Step-by-Step Guide: An Easy Win for Managing Your Credit Card Payments

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

It’s crucial to stay organized when you’re in the miles & points hobby. Because if you don’t pay your bills on time and in full every month, any interest you accrue will likely negate any rewards you earn.

And some folks like to time their credit card payment due dates around the same time or at a certain time of month to make them easier to remember and manage.

So I’ve put together a step-by-step guide to show you how to choose your payment due date on Chase cards!

Changing Your Chase Card Bill’s Due Date

One simple way to stay organized in the miles & points hobby is to schedule your cards’ payment due dates in a way that makes managing them easier for you.

For example, most folks get paid on a regular schedule, so you could arrange your payment due dates to coincide with when you’re paid. Or you could arrange the due dates on all of your accounts to fall around the same time, so they’re easier to remember.

You might even want to pay them towards the middle of the month so that your rent or mortgage isn’t due at the same time!

Million Mile Secrets team member Harlan recently took the time to reschedule his credit cards’ due dates, and said it has been such a relief (and less of a hassle!) to have them due around the same time each month.

There’s also the timing of the Southwest Companion Pass. Your credit card payment due dates can come into play if you’re earning the pass with the sign-up bonuses from the Chase Southwest cards. Because you’ll want to make sure the Southwest points you earn post at the beginning of the year, so your pass will be valid for 2 full years!

Here’s a step-by-step guide to how you can schedule the due date on any of your Chase credit cards.

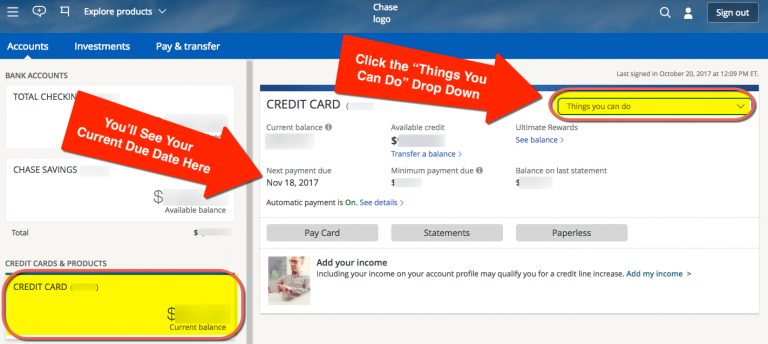

Step 1. Log-In and Select Your Account

Log-in to your Chase account. After selecting the account you’d like to manage, you’ll see the account’s current payment due date.

Note: Depending on the Chase accounts you have (personal, business, checking, savings, etc.) your interface may look slightly different.To change your due date, click the “Things You Can Do” dropdown menu.

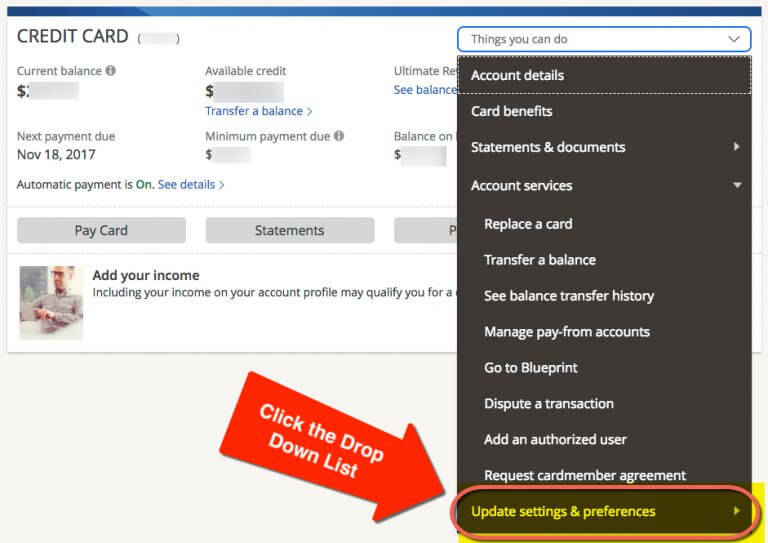

From there, click “Update Settings & Preferences.”

