$3.49 Debit Card Fee = LOTS of Delta Miles For Tax Payments!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Disclaimer: I am NOT a tax professional, so please consult YOUR tax professional before you make any tax-related decisions.I wrote earlier about a debit card which offered a 30,000 Delta mile sign-on bonus. Unfortunately, the sign-on bonus for that debit card is now only 5,000 Delta miles.

However, this debit card could be worth it for folks who make large tax payments and are searching for a way to get lots of miles or points for their tax payments.

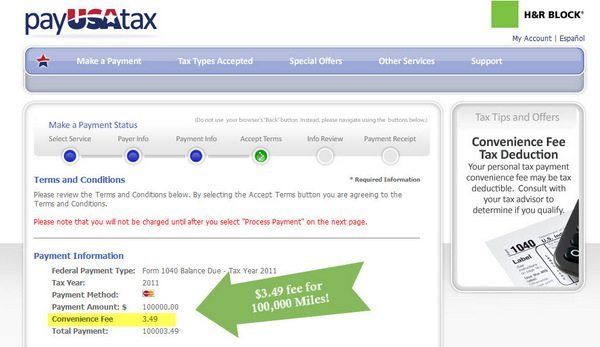

PayUSATax lets you pay your taxes using a debit card for a flat fee of only $3.49. This means that you could theoretically pay $100,000 in taxes and earn 100,000 miles or points for only $3.49 – a terrific deal!

But debit cards are not very profitable for banks, so most banks don’t let you earn miles or points for using a debit card and certainly not for tax payments.

For example, the terms and conditions of the Bank of America debit cards say:

“Mileage credit will not be awarded for federal, state or local tax payments, or similar payments to federal, state and local government agencies.”

I recently made two estimated tax payments of $10 before the June 15 deadline, as a test, with the Bank of America Alaska Airlines Visa debit card and the MasterCard debit card which earns Delta miles using PayUSATax.

PayUSATax charges a flat fee of $3.49 if you use a Visa or MasterCard debit card.

I didn’t earn any Alaska airlines miles for using the Bank of America Alaska Airlines card, but I did earn miles using the Delta debit card! I also earned miles for the $3.49 convenience fee.

As always, this was my personal experience, and your experience could be different! View from the Wing points out that the bank which issues the Delta airlines debit card recently failed the Fed stress test and they may be issuing points earning debit cards as a way to attract deposits.

The terms of the Delta debit card do NOT (as of now) prevent you from earning miles for using the debit card for tax payments.

I don’t expect this to last very long, because I suspect giving away potentially hundreds of thousands of Delta miles for only a $3.49 fee isn’t commercially viable for some of the parties involved.

The Delta debit card has a personal and business version, but the personal version earns 1 mile per $1 spent, whereas the business version earns only 1 mile per $2 spent.

Note that there are limits on the number of payments you can make with PayUSATax, but you may be able to make more payments via telephone. My Delta mile earning debit card had a limit of $35,000 per day, but won’t be testing if that is really enforced, because of the absence of $35,000 in my Suntrust account.

But is it worth it to earn Delta miles – even if they are close to free? View from the Wing debated The Points Guy at Frequent Traveler University in April, so refer to this summary to see if earning Delta miles makes sense for you!

Bottom Line: Paying only $3.49 for a lot of Delta miles when you pay your taxes could be a great deal for some folks!Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!