Never Pay Interest on Your Chase Cards Again With This Simple Trick!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

If you’ve got your travel plans in place and you’re earning a big sign-up bonus, there is one more thing you do NOT want to forget!

You’ll want to pay your balance in FULL every month. Because paying interest and fees can negate the value of any points you earn.

Once you have multiple credit cards, it can be trickier to stay organized. And we’ve all had that terrible feeling that comes with missed a due date! But an easy way to keep track of payments and avoid interest is to set up automatic payments.

I’ll show you how to set up automatic payments for your Chase credit cards, like the Chase Sapphire Reserve or Chase Ink Business Preferred. So you don’t have to worry about accidentally missing a due date or paying fees or interest!

Setting Up Chase Automatic Payments

Setting up automatic payments is a straightforward process and shouldn’t take more than a few minutes.

It’s worth doing so you don’t forget to pay your balances off each month. This is important because the value of your rewards can easily be erased by interest and fees! Here’s a step-by-step video guide!

Step 1. Log Into Your Account

First, log into your Chase account. Not every Chase homepage will look the same. So I’ll show you 2 different sets of screenshots.

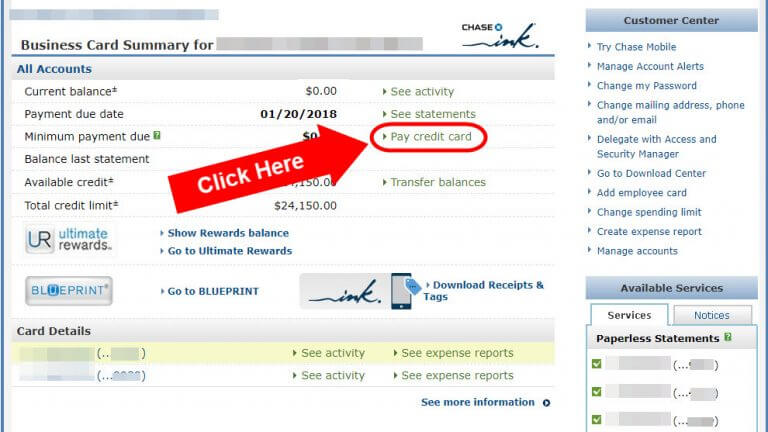

If your account page looks like the one below, you’ll need to scroll down and select the “Pay credit card” tab under the account you want to pay.

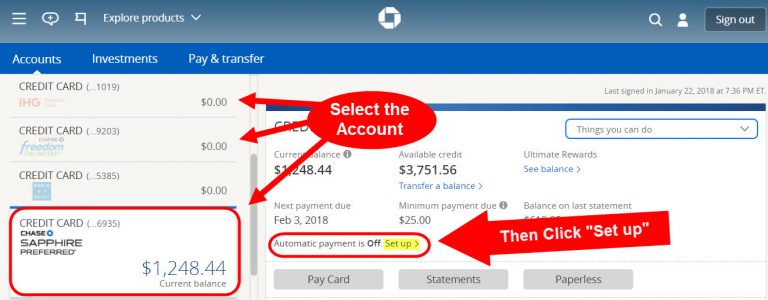

Or if your Chase homepage looks like this other screen, you’ll select the appropriate credit card account on the left side of the screen. Then, click “Set up.”

The “Set up” link is near the center beside where it says “Automatic payment is Off.”

Step 2. Select “Automatic Payments“

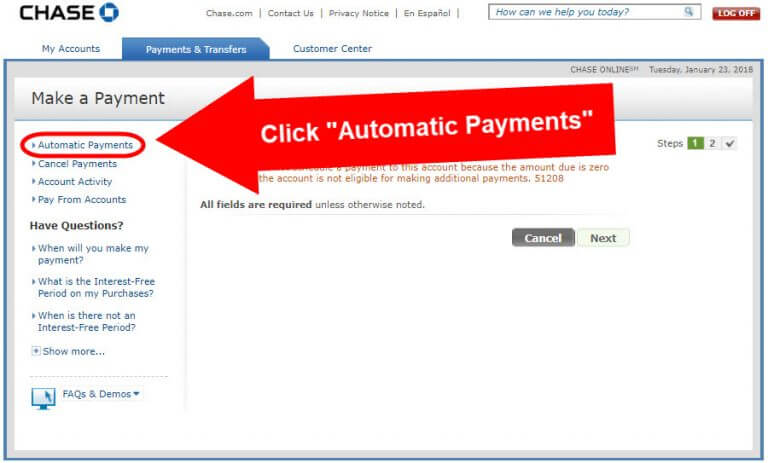

Next, you’ll click the “Automatic Payments” tab on the upper-left side of your screen.