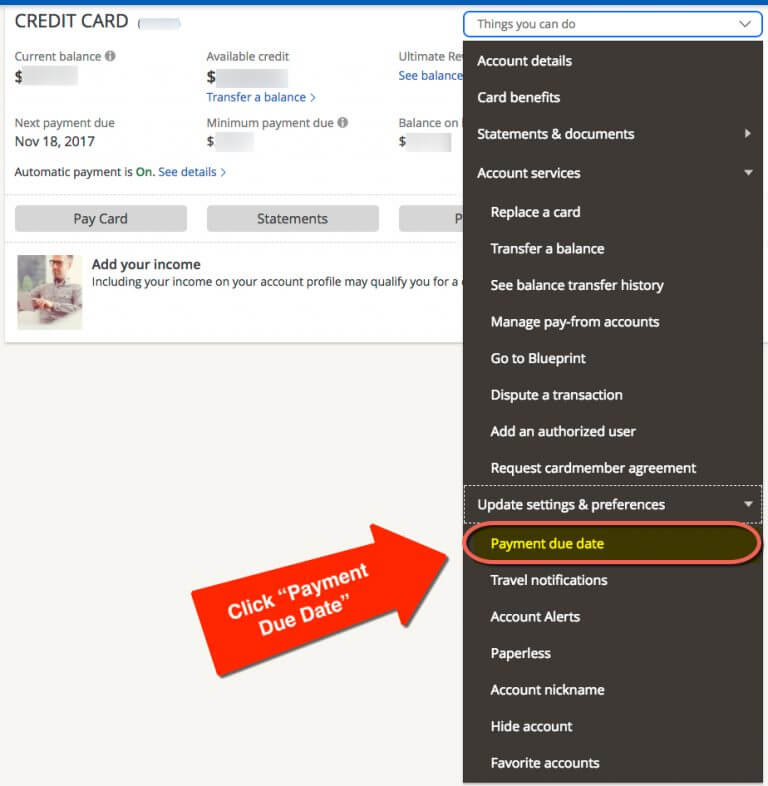

This will bring you to another dropdown list, where you can then select “Payment Due Date.”

Step 2. Choose Your New Due Date

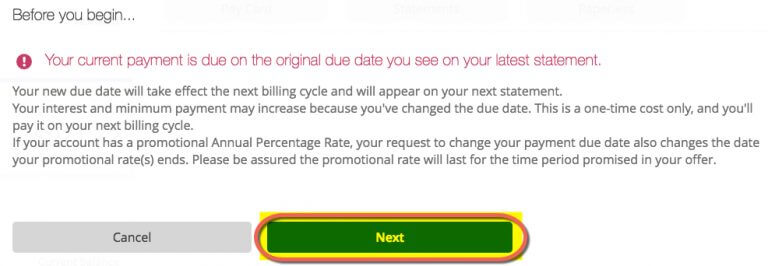

Before selecting your new due date, you’ll see an alert to remind you that your current payment is still due on the date you see on your latest statement. Because it will take at least 1 statement period for your new due date to go into effect!

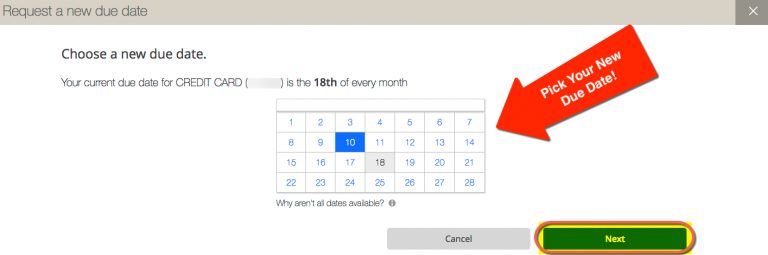

After clicking the “Next” button, you’ll see a calendar.

From there, choose your desired due date and click “Next” again.

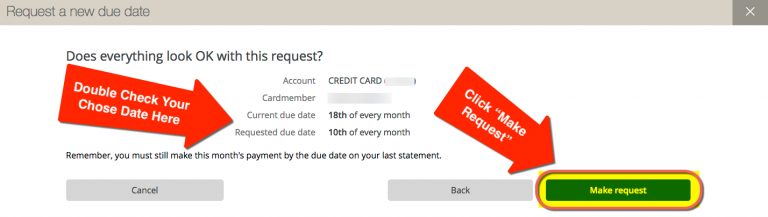

Step 3. Finalize Your Due Date Change Request

Before your payment due date is updated, look over the details of your request to make sure everything is correct. Then click the “Make Request” button. And you’re all set!

Bottom Line

Knowing how to change the payment due date on a Chase credit card is useful information for anyone in the miles & points hobby.

And scheduling your payment due dates around the same time, or to coincide with your paycheck, can save you lots of time, hassle, and money. Because staying organized and paying your bills in full and on time every month is the first step in ensuring you’re getting the most out of your hard-earned rewards!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!