Want to Save More? Here’s a Foolproof Way to Start

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Everyone knows saving money for retirement is important. But where’s a good place to start? Team member Harlan advises folks to save 10% of all their income. I asked him to explain why!

Harlan: First of all, I am NOT a financial expert. I’m a regular guy who wanted to set something aside for retirement. I didn’t know where to begin but I knew it was important to start somewhere.I read “The Automatic Millionaire” a few years ago and became inspired by its core message: save 10% of everything you make. At the time, I was saving 0%, so I decided to give it a try!

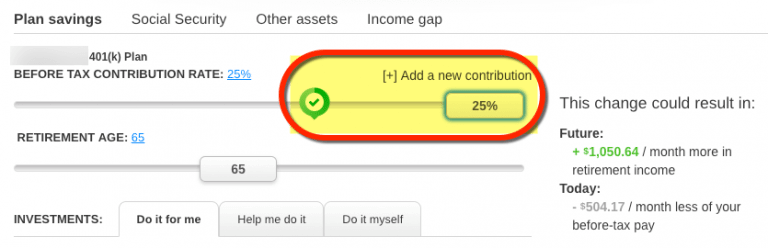

It hurt at first. But then, I kept increasing that number. These days, I’m saving 25% of my income and still feel like it isn’t enough. But I’m also paying down student loans.

This plan will NOT work for everyone. Because personal finances are…personal. But if you aren’t currently saving, the best time to start is right this second!

Save 10% of Everything You Make

To some folks, 10% sounds like a lot. To others, not nearly enough. I think of it as:

- Make $10, save $1

- Make $100, save $10

- Make $1,000, save $100

It’s easy to scale up and down from those simple benchmarks. The best way to start saving is to take it directly out of your paycheck before you see it. This idea is called “paying yourself first.”

By automating, you learn to live on what’s left over. And all the while, your savings grow. Many folks keep increasing their savings rate until they learn to live on the absolute minimum while saving the maximum. So far for me, that rate is 25%.

How to Start Saving

Link: Fidelity IRAs

Link: Vanguard IRAs

The best way to pay yourself first is to contribute funds to an employer-sponsored 401(k). Companies let you choose your savings rate. And take the money out of your check before you’re paid.

Even better, many companies will match a portion of your contribution. That’s literally free money! And a huge added value to your overall earnings. If you can get a match, take it!

If you don’t have a retirement plan through work, you can set up your own. Every bank offers retirement accounts. And other popular choices are Fidelity and Vanguard. You can decide between Traditional and Roth IRAs.

The most important difference is you can deduct your Traditional IRA contributions each tax year. But NOT your Roth IRA contributions. There are others too, so look to see which option makes sense for you.

You can always switch your account later if you decide. The most important step is to get started right now!Finally, you can always open a savings account with any bank. And auto-deposit a portion of your check into it. If you get paid with a paper check, or cash, you can easily move cash into your account each time you’re paid. This isn’t ideal because it’s not automatic and won’t earn as much (if any) compound interest – but it’s better than not saving anything!

What If You Have Debt or Loans?

If you’re carrying credit card debt, you must pay them completely off before you can begin saving. Because the interest you’re paying is likely many times more than what you’re able to save. Plus, it compounds every month. So step number 1 is to get rid of any credit card debt.

Student loans are more difficult to lay out a rule of thumb. It depends on:

- How much you owe

- The interest rate you locked-in

- The type of repayment plan you’re on

- If you plan to save in a retirement account or savings account

Personally, I am putting a lot of money into paying down my student loans. Without them, my savings rate would be much higher. My interest rate is 6.5%, which is very high. So I’d rather pay the student loan down now and save more in the future. But there are 2 ways to think about it.

The first is to consider how much your investments will accrue over their lifetime. The return on most stock investments tends to hover around 7%. So if your student loans are, say, 3%, you might decide to invest more and pay less toward them.

The other way of thinking about it is your savings from paying off your loans are guaranteed. If your interest rate is 6%, you’re guaranteed to save at least that much. But with investments, returns are never guaranteed. Some folks like the sure bet as opposed to the “expected” return.

Take a good look at the numbers, especially if you’re carrying credit card debt. Sit down before you look, because interest rates can be well over 20%! You must pay them off if you ever plan to save!

Invest Your Travel Funds

Do you earmark money to take a fabulous trip once or twice a year? Lots of folks do!

But using the tips you’ll find here on Million Mile Secrets, you can save hundreds – or thousands – on your travels, even to luxurious and coveted destinations. Here’s a getting started guide if you’re new to miles & points.

If you can use miles & points to take your vacations, you could transfer your travel fund directly into your retirement savings. You get your amazing trip now AND save for the future. This is an easy way to instantly boost your savings rate!

10% Won’t Work for Everyone

No generalization is one-size-fits-all. Here are 2 sources that say 10% isn’t nearly enough. They say it only works if you start in your 20s and save for your whole life. But that’s NOT the point.

I see it like planting a tree: the best time to plant a tree was 20 years ago and the second best time is right this second. So it goes with savings. Don’t get discouraged by feeling behind before you begin.

Other folks might say 10% is too much for them. Or not enough.

So 10% is a generalization, but it’s a good one. If anything, it’s a place to start. But whether you start at 1% or 30% doesn’t matter. The main takeaway is to start right now. Time is of the essence. Because the longer your investments can grow, the better.

I didn’t get started until my 30s. So I’m “behind” according to lots of popular wisdom. But I’m glad I started anyway!

Keep It Going!

After you find your starting point, keep increasing your savings rate by paying yourself first. Find the point where you can live on as little as possible while saving as much as possible. And adjust as needed.

Another important trick is to NOT look at your investments or savings accounts. This way you “hide” the money from yourself. And you won’t be tempted to spend it! Put your money in a place that’s hard to access. Or hide the account from your online banking overview. Out of sight, out of mind! 😉

Bottom Line

Team member Harlan recommends starting your savings rate at 10%. And increasing from there.

Decide whether you want to save in a 401(k), IRA, or regular savings account. Have the money deposited automatically if you can. Otherwise, become diligent about your savings rate and commit to it!

This is just a starting point. Find what works for your personal financial situation and go from there. The most important thing is to begin right this second!

Do you have any advice to add about how to start saving?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!