Success! Family of 6 Explored Disney for 12 Days for Nearly Nothing With Miles & Points!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Welcome to the next installment of our Reader Success Series where Million Mile Secrets Readers share how they booked a trip with miles & points to get Big Travel with Small Money!

Carole is our newest reader success story to show folks it’s possible to travel without spending a lot of money.

A big thank you to Carole for sharing her story!

Please introduce yourself to everyone and tell us how long you’ve been involved in the miles & points hobby.

My name is Carole Rains and I am the research queen of our family of six. 🙂

We live in Northern California and have always made travel a priority. I stumbled across a few blogs like Million Mile Secrets only last year, in February 2015.

What was the goal of your trip?

My eldest daughter is 16. Last year I suddenly realized our dream of a family trip to Walt Disney World was going to get a lot more difficult once she went to college.

My first goal was to cover the plane tickets and hotel stays with points. But before it was over, I challenged myself to have a net cost of $0!

How long did you collect miles and points for your trip?

As soon as we returned for our summer trip in 2015, I starting strategizing for a November 2016 trip to Florida. I met my ultimate goal in approximately 15 months.

Which points did you save to take your trip?

My husband doubled up with 2 Chase Southwest credit cards (Southwest Rapid Rewards Premier Credit Card and Southwest Rapid Rewards Plus Credit Card), which covered most of the airline points and saved us one round-trip ticket with the earned Companion Pass.

I opened an AMEX Starwood card to cover 4 award nights at the Sheraton Vistana Resort Villas, Lake Buena Vista/Orlando – which gave us the 5th night free.

My Citi Hilton HHonors Visa Signature Card bonus covered part of our stay at the Doubletree in Disney Springs, an all-suite hotel. I made up the difference with a 100% bonus points purchase, which meant we could get the 5th night free at this location, also.

What cards would you recommend to someone starting out with miles & points?

- Chase Southwest Premier Visa – The Companion Pass has given us flexibility to take more trips beyond this one over the last year.

- Capital One® Venture® Rewards Credit Card – Out of the travel cards options, I found the earn rate (2%) and ability to redeem the most useful for us.

- Pick a card (or 2!) with hotel points that fits your situation – we found the AMEX Starwood card to be a good choice.

- Discover it® Cash Back – We used this to purchase discounted Disney gift cards for meals and other incidentals.

- Blue Cash Preferred® Card from American Express – As a large family, the 6% cash back (then 1%) at US supermarkets is a great benefit. This helped cover travel costs like food (one of our biggest expenses) or things like extra points to round out a reward stay.

How did you search for and find the award flights?

I made it a habit to check the price of the flights regularly on the Southwest site or app.

This saved us over 30,000 points over the course of a few months – enough to fund even more free travel!

How did you find your hotel accommodations?

One of the things I learned early was a family of 6 can not stay in standard reward rooms at most hotels. This made my goals difficult to execute and involved digging for the accommodations options at several resorts and hotels first before rushing to apply for what seemed to be a perfect credit card sign-up bonus.

Also, when I had to book a standard award night, I immediately called the hotel to make sure we could upgrade somehow, even if it meant a few more points or cash.

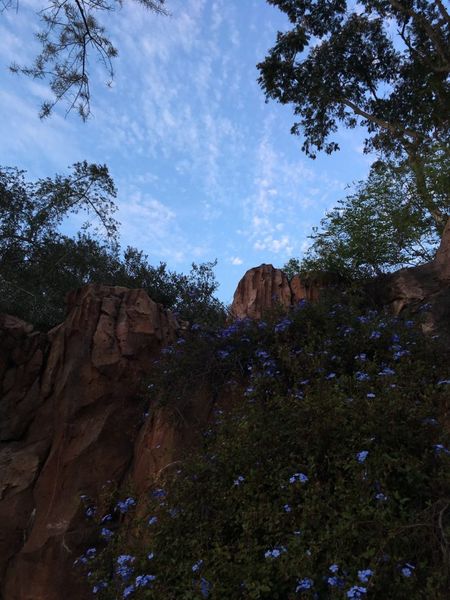

We stayed at the Art of Animation, a Disney resort, our first night at Disney for the perks: shuttle from the airport, magic bands, early access to reservations. That stay was paid with cash, but I had a coupon for $50 towards any hotel booking through Expedia.

What was the most challenging part about planning your trip? How did you solve it?

Disney does not code as travel. I had a dilemma. How was I going to find a way to make a dent in that $2,000+ park ticket cost?

I found an online travel agency selling 7-day hoppers for less than I expected to pay for 5 days/one park per day. I purchased each of the six tickets as separate transactions, split equally between the Barclaycard Arrival Plus and Capital One Venture.

It was a quick way to knock out the minimum spend for both credit cards, then turn around and use the bonus (a total of $930) to “erase” some of the ticket purchases.

Give us a few recommendations or tips for what to do at your destination. Parks, restaurants, hidden gems, etc.

Renting a minivan runs at least $80 a day, not including gas or parking. Between strategic hotel choices and the Disney transportation system, there are lots of other ways to get around.

In the end, we were surprised to find that taking UberXL or Lyft Plus was the quickest, most comfortable way to get to the parks. One-way trips were $10 to $15 to any park and with referrals, codes, and the ability to use our travel credit when charged to the Capital One Venture card, it was “free” most of the time.

What did you learn about yourself on the trip?

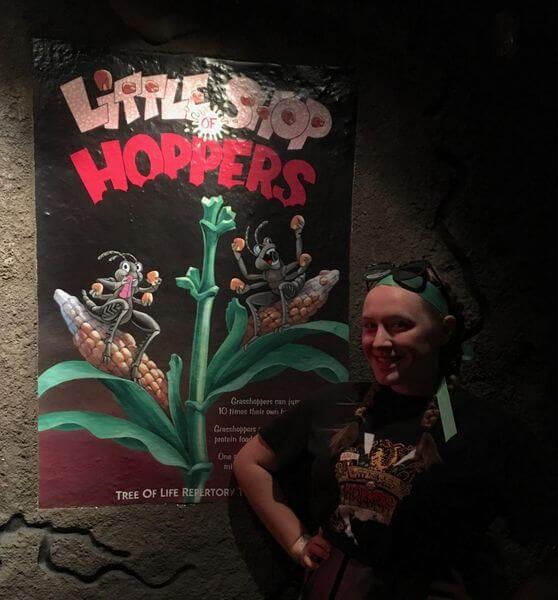

I thought I would be sick of Disney after 12 days, but it turns out we are true fans!

Also, there were many times that we all had to be flexible – or not very comfortable – when things didn’t turn out the way we planned. I began to better understand that under the occasional grumpiness and whining, our family’s great attitude is what makes travel adventures possible.

What would you say to folks looking to plan a similar trip? Or to those who haven’t taken a miles & points trip yet!

The thing that made the biggest impact is the willingness to meet SOME goals, a little at a time.

For instance, I signed-up for a Chase banking account for the $300 bonus. For me, that represented 3 days of meals in the parks!

Also, I cannot stress enough a master tracking spreadsheet or some other way to track your expenditures and earnings toward your trip. In my case, I used a very primitive method – a draft email. I found that being able to access my tracking system from my iPhone or computer, without any formatting, was the most effective way to see our progress at a glance.

Want to Share Your Story?

If you’d like to be considered for our reader success story series, please send me a note! Emily and I would love to hear about how you travel with miles and points!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!