Big Changes May Be Coming to Citi Prestige – For the Better??

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Citi is an MMS advertising partnerCiti must be hearing the murmurs from their Citi Prestige® cardholders after making so many changes to the card.

Via View From the Wing, Citi has sent a survey to select members asking them their opinion on possible new card features. And (nearly) all of them are welcome changes!

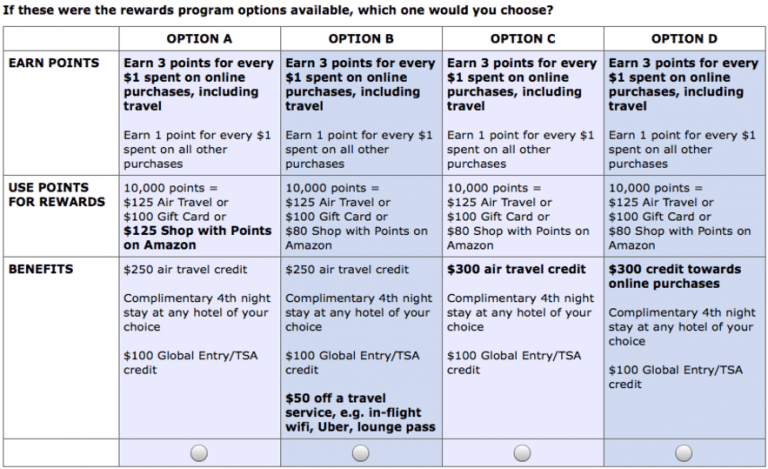

Citi Prestige Possible Benefit Changes

Link: Citi Prestige® Card

Link: My Review of the Citi Prestige

Link: This Citi Prestige Perk Might Be the Most Lucrative Benefit of ANY Credit Card!

A couple of months ago, the Citi Prestige lost several valuable perks, like American Airlines Admirals Club lounge access, the ability to redeem points at a rate of 1.6 cents each towards American Airlines flights, and reimbursement for the actual cost of the 4th night and taxes when using the 4th night free benefit.

But it now looks like Citi is trying to make the card more enticing! Here are some ideas they’ve been kicking around:

- Earn up to 5 points per $1 for either air travel or dining

- Earn 3 points per $1 for all online purchases

- Redeem points for up to 1.5 cents each towards air travel

- Bumping annual airline credit from $250 to $300

- Switching the annual airline credit to an annual $300 dining credit

- 25% points rebate

- 4th night free limited to only 4 uses per year

- 4th night free becomes 3rd night free, limited to only 2 uses per year

- Fixed points prices for airfare (for example, 20,000 points for a domestic flights, or 40,000 points for an international flight)

To be clear, Citi is NOT considering adding all of these features to the Citi Prestige. They’re surveying folks to see which of them are the most popular.

Making a few of these changes would make the card much more competitive with cards like the Chase Sapphire Reserve, which already has a $300 travel credit, points worth 1.5 cents each towards travel, and much better transfer partners. In my opinion, Citi ThankYou points are the least useful points of all flexible transfer programs.

But if Citi wants to keep card members, they do NOT want to limit their unique 4th night free benefit. It’s the only feature of the card that sets it apart from its competitors. If they limit the free night benefit, they might see a lot of cancellations, similar to what happened when the US Bank Club Carlson card lost its free night perk.

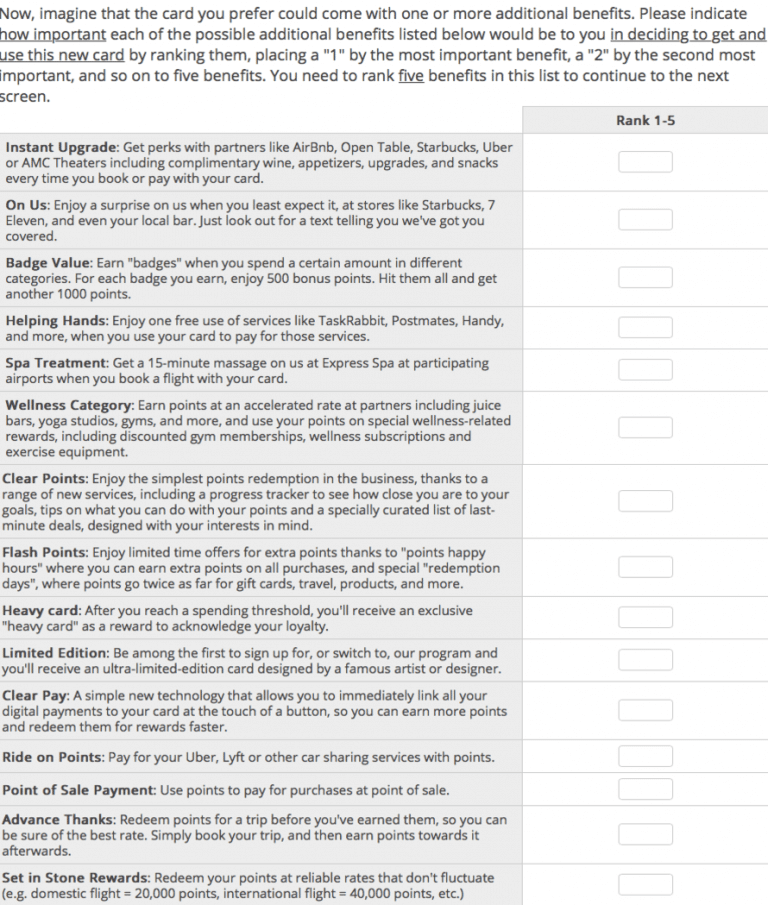

Other Fun Features

Another section of the survey shows several unconventional perks that would definitely make the card more fun!

I like the idea of a LOT of these benefits. For example, “Instant Upgrade” will give you perks with lots of travel and dining companies, like free wine, appetizers, and upgrades every time you book with your Citi Prestige. And they describe the “On Us” perk as a random surprise every now and then when you use your card. You’ll receive a text from Citi telling you they’ve “got you covered”. I assume that means they pay your bill??? 😉

What Do You Think?

Because Citi has no intention of adding all these benefits (based on the surveys, it looks like there will be ~3 changes to the card), which is most important to you?

Most of us in the hobby have credit cards to fit every type of spending we do. Which of these changes would best suit your lifestyle? Would you prefer 3 points per $1 for online purchases? Or would you rather have 5 points per $1 on strictly dining?

Would you like a fixed value for airline tickets? Or the ability to book flights with points before you’ve earned them? Would you be okay with having the 4th night free limited to 4 uses per year if the annual airline credit increased to $300?

Citi has presented lots of possibilities in this survey. You can check out even more screenshots at Miles Talk.

Bottom Line

I’m a little surprised that Citi is looking to improve the Citi Prestige after all the recent changes. They must hear the rumblings of an uprising!

They’ve been passing around a survey to see which changes folks would be most interested in. I’d be very excited to see several of these features added to the card.

Which proposed benefits most excite you? Let me know in the comments!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!