Trick for Big Travel on Southwest Using US Bank FlexPerks Cards

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.For folks with a US Bank FlexPerks card (like the US Bank FlexPerks Travel Rewards Visa or US Bank FlexPerks Travel Rewards AMEX), there’s a trick to redeeming your FlexPoints for more Big Travel on Southwest!

I haven’t tried this myself, but I’ll show you how it works. And give you some ideas about how to use your Southwest credits!

About the US Bank FlexPerks Cards

Link: US Bank FlexPerks Travel Rewards Visa

Link: US Bank FlexPerks Travel Rewards AMEX

Link: US Bank FlexPerks Select+ AMEX

US Bank FlexPerks Travel Rewards Cards

When you open the US Bank FlexPerks Travel Rewards Visa or US Bank FlexPerks Travel Rewards AMEX, you’ll earn 20,000 FlexPoints when you spend $3,500 on purchases within 1st 4 months of opening your account.

The annual fee on both cards is $49, waived the 1st year.

Now here’s the fun part. With your 20,000 FlexPoints, you can book a flight that costs, at most, $400. But in reality, you might find a flight that costs $310 or $250. So you’d be leaving money on the table! The trick I’ll show you is a way to get your full $400 worth of flights (on Southwest) from the 20,000 FlexPoints sign-up bonus!With the US Bank FlexPerks Travel Rewards Visa, you’ll also earn:

- 3X FlexPoints per $1 spent on charitable donations

- 2X FlexPoints per $1 spent on either gas, groceries or air travel – whichever you spend most on each monthly billing cycle, and most cell phone expenses

- NO foreign transaction fees

And with the US Bank FlexPerks Travel Rewards AMEX, you can earn:

- 3X FlexPoints per $1 spent on charitable donations

- 2X FlexPoints per $1 spent at restaurants, fast food, and most cell phone expenses

- 2X FlexPoints per $1 spent on gas, grocery or airfare – whichever you spend most on each monthly billing cycle

- NO foreign transaction fees

Both cards come with:

- 3,500 bonus FlexPoints each cardmember year you spend $24,000 in net purchases, which can be redeemed for your annual fee or other rewards of your choice

- 1 FlexPoint per $1 you spend on everything else

- Up to $25 statement credit per award ticket for airline expenses (checked bag fees, in-flight food, and drinks – you’ll get $25 max for 1 transaction)

You’ll have to call US Bank at 877-978-7446 to get the $25 credit for in-flight purchases within 90 days of a qualified purchase and it’s only valid on the dates for when you booked your award.

US Bank FlexPerks Select+ AMEX

Folks who want a card with no annual fee might consider the US Bank FlexPerks Select+ AMEX. You’ll earn 10,000 FlexPoints after spending $1,000 on purchases within 1st 4 months of opening your account. And 1 FlexPoint per $1 spent on the card.

Keep in mind it has a 2% foreign transaction fee for transactions in US dollars, and a 3% fee for foreign currency transactions, so it’s NOT a good card to use abroad.

Redeem FlexPoints for Southwest Flights

Link: Ways to Redeem Your FlexPoints

You can redeem your FlexPoints for lots of travel options, including:

- Airfare

- Car rentals

- Cruises

- Hotel stays

Or, spend them for gift cards, statement credits, and merchandise.

You can use FlexPoints to book flights on most airlines, including Southwest. Note you’ll have to call to book flights on Southwest because they can’t be booked online.

US Bank charges a $25 fee to book over the phone. But you can request they waive the fee for you because it’s impossible to book online.

I haven’t personally booked 1 of these award flights, so let me know if the comments what your experience has been!

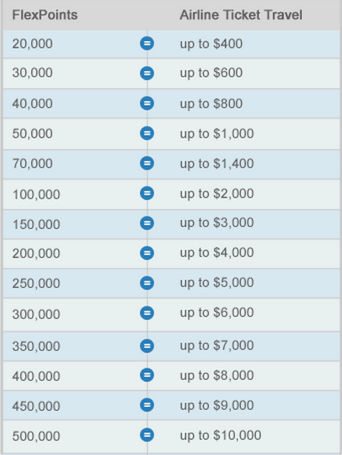

Book flights starting at 20,000 FlexPoints. For that amount, you’ll get a plane ticket up to $400.

