How to See if Your Credit, Debit, & Gift Card Tax Payments Are Received by the IRS

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Don’t forget to follow me on Facebook or Twitter!

I’ve written before on how to use the Delta debit card to earn miles while paying taxes and how to select the top credit cards to use to pay your taxes. Frequent Miler has also written on how to use gift cards to pay your taxes. You do pay a fee for using a credit card to pay your taxes, but it could be worth it to complete the minimum spending on your credit cards or to earn airline and hotel perks.

The IRS website suggests that you can make 2 estimated tax payments per quarter using a credit card, but readers commented that you can make more payments with a credit card or a gift card by:

- Using each of the 4 different tax payment providers to make 2 estimated tax payments per quarter online for a total of 8 online payments

- Calling each of the 4 payment processors and have them process additional payments over the telephone

Note that not all providers offer the same fee for using a credit card and the flat fee of $3.49 for using your debit card.

But talk to YOUR accountant or lawyer before making more than 2 payments per quarter with a credit card towards your quarterly taxes, since the IRS rules aren’t very clear on what is the maximum number of payments allowed.

Track Tax Payments

But how do you keep track of all these payments? Million Mile Secrets reader Brant (thanks!) emailed me about the Electronic Federal Tax Payment System (EFTPS) which will show you a record of your tax payments.

This is a great way to see if your payments were accepted by the IRS and also lets you see your payment history so that you can calculate the amount of payments you’ve made.

The EFTPS system shows you your payments regardless of the way in which you made the payment, so you’ll see online payments, check, and bank transfer payments.

If you haven’t enrolled, follow the steps in the next section to enroll. Once you have enrolled and received your PIN via US mail, you can log in and see your tax payments.

How To Enroll

Step 1 – Sign-up

Go to the EFTPS website and click on “Enroll“

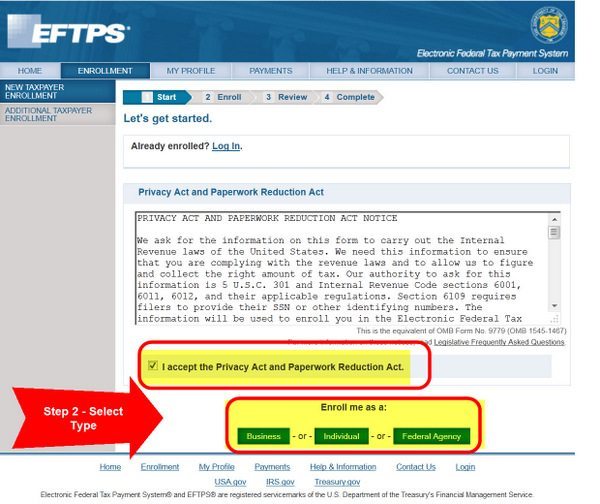

Step 2 – Select Type

Check the box that you’ve read the fine print and select whether you want to see tax payments for your business or for yourself. If you are a sole proprietor who pays estimated taxes, you should select “Individual.“

If you’re unsure of which type to select, ask your accountant or lawyer.

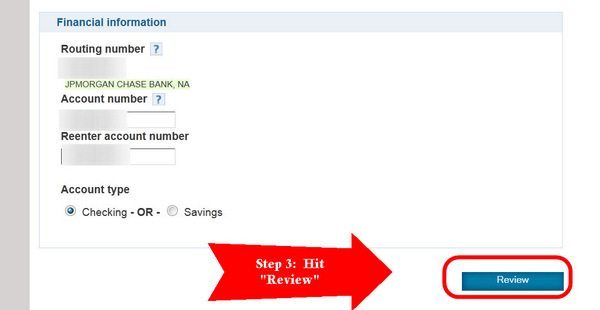

Step 3 – Enter Information

Enter in the required information and hit review. If in doubt, ask your accountant or lawyer for help. Electronically sign the document and hit complete.

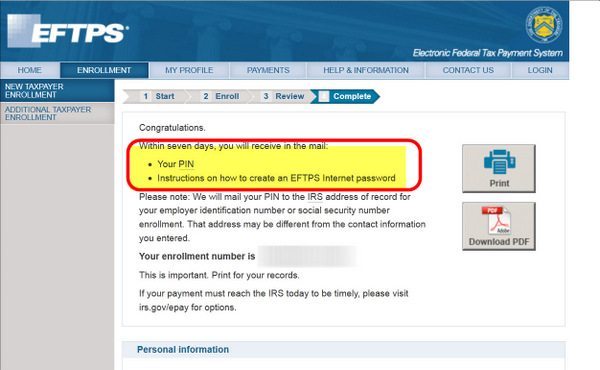

Step 4 – Wait for your PIN

You will get a confirmation that you PIN will be mailed to you via US mail. You should get the PIN in about 7 to 10 days. Once you get the PIN you can log into the system and see if your payments have been applied to your account.