If you have the other style homepage, then skip to step 4.

Step 3. Choose Your Credit Card

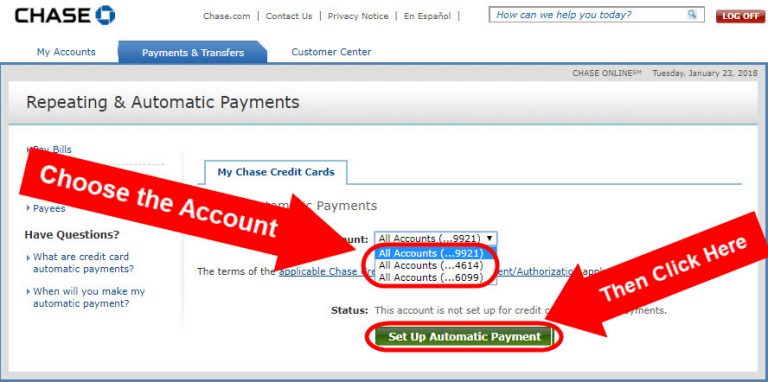

Once you click “Automatic Payments,” you’ll be able to select the credit card account you want to set up an automatic payment for.

Then click “Set Up Automatic Payment.”

Step 4. Choose a Bank Account to Pay With

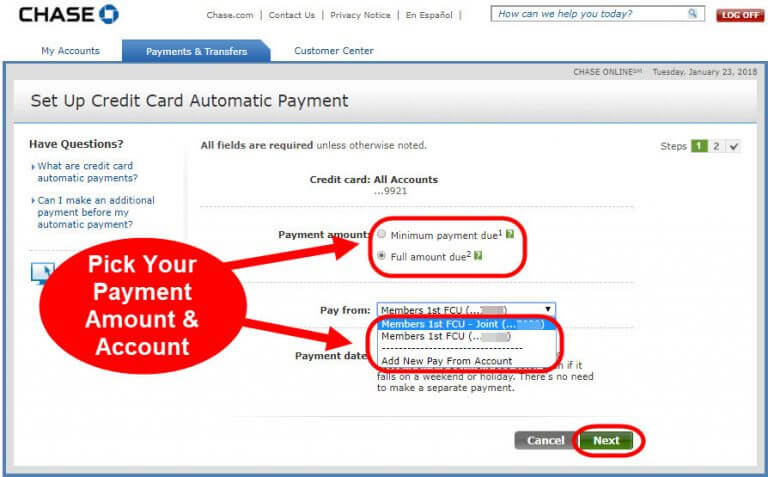

Choose a payment amount. You can pay the “Minimum payment due” or “Full amount due.” The default is usually set to pay the minimum amount due.

Then select a bank account from the “Pay from” drop-down menu or add a new bank account and click the“Next” button.

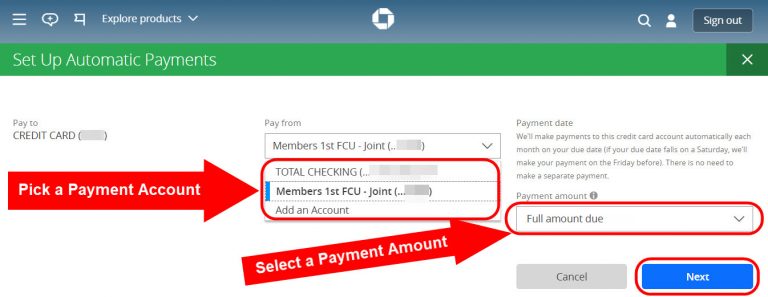

The other homepage looks different, but you’ll follow the same steps.

You’ll need to choose a bank account and a payment amount. Then click the “Next” button.

