Imagine the Savings You’ll Enjoy by Having the Southwest Companion Pass Year After Year

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

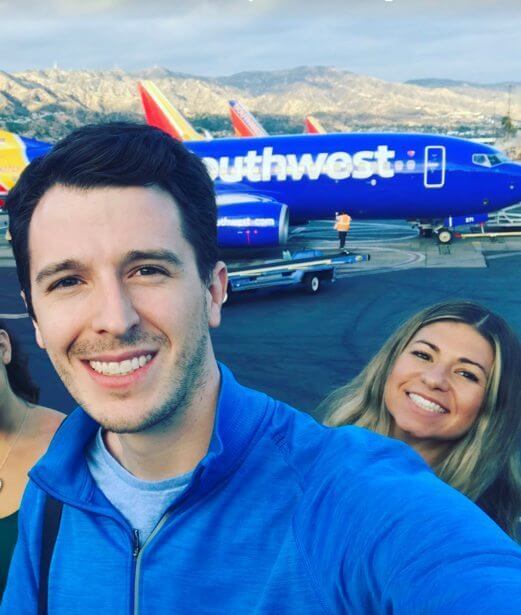

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Emily and I think the Southwest Companion Pass is the best deal in travel. Because a friend or family member can travel with you for (almost) free on paid and award tickets for up to 2 years. And you can earn it more than once, so the airfare savings can really add up!

We got a question about the Companion Pass from Million Mile Secrets reader Sandy, who commented:

I’ve had the Southwest Companion Pass for 1.5 years. I’m trying to earn it for a 3rd year. So far, I’ve earned half of the required 110,000 Southwest points. Can I sign-up for another personal Southwest credit card to earn the sign-up bonus and get the Companion Pass again?

As long as you earn 110,000 qualifying Southwest points in a calendar year, you’ll earn the Companion Pass. It will be valid through the end of the following calendar year.

And the sign-up bonus points you earn with a Chase Southwest card counts toward the Companion Pass requirement.

Sign-Up Bonuses Are the Easiest Way to Earn Companion Pass Points!

Link: Southwest Rapid Rewards® Plus Credit Card

Link: Southwest Rapid Rewards® Premier Credit Card

Link: Southwest Rapid Rewards® Premier Business Credit Card

You can currently earn 60,000 Southwest points after spending $2,000 on purchases in the first 3 months of opening either the Chase Southwest Plus or Chase Southwest Premier card. But these offers are ending very soon, on October 4, 2017.

And with the Chase Southwest Premier Small Business Card, you’ll earn 60,000 Southwest points after spending $3,000 on purchases in the first 3 months of account opening. You can read my post with more details on the current offers.

Taking advantage of 2 of these card offers gets you more than enough points to earn the Companion Pass.

Just remember, if you’ve opened 5+ cards from any bank (NOT counting Chase business cards and these other business cards) in the past 24 months, it’s unlikely you’ll be approved for these Southwest cards.

I typically recommend folks earn the Companion Pass as early in the year as possible. Because the it’s valid through December 31 of the following year in which it’s earned. So earning the pass early in the year means you can take advantage of the BEST deal in travel for nearly 2 full years!

Instead of earning a sign-up bonus now (late in the year), Sandy’s companion could apply for the Southwest cards toward the end of this year or early in 2018. This way they’ll have even more time to use this amazing perk!

Note: If you’ve previously had a Chase Southwest card, you’re eligible to earn the bonus again so long as you don’t have the card currently open and it’s been more than 24 months since you last earned the bonus (NOT opened the card).Earn Companion Pass Points Booking Hotel Stays, Shopping, and Many Other Ways!

Link: 10 Unusual Ways to Earn Southwest Points

Link: Earn Companion Pass Points Through SouthwestHotels.com

Link: Earn Southwest Companion Pass Points With These Products

Lyn from GotoTravelGal.com wrote helpful posts (linked above) with ways to earn Southwest points beyond earning credit card sign-up bonuses. These methods can help folks looking to earn the Companion Pass who already have some Southwest points from booking paid flights or from credit card spending.

For example, you can do your online shopping through the Southwest Rapid Rewards shopping portal where you’ll earn points on purchases you were already planning to make.

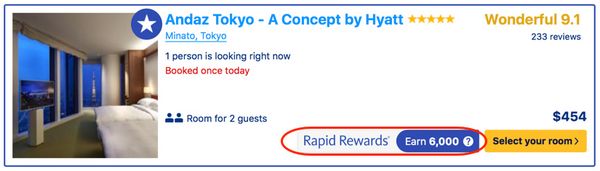

Or, book hotel reservations through SouthwestHotels.com and earn up to 10,000 Southwest points per night at certain hotels!

Just be sure to avoid these 3 mistakes that keep you from earning the Companion Pass!

Bottom Line

The easiest way to accumulate eligible points toward the Southwest Companion Pass is by earning the sign-up bonuses on the Chase Southwest credit cards.

You can currently earn 60,000 Southwest points on all 3 versions of the Chase Southwest cards. But the increased sign-up bonuses on the Chase Southwest Plus and Chase Southwest Premier cards are ending on October 4, 2017.

Emily and I think the Companion Pass is the best deal in travel! Because a friend or family member can travel with you for (almost) free on paid and award tickets for up to 2 years!

Remember, you must earn 110,000 Southwest points in a calendar year to get the Companion Pass. If you’re looking to earn extra points beyond credit card points, consider making online purchases through the Southwest Rapid Rewards Shopping Portal. Or book hotel reservations through SouthwestHotels.com.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!