Trivia Time: What Do the Numbers on Your Credit Card Mean?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Have you ever wondered what the numbers on your credit card mean? Are they a random assortment of digits, or do the numbers actually mean something? And why does your AMEX card usually start with “3” and your Visa card usually start with “4”?

You’ve probably noticed that certain types of cards always begin with the same number. But there’s a lot more information contained in your credit card number than you probably realized!

It’s Not Just a Random Number

Most credit card issuers follow the system governed by the American National Standards Institute (ANSI). You can get a lot of information from a card just from the numbers!

1. First Digit on the Card

The 1st digit on the card is the Major Industry Identifier (MII). This tells you the category of the card issuer. For example:

- Cards beginning with 1 or 2 are issued by airlines or other (future) industries

- Cards beginning with 3 are travel, entertainment, or banking & financial cards (this includes American Express, some Diner’s Club cards, and Carte Blanche)

- Cards beginning with 4 are banking & financial cards (Visa)

- Cards beginning with 5 are banking & financial cards (includes MasterCard)

- Cards beginning with 6 are merchandising, banking & financial cards (includes Discover)

- Cards beginning with 7 are petroleum cards (like Exxon)

- Cards beginning with 8 are telecommunications cards

- Cards beginning with 9 are for national assignment

2. First 6 Digits

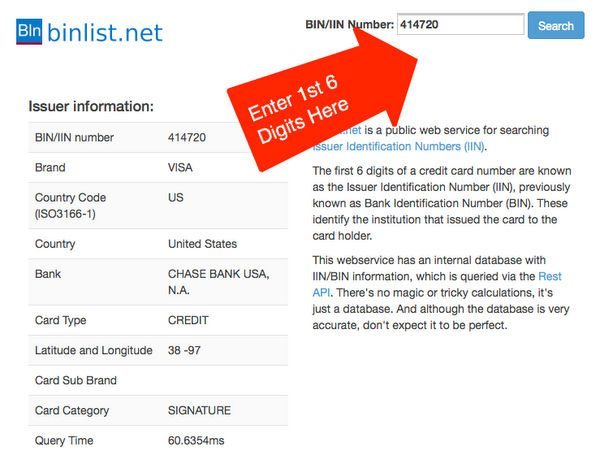

You can get even more information from the 1st 6 digits on the card. This is known as the Issuer Identification Number (IIN). From the IIN, you can tell which bank issued the card, the country of origin, and sometimes the specific card type (for example, Visa Signature, World MasterCard, or business card).

You can find out your credit card details by going to the Binlist.net website and entering the 1st 6 digits of any card in the search box. I tried it with the Chase Sapphire Preferred card and it told me:

- The card issuer (Chase Bank)

- The country (US)

- The brand (Visa)

- The card category (Visa Signature)

- The latitude and longitude (38 degrees north and 97 degrees west) of the issuing country!

This is kind of fun if you like numbers or are just obsessed with credit cards (like some of us!). 😉

I tried out the American Express Gold Delta SkyMiles card, and it knew it was an AMEX credit card:

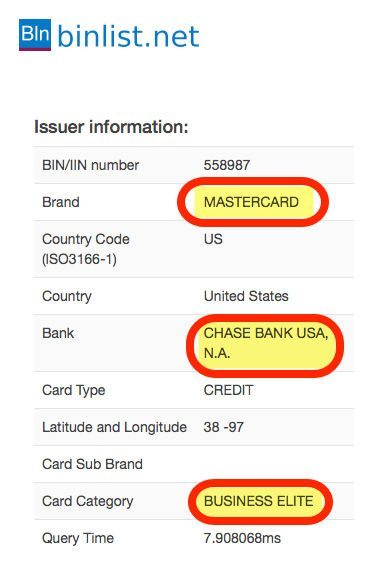

And it recognized my old Chase Ink Plus card as a business elite MasterCard (although new cards are issued as Visas)!

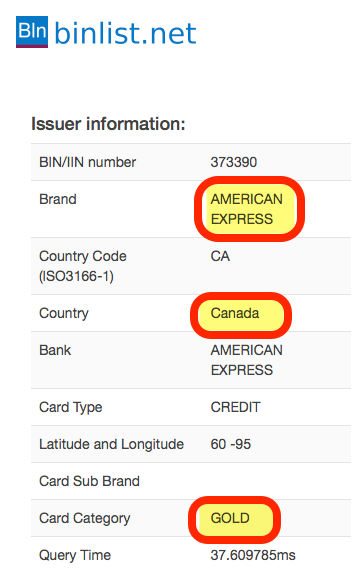

Cards from foreign countries will return similar information. For example, a Canadian American Express card looks something like this:

I won’t admit to how much time I spent entering random 6-digit numbers beginning with 3, 4, and 5, but let’s just say there are a lot of different credit cards in the world!

3. The Next Digits (Except the Last)

The numbers that follow the Issuer Identification Number (except the last digit) are your account number. The length of the account number depends on the type of card.

Often, authorized users on credit card accounts will have an account number slightly different from that of the primary cardholder. But that’s not always the case!

Account numbers are random, which is probably a good thing!

4. The Last Digit

The last digit on any credit card is a check digit or checksum, which is used to validate the credit card number.

Credit card issuers use a formula called the Luhn Algorithm to create the check digit. But with a little math, you can use the check digit to find out if a credit card number is fake! I’ll show you how to do this in a future post.

Bottom Line

You can learn a lot from your credit card number! It’s not just a random sequence of digits.

The 1st digit will always tell you the type of card such as Visa or MasterCard. And the 1st 6 digits will tell you the country, issuing bank, type of card, and sometimes even sub-category. You can find this information online by searching on Binlist.net.

The last digit of your credit card number is the check digit. It’s used to validate the card. I’ll show you how to use the check digit to find out if a card number is fake in a later post!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!