How To View Your Tax Payments

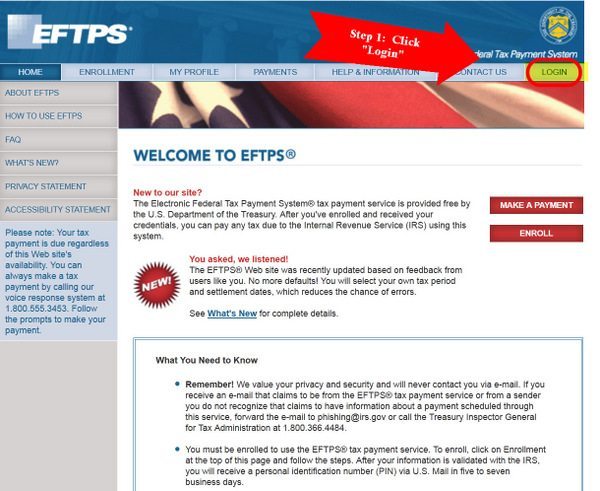

Step 1 – Log in

Go to the EFTPS website and click on “Login.“

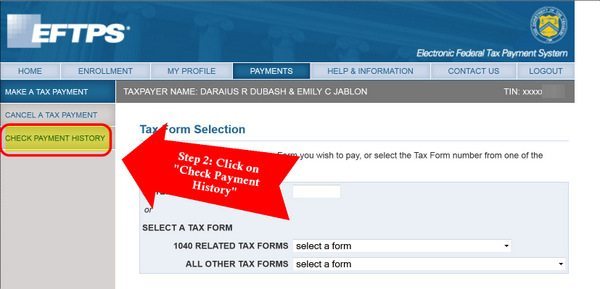

Step 2 – Check Payments

Click on the “Check Payment History” tab on the left.

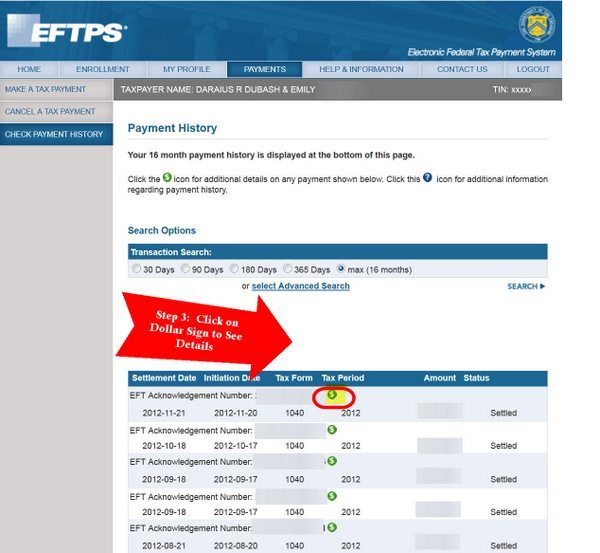

Step 3 – Review Payments

You will see a list of all your payments, together with the tax year to which they were applied. You can sort your payments and download them as well.

Click the little green dollar sign to get more details about a particular payment.

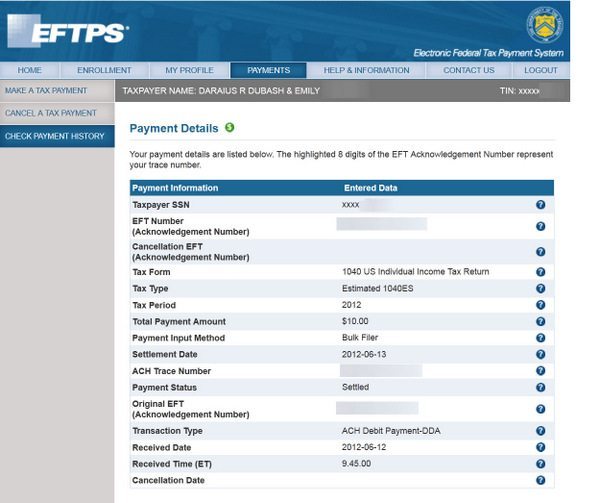

You will see the tax form and tax type to which the payment was applied. In this way, you can ensure that your payment was applied to a particular tax type. For example, you can check that your estimated payments for, say 2012, was indeed applied towards your estimated payments for 2012.

Bottom Line

If you pay your taxes with a credit, debit, or gift card online, the EFTPS site is great way to check that the payment was actually received by the IRS. It also lets you see your payments for the last 16 months so that you calculate how much tax you’ve paid.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!