That means that the ticket could be $100, $250, or $399 – all of them cost 20,000 FlexPoints.

And, you’ll earn frequent flyer miles on these tickets!

How Does It Work?

Because you can use 20,000 FlexPoints for flights up to $400, the trick is to find a flight as close to $400 as possible.

1. Find a $400 Flight on Southwest (Wanna Get Away Fares Do NOT Count)

Search on Southwest’s website until you find a flight that’s close to $400.

I found a flight from Chicago to Dallas for $399!

Keep in mind 3rd parties can NOT book Southwest’s “Wanna Get Away” fares. So look for “Business Select” or “Anytime” fares.

2. Call US Bank to Book

When you find a flight that’s close to $400, call 888-229-8864 to book using FlexPoints with a US Bank representative.

US Bank might pull higher prices on their flight booking software, so be sure to verify the price. It’s a good idea to have a couple of backups at a slightly lower price in case they price it higher.

3. Call Southwest to Link Your Rapid Rewards Number

After the flights are booked and you have a confirmation number, call Southwest at 800-435-9792 to link your Rapid Rewards number to the flight reservation.

They’ll ask for your name, flight information, and Rapid Rewards account number. The confirmation number from US Bank will NOT be the same as the 1 from Southwest, so be sure to ask for your Southwest confirmation number.

4. Cancel Your Flight Online

When you see the flight in your Rapid Rewards account, you can cancel it for free. That’s because Southwest doesn’t charge any fees to change or cancel their flights. Be sure to select “Hold funds for future use.”

Keep in mind you can’t transfer the credit – you must use it for your own flights.

The credit will be available to you to use on Southwest flights for a full year!

Again, I haven’t personally tried this trick, but it should work!

Who Should Do This?

This trick is handy for folks who:

- Want to get as much value as possible from their FlexPoints

- Want to take more than 1 Southwest flight within a year

- Need to use their FlexPoints before they cancel their US Bank FlexPoints credit card

- Want the flexibility Southwest offers

But the biggest reason to use this trick is to fly with a partner if you have the Southwest Companion Pass. That’s because they can fly with you for nearly free on any ticket!

This way, your 20,000 FlexPoints are worth $800 in Southwest flights instead of $400. That’s a great deal!

With the current offers for 50,000 Southwest points on the Chase Southwest cards, it’s easy to earn the Southwest Companion Pass!The flights you take will count toward Southwest A-List elite status, and help you earn more qualifying points toward your next Companion Pass because it’s like booking a paid ticket!

And remember, everyone gets 2 free checked bags on Southwest flights!

The drawbacks to this deal are the possible $25 phone booking fee, and you won’t be able receive statement credit for in-flight goodies if you fly on dates that are different from the ones US Bank booked for you.

But this can still be a great deal for some folks, especially if you have the Southwest Companion Pass!

Bottom Line

You can redeem your FlexPoints earned with the US Bank FlexPerks Travel Rewards Visa, US Bank FlexPerks Travel Rewards AMEX, or US Bank FlexPerks Select+ AMEX for flights on Southwest.

20,000 FlexPoints are worth up to $400 in airfare. But most folks probably end up booking a ticket for less than the full $400 they’re entitled to. Because they’ll find the flight they want for say, $290, and think that’s close enough.But…when you book a Southwest flight that’s close to $400, you can cancel the ticket to use the credit for future flights. So you’ll the highest redemption possible. And, if you have the Southwest Companion Pass, you’ll get nearly $800 worth of flights!

Be aware US Bank may charge $25 to book the flights over the phone (but ask them to waive it for you), and you can’t ask for statement credits if you fly on dates that differ from the ones you requested for your award flight.

You’ll have a full year to use the Southwest flight credit. This can be a great deal for folks who like to fly on Southwest. And, you’ll earn frequent flyer miles!

Let me know if you’ve had success with this trick!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!