How Does a Citi Card Product Change Impact Earning Future Sign-Up Bonuses?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers. Citi is an MMS advertising partner.Million Mile Secrets reader, Laura, sent in a question on Facebook:

I received the sign-up bonus from the Citi AAdvantage Platinum Select World Elite Mastercard. The Citi rules say you can NOT get the sign-up bonus again on a Citi card if you opened or closed any card in the same “brand” over the past 24 months.Does upgrading the Citi AAdvantage Platinum Select card to the Citi AAdvantage Executive World Elite Mastercard re-start the 24-month timeframe? Or does the clock only start once I cancel the card?

Excellent question, Laura!

The Citi rules restrict folks from earning a new card sign-up bonus if you’ve opened OR closed a card under the same family of cards in a 24-month timeframe.

I checked with Citi and a product change does NOT restart the clock. But there are some exceptions. This is generally good news if you’re planning on re-applying for the card in the future.

I’ll remind you about the Citi sign-up bonus rules and share tips to make the most of Citi bonuses in the future!

What Are the Citi Sign-Up Bonus Rules?

Link: Citi Rules Restrict Sign-Up Bonuses to Once per “Brand” Every 24 Months

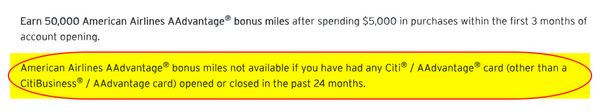

With Citi cards, you can only earn one sign-up bonus within the same family every 24 months. This means you can NOT earn a sign-up bonus on a card within 24 months after you’ve opened or closed a card within the same brand.

These are the Citi card brands and cards impacted:

1. American Airlines

- Citi American Airlines Platinum Select Mastercard

- Citi American Airlines Executive World Elite Mastercard

2. ThankYou Points

- Citi Prestige

- Citi Premier Card

- Citi ThankYou Preferred

- Citi ThankYou Preferred Card for College Students

As an example, here’s how the new rule works.

If you have opened OR closed the Citi American Airlines Platinum Select Mastercard in the past 24 months, you wouldn’t be eligible to earn the sign-up bonus on Citi American Airlines Executive World Elite Mastercard. Because these 2 cards are in the same family.

The Citi rule applies specifically to earning sign-up bonuses. So it’s still possible to apply and get approved for a new card within the same family. But you’ll miss out on the sign-up bonus.

Completing a product change (downgrade) will NOT re-start the clock. But only if you keep the same account number.

For example, let’s say Laura’s had the Citi American Airlines Executive World Elite Mastercard for less than 24 months. Then, she completes a product change and downgrades to Citi American Airlines Platinum Select card. She does NOT have to wait 24 months from the date of downgrading to re-apply and earn the sign-up bonus on the Citi American Airlines Executive World Elite Mastercard.

But if you product change from the Citi Prestige® Card to a card within a different brand family like the no annual fee Citi® Double Cash Card, you’ll likely get a new account number. This means the 24 month clock WILL restart for earning the Citi Prestige sign-up bonus again.

The information for the Citi Prestige has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.Thanks to Million Mile Secrets reader Dave for clarifying the rules!

Strategy for Earning Citi Sign-Up Bonuses

Link: How to Qualify for a Small Business Credit Card (And Why You Should Get One!)

Here’s a tip for timing your Citi sign-up bonuses.

Consider applying first for certain Citi business cards, which are not impacted by the rules.

For example, you’re eligible to earn the sign-up bonus with the CitiBusiness AAdvantage Platinum Select World Mastercard, even if you have one of the other Citi American Airlines personal credit cards.

And remember you don’t need a huge corporation to get a business credit card. Here’s a post with 10 activities that may qualify you as a small business.

The information for the Citi AAdvantage Platinum and CitiBusiness AAdvantage Platinum card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Plus, Citi small business cards don’t count toward Chase’s tougher application rules. so opening one won’t knock you out of the running for valuable Chase cards.

Bottom Line

Citi’s rules make it difficult to earn multiple sign-up bonuses for cards within the same brand or family.Because if you open or close a card within the same brand, you’ll have to wait 24 months to be eligible to earn a new sign-up bonus on another card within the same brand.

The Citi brands include the American Airlines and ThankYou points cards.

That said, completing a product change (like downgrading) does NOT count as closing your account. But you must keep the same account number.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!