New Rules for Chase Credit Card Approvals & What to Do About It!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.There have been rumors on FlyerTalk and other blogs in the past few weeks about possible new rules for getting approved for Chase credit cards.

I’ve done some digging and spoke to a Chase representative. It’s NOT good news for folks who apply for lots of cards!

If you’ve opened 5 or more credit card accounts (from any bank) in the past 24 months, it’s VERY UNLIKELY Chase will approve you for some of their Chase Ultimate Rewards earning cards, like the Chase Freedom or Chase Sapphire Preferred.

However, it’s uncertain whether this rule applies to cards like Chase Ink Business Cash Credit Card or Chase Ink Plus.

While there’s no official word from Chase about the new policy, I’ll share what I know and what I learned from a Chase representative.

What’s Going On?

Link: FlyerTalk Chase Policy Thread

Some folks report on FlyerTalk that Chase has denied their recent applications because they’ve opened too many new cards in the past 24 months. And that’s from ALL banks, not just Chase cards!

Details sometimes vary, but it appears the new rule applies to some Chase branded cards, NOT airline or hotel cards. These cards include:

And commenters on Doctor of Credit, Milevalue, and Mommy Points all confirm that they’ve been denied for these cards for the same reason.

Even folks with 800+ FICO scores and a long-term banking relationship with Chase are being turned down. Some have asked their personal bankers to intervene, but they’ve had no luck getting approved either.

That said, the new policy does NOT yet seem to impact Chase cards issued on behalf of airlines and hotels, like the Chase United Explorer, Chase British Airways, Marriott Rewards® Premier Credit Card, or Chase IHG Rewards Club Select Credit Card.

What Does Chase Say?

I called Chase to find out if this was a new rule across the board. The representative did some searching, then confirmed what others have reported.

If you’ve opened 5 or more new credit card accounts (any bank!) in the past 24 months (excluding authorized user accounts), you will NOT be approved for a Chase branded personal card.Yikes. This could be bad news for many of us in the miles and points hobby.

However, the representative could not say if the new policy applies to Chase’s other “card products,” like airline and hotel cards.

And she could NOT confirm if business cards counted towards the 5 card rule. There are reports on FlyerTalk that say Chase Ink cards are not affected.

What to Do

1. Folks Who Are New to Our Hobby

If you’re new to miles and points, you likely haven’t opened more than 5 credit card accounts in the past 24 months.

I would NOT apply for any new cards until you decide if you want cards like the Chase Sapphire Preferred or Chase Freedom. So if you like these cards, apply for them before any others!

These are some of the most valuable cards for Big Travel with Small Money. That’s because they have great sign-up and spending category bonuses which make it easy to earn lots of Chase Ultimate Rewards points fast.

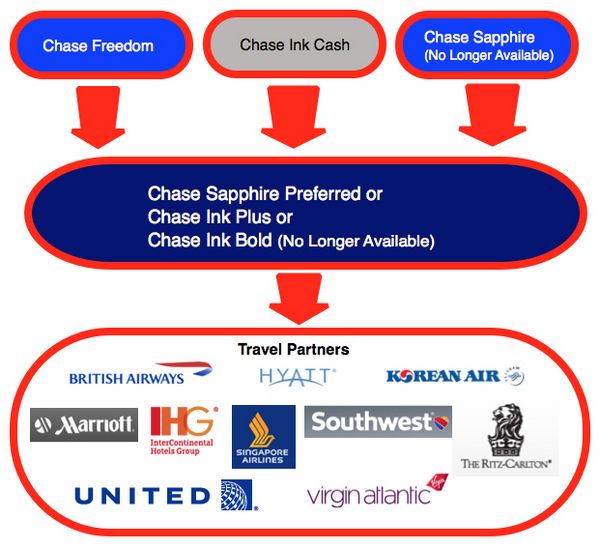

And if you have the Chase Ink Bold (no longer available), Chase Ink Plus, or Chase Sapphire Preferred card, you can transfer points to airline, hotel, and rail partners for even more travel!

Having 1 of those 3 cards allows you to transfer points you earn from the Chase Freedom and Chase Ink Cash.

Again, if you’re new to miles & points, I always suggest starting with cards that earn transferable points (like these Chase cards) for the most travel flexibility.

With Chase’s new rules, I’d strongly suggest you apply for these cards FIRST.

2. Experienced Miles & Points Enthusiasts

Folks who’ve been collecting miles & points for a while generally open more than a few new credit cards each year. I know Emily and I do!

If you’re in this situation, you’re most likely out of luck if you want to apply for a new Chase branded card. 🙁 I wouldn’t even suggest trying, because you might waste a credit inquiry.

For the time being, this policy change does NOT seem to apply to other Chase cards, including:- Chase British Airways

- Chase Fairmont

- Chase Hyatt

- Chase IHG Rewards Club Select Credit Card

- Marriott Rewards® Premier Credit Card

- Marriott Rewards® Premier Business Credit Card

- Chase Ritz-Carlton

- Chase Southwest Rapid Rewards Premier (Personal)

- Chase Southwest Rapid Rewards Premier (Business)

- Chase Southwest Rapid Rewards Plus

- Chase United MileagePlus® Explorer Card

- Chase United MileagePlus® Explorer (Business)

- Chase United MileagePlus Club

That said, I do NOT know if or when Chase will extend their new rules to their airline and hotel cards.

So if there’s a card you’ve wanted to apply for, it won’t hurt to sign-up sooner rather than later.

Hopefully Chase will not change their approval policy for these cards. But there are no guarantees.

You could consider holding off on any more card applications until you have fewer than 5 new accounts in the past 24 months. But you’d miss out on lots of other great sign-up bonuses!

3. Folks Who Already Have Chase-Branded Cards

If you already have cards which charge an annual fee, like the (no longer offered) Chase Ink Bold, Chase Ink Plus, or Chase Sapphire Preferred, you’ll have to give careful thought as to whether you want to keep them when the annual fee comes due.

I always have at least ONE of these cards open, so I’m able to transfer any of my Chase Ultimate Rewards points to travel partners like Southwest and Hyatt.

In the past, some folks would cancel these cards, then re-apply at a later date. Chase says you can get the sign-up bonus again as long as you don’t currently hold the card, and haven’t received the sign-up bonus in the past 24 months.

But with the new rules, this could be difficult or impossible for experienced miles & points collectors who apply for lots of cards!

If you don’t want to pay the annual fee, consider downgrading a Chase Ink Bold, Chase Ink Plus, or Chase Sapphire Preferred card to the Chase Freedom card, which has no annual fee.

You will NOT get a sign-up bonus, but you’ll keep your Chase Ultimate Rewards points safe! And you’ll earn 5X Chase Ultimate Rewards points in rotating categories each quarter with the Chase Freedom.

Remember, you have to have at least 1 of the Chase Sapphire Preferred, Chase Ink Bold, or Chase Ink Plus cards to transfer Chase Ultimate Rewards points to travel partners! So don’t downgrade or cancel all your cards!

Bottom Line

Chase has changed the rules for approving folks for Chase-branded cards like the Chase Sapphire Preferred and Chase Freedom.

If you’ve opened 5 or more new credit cards in the past 24 months (from any bank), your application will likely be denied.

This policy does NOT seem to apply to Chase’s airline and hotel cards, like the Chase British Airways, Chase Hyatt, or Chase Southwest cards. At least not yet!

This isn’t good news for folks who apply for lots of cards. And if you’re new to miles and points, I’d suggest applying for Chase Ultimate Rewards cards FIRST.

Have you recently applied for Chase cards? Please share your experience in the comments!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!