Are Fees & Credits Included for Chase Sapphire Reserve Minimum Spending Requirements?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Million Mile Secret Agent YSL commented:

I got the Chase Sapphire Reserve card, but I’m not sure if I met the $4,000 minimum spending requirement in the first 3 months to earn the 50,000 point sign-up bonus. I spent more than $4,000 on the card, but that included the card’s $450 annual fee. The total purchases shown on my statement are $3,750. Does this mean I won’t earn the sign-up bonus points?

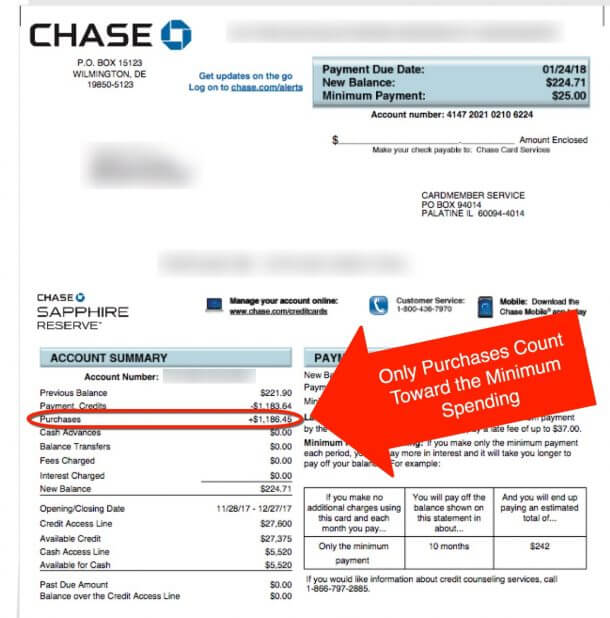

Unfortunately, it looks like YSL made an honest mistake and counted the annual fee toward the Sapphire Reserve’s minimum spending requirement. But annual fees do NOT count toward meeting the minimum spending requirements on credit cards.

That said, Chase usually gives folks between 103 and 115 days from the date of card approval to meet minimum spending requirements. So if it’s only been 3 months (90 days) since approval, it’s still possible there’s time to make additional purchases and hit the spending requirement. But you’ll want to call Chase right away to confirm!

I’ll remind y’all what does and does NOT count towards minimum spending requirements. And how you can monitor your progress during the minimum spending period.

Chase Minimum Spending Requirement

Link: Do NOT Make These 4 Mistakes With Minimum Spending Requirements!

Link: 10 Ways to Meet the Chase Sapphire Reserve Spending Requirement

Earning lucrative credit card sign-up bonuses are the best way to get Big Travel with Small Money! That’s why it’s so important to meet the requirements to get these big bonuses.

For example, the Chase Sapphire Reserve comes with a 50,000 Chase Ultimate Rewards point sign-up bonus after spending $4,000 on purchases in the first 3 months.

The spending requirement must be met with new purchases minus any returns or refunds. So the card’s $450 annual fee does NOT count towards the spending requirement.

You can track total purchases on your monthly statement by looking at the “Purchases” line in the account summary table.

Keep in mind, if your card comes with credits for things like travel or Global Entry, you will NOT have to spend extra to make up for the credit.

As an example, the Sapphire Reserve comes with $300 in travel credit per calendar year for purchases like airfare and hotels.

So let’s say you spend $3,000 in the first month of having your card, which includes a $300 travel purchase. Your statement will show a balance due of $2,700, plus the annual fee. In months 2 and 3, you’ll only have to spend a total of $1,000 to hit the $4,000 minimum spending requirement.

Start Early and Go a Little Over

To be safe, I always recommend spending slightly more than the minimum spending requirement. This will account for any returns you may have to make in the first few months.

And if possible, it’s best to meet the minimum spending in the first or second month of a 3-month spending requirement. This gives you extra time to confirm with the bank that you’ve met the requirements.

Remember the minimum spending clock starts on your approval date, NOT your activation date. So keep track of the date Chase approves you, not when you get the card in hand and activate it!

And although Chase says you have 3 months to meet the spending requirement, they usually give you between 103 and 115 days from the date of card approval. It’s best to call the bank or send a secure message to confirm the date for your situation.

Bottom Line

Annual fees do NOT count toward meeting the minimum spending requirements on credit cards.

So to earn the sign-up bonus on the Chase Sapphire Reserve, you’ll need to spend $4,000 on new purchases in the first 3 months, in addition to paying the annual fee.

Keep in mind, any credits you earn during the minimum spending period related to perks like annual travel or Global Entry credits do NOT require you spend additional money. These purchases do count toward the spending requirement, even with the offsetting credits.

But store returns or refunds will count against you. So I always recommend spending slightly more than the minimum requirement in case you have to make a return.

Chase says you have 3 months from the card approval date to meet minimum spending requirements. But you usually get between 103 and 115 days. I recommend contacting Chase once you get a new card to confirm the exact date.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!