Remember, you always want to pay off your balance every month! Because late fees and interest are the worst!

Note: If you are taking advantage of a 0% APR offer, then you might want to pay less than the full balance each month. But remember, if you only pay the minimum amount due and the 0% APR expires before you pay the balance off, you will start paying interest!

Step 5. Review & Confirm the Information

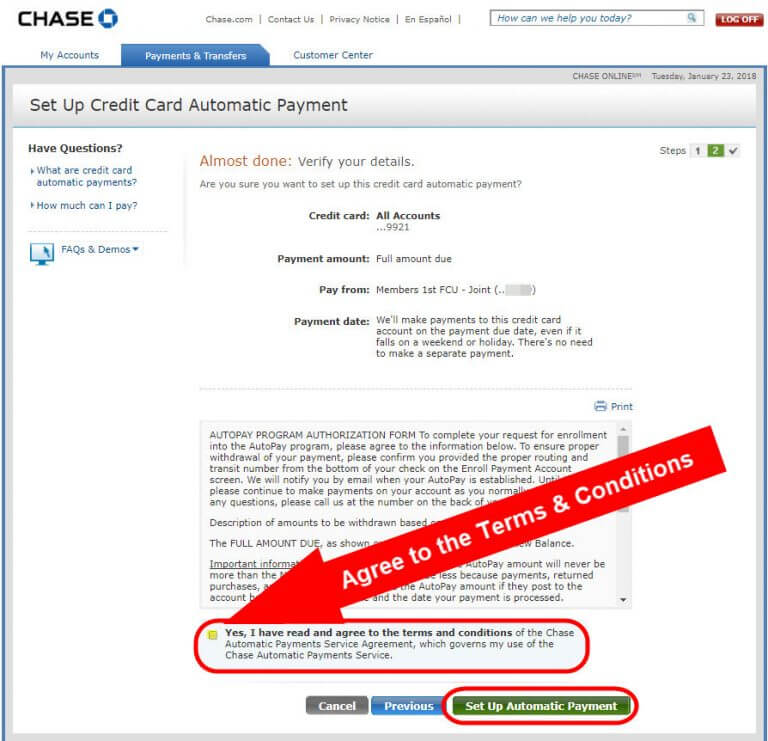

Now is your chance to make sure you chose the correct credit card, payment amount, and bank account.

You’ll have to review and agree to the terms and conditions before you can click the “Set Up Automatic Payment” button.

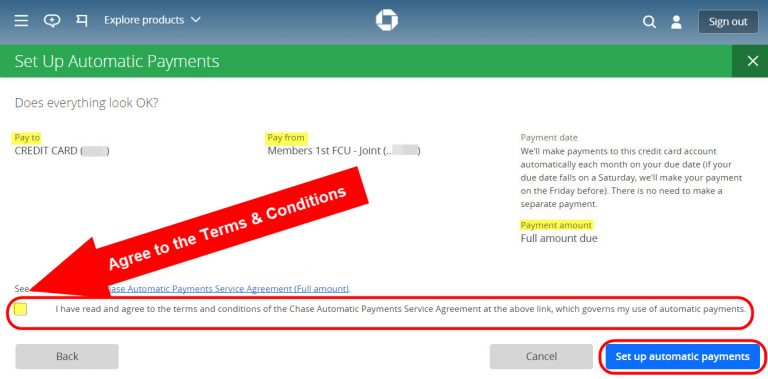

If you have the other homepage, once again, the steps will be the same.

Double check that your information is correct, including which card you’re registering, which bank account you’re using, and that you’re paying the full amount due.

Next, check the box to agree to the terms and conditions and click “Set up automatic payments.“

At this point, you should see a page confirming that you’ve successfully registered.

That’s it!

Now you can continue earning lots of miles and points with your Chase credit cards! And you won’t worry about missing a payment, getting hit with fees, or accruing interest on your account. 🙂

Bottom Line

You can easily set up automatic payments for your Chase credit cards! This can give you peace of mind.

You won’t have to worry about remembering your due dates. And with your payment being made in full each month (or the minimum payment) you’ll avoid late fees and interest!

Do you normally use the automatic payments feature to keep up with your credit card bills? Or do you have a different method for staying organized? Let me know in the comments!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!