sounds SO relaxing, and it is SO cheap. And yes, it involves all-inclusive resorts.

The key to this free trip is with:

- Southwest points

- Hyatt points

- Capital One miles (optional)

I’ll run down the strategy with you and show you how it’s possible to actually pay zero dollars for a bucket list vacation. You can sign-up for our newsletter if you want more strategies to take 5-star vacations while paying no money.

Booking Flights to One of the Best All-Inclusive Resorts With Points

Here’s the itinerary:

- Book flights to Cancun with Southwest points

- Stay at the Hyatt Zilara all-inclusive resort with Hyatt points

- Use Capital One miles to pay for all incidental travel expenses

Again, Capital One miles aren’t that important here. But to achieve a zero dollar vacation, you’ll need them. I’ll quickly show you my booking process so you can replicate it from your own home airport.

1. Book a Stay at the Hyatt Zilara Cancun

Hyatt has a handful of all-inclusive resorts around the Caribbean and Mexico. They’re called Hyatt Ziva (family-friendly) and Hyatt Zilara (adults-only).

From my research, Hyatt’s best all-inclusive resorts seem to come from the Hyatt hotels in Cancun. The Hyatt Zilara costs 25,000 Hyatt points per night. That’s pretty good, considering you’ll receive:

- An ocean view suite with a giant hot tub

- Unlimited free food at 6 restaurants and 5 bars

- Free top-shelf alcohol

- Free activities and entertainment

Booking an all-inclusive hotel with points is just about the closest thing to an actual free lunch. You don’t need to pay for ANYTHING while you’re there.

To earn Hyatt points quickly, you can open the World of Hyatt Credit Card. It comes with up to 60,000 Hyatt points:

- 30,000 bonus points after you spend $3,000 on purchases in the first three months from account opening.

- Another 30,000 bonus points by earning 2 bonus points total per $1 spend on purchases that normally earn 1 Bonus Point, on up to $15,000 in the first six months of account opening.

That’s enough for a weekend at the Hyatt Zilara Cancun!

You can also instantly transfer points you earn with the following cards to Hyatt:

- Chase Sapphire Preferred® Card – 50,000 point bonus after you spend $4,000 on purchases in the first 3 months from account opening

- Ink Business Preferred℠ Credit Card – 80,000 point bonus after you spend $5,000 on purchases in the first 3 months from account opening

- Chase Sapphire Reserve® – 50,000 point bonus after you spend $4,000 on purchases in the first 3 months from account opening

2. Book Southwest Flights to Cancun

Southwest flies to lots of fun destinations in the Caribbean, Central America, and Mexico (including Cancun!).

