Why I Treat My Credit Cards Like Debit Cards

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

I’ve always said the best (and quickest) way to earn lots of miles & points for Big Travel is from credit card sign-up bonuses and spending.

But there are still folks out there who balk at applying for lots of cards. They’re afraid their credit score will suffer, or that they’ll spend more they can afford and end up in debt.

This hobby is NOT for everyone. If over-spending tempts you, or if you’re not good at budgeting and keeping track of expenses, you might get yourself in trouble.

One trick I always use to make sure I don’t spend too much or end up carrying a balance is treating my credit cards like debit cards.

I’ll explain how folks in our hobby maintain a high credit score and share some tricks that make it easier to manage your credit card spending.

Don’t Spend More You Can Afford!

By treating your credit cards like debit cards, you’ll avoid spending more than you have in your bank account!

I try not to rack up charges unless I know I’ve got the money to immediately pay them off.

And it’s best to avoid spending based on the fact that you’ll get paid in a week, or two. That’s an easy way to fall behind!

Some folks stay organized by paying their bills on the same day each month, even if they’re not due until later.

For example, my buddy pays all his credit cards on the 1st of the month. In full. Regardless of when they’re actually due.

Other folks pay their credit card every time they make a purchase. That seems like a lot of work to me, but it could help you avoid spending more than you have.

It never makes sense to carry a balance. The interest you’ll pay (often more than 20%!) negates the value of the miles & points you’ll earn.

Stay Organized

Being in this hobby requires a good deal of fiscal responsibility and organization. It is NOT for everyone! Only you know if you’re disciplined enough to stick to a budget and keep good records.

I (and many others in our hobby) use a spreadsheet to track the cards I’ve applied for, sign-up bonus, approval date, the minimum spending requirement and deadline, and when I completed the spending.

And I keep a separate spreadsheet showing the payment due dates for each card I use.

But I also know folks who manage to keep track of everything using sticky notes and a paper notebook! Do whatever works for you – but stay on top of it!

It can be discouraging to lose track of your cards and deadlines. I’d be heartbroken if I missed out on a big bonus if I didn’t meet a spending requirement on time!

Start Slow, Protect Your Credit Score

I’ve always said if you’re new to miles & points, it’s best to start slow and only apply for 1 or 2 cards. That way, you can assess the impact on your credit score and see if you can handle the record-keeping and spending required!

Folks who’ve been in our hobby for a while typically have excellent credit scores. That’s despite opening lots of credit cards!

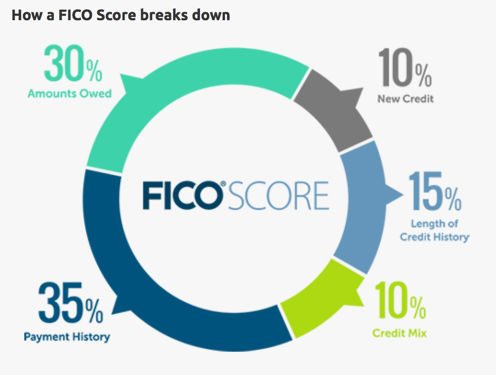

Remember, according to FICO, your credit score is based on the following factors:

- 35% Payment History

- 30% Amounts Owed

- 15% Length of Credit History

- 10% New Credit

- 10% Types of Credit

Notice that your payment history (do you pay your bills on time?) and amounts owed (do you carry a balance?) account for 65% of your FICO score.

So folks who don’t carry a balance and always pay their bills on-time and in full typically have the highest credit scores.

Remember, you can get your FICO score for free by having certain credit cards. Or get an estimate of your score from free sites like Credit Karma.

Bottom Line

Being successful in our miles & points hobby requires discipline and organization! To maintain a good credit score and avoid going into debt, I treat my credit cards like debit cards.

This means I never spend more money than I have in the bank. And I always pay my cards in full each month.

Staying organized with spreadsheets (or whatever method you prefer) will help you stick to a budget and keep track of your spending. Not everyone is good at this! So if you’re new, start slow to see how you handle your new credit cards!

Do you have any tips or tricks to share? How do you stay organized and avoid over-spending?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!