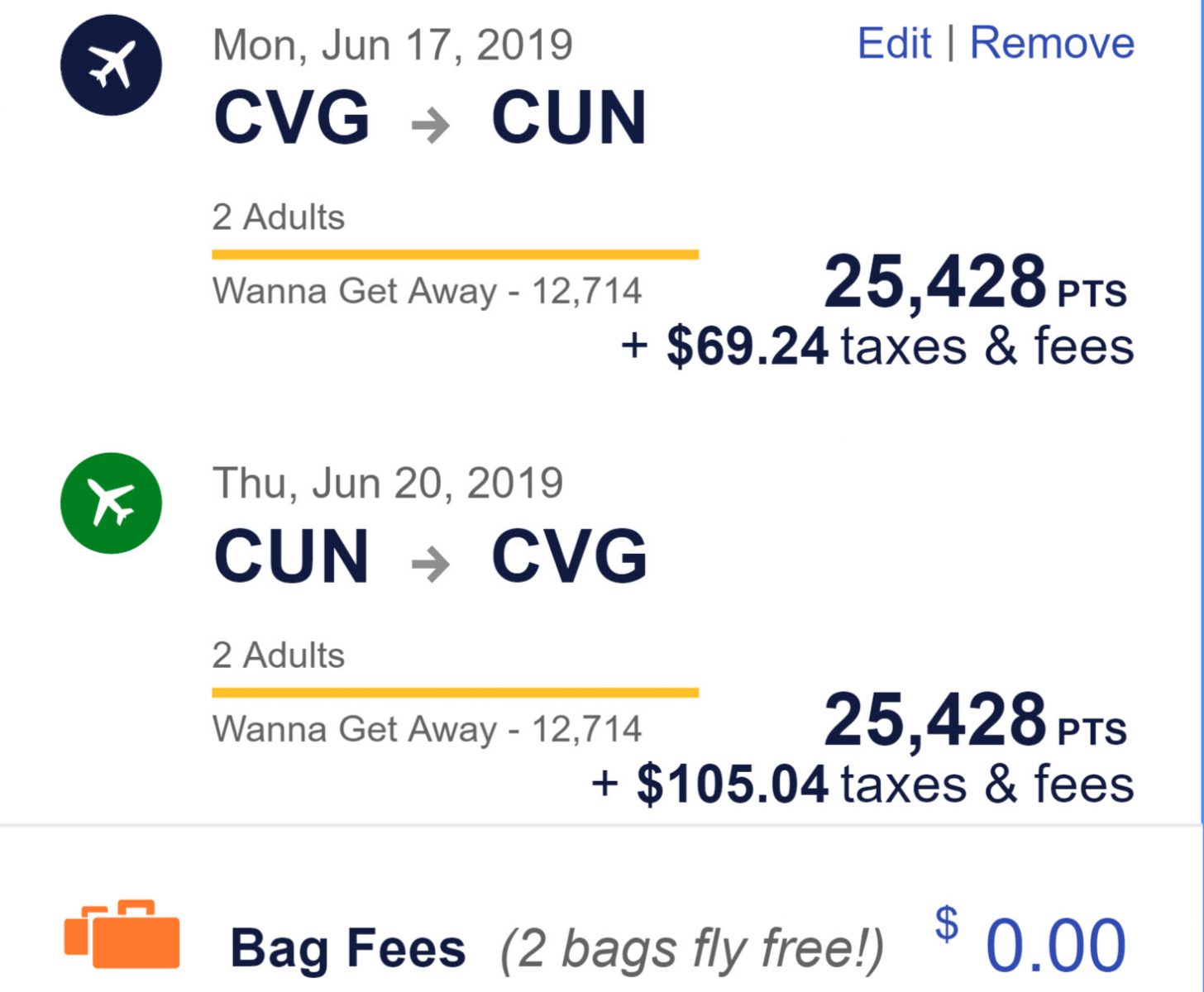

From my home airport of Cincinnati, it costs ~25,500 Southwest points round-trip to visit Cancun. Not to mention ~$87 in taxes & fees.

My woman and I have the Southwest Companion Pass (as I know many of you do!). A Companion Pass allows you to bring a travel buddy with you for just the cost of taxes and fees every single time you fly Southwest.

This means reaching Cancun will cost us just ~25,500 points total. However, we’ll still need to pay taxes & fees, so our round-trip flights will cost ~$174.

How to copy this plan

To earn Southwest points, you can open any of the following cards:

- Southwest Rapid Rewards® Plus Credit Card – 60,000 point bonus after you spend $2,000 on purchases in the first 3 months

- Southwest Rapid Rewards® Premier Credit Card – 60,000 point bonus after you spend $2,000 on purchases in the first 3 months

- Southwest Rapid Rewards® Priority Credit Card – 60,000 point bonus after you spend $2,000 on purchases in the first 3 months

- Southwest Rapid Rewards® Premier Business Credit Card – 60,000 point bonus after you spend $3,000 on purchases in the first 3 months

You can also instantly transfer points you earn with the following cards to Southwest:

- Chase Sapphire Preferred® Card – 50,000 point bonus after you spend $4,000 on purchases in the first 3 months from account opening

- Ink Business Preferred℠ Credit Card – 80,000 point bonus after you spend $5,000 on purchases in the first 3 months from account opening

- Chase Sapphire Reserve® – 50,000 point bonus after you spend $4,000 on purchases in the first 3 months from account opening

To earn the Southwest Companion Pass, you’ll need to earn 125,000 qualifying Southwest points in a calendar year. You can quickly earn Southwest points by opening any of the above Southwest cards and earning the bonus.

But you can only have 1 Southwest personal card at a time. And you are only eligible for a bonus on a personal Southwest credit card once every 24 months. So I recommend opening one Southwest personal card and one Southwest small business card (you’ll have 104,000 of the points you need after you meet your minimum spend requirements!).

Read this for everything you need to know about the Southwest Companion Pass.

3. Other Expenses

We’ve now reserved our hotel ($0 and 25,000 Hyatt points per night) and our flights ($174 and 25,500 points). That’s pretty great for a 5-star vacation. But there are other random expenses that will fall into your lap.

For example, you’ll need transport between the Cancun airport and the hotel. You can:

- Hire a shuttle company (~$70 round-trip)

- Request that the Hyatt Zilara pick you up in a luxury SUV ($165 round-trip)

- Rent a car (~$11 per day, free parking on-site)

With any travel expense (such as a rental car or a purchase made with the hotel, like an airport transfer), you should be able to redeem Capital One miles instead of paying cash. So for example:

- If you book an airport pick-up with the hotel, you’ll be able to get it for free with Capital One miles

- If you’re paying $174 in taxes & fees for your award flight (like the example above), you can use Capital One miles instead of cash and pay nothing

To earn Capital One miles, you can open cards like:

- Capital One® Venture® Rewards Credit Card – 50,000 Capital One miles ($500 in travel) after you spend $3,000 on purchases within the first 3 months from account opening

- Capital One® Spark® Miles for Business – 50,000 Capital One miles ($500 in travel) after you spend $4,500 on purchases within the 3 months of account opening

Read here to learn how to use Capital One miles.

Bottom Line

With a combination of Southwest points, Hyatt points, and Capital One miles, you can actually pay $0 for a 5-star vacation at an all-inclusive resort:

- Southwest points cover the flights

- Hyatt points cover the hotel, food, and drinks

- Capital One miles cover flight taxes & fees and airport transfer, Uber to the airport, and any other miscellaneous travel expenses

The only expenses you’ll pay for are things like fuel (if you rent a car), airport parking from your home city (if you don’t Uber to the airport), and airport food if you eat during your journey.

That’s a super amazing, $1,000+, Instagrammable, bucket list, make-your-friends-jealous kind of trip. And it cost you barely ANYTHING out of pocket.

Let me hear your idea of the cheapest possible vacation with miles & points! No way can you come up with a cheaper itinerary.

Subscribe to our newsletter if you want to hear more ways to take FREE vacations!

[gravityform id=”3″ title=”false” description=”false”]

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!