My Review of Chase’s New (Free!) Credit Monitoring Service, Credit Journey

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers. Knowing your credit score is important in the points & miles hobby. And Chase has just launched Credit Journey, giving anyone (not just Chase cardholders) free access to an estimate of their TransUnion score.So folks now have another free tool to help keep tabs on their credit!

That’s important, because having a higher score improves your likelihood of getting approved for credit. So you can earn more sign-up bonuses. 😉

Here’s more about Chase’s new credit score service.

Get an Estimate of Your TransUnion Score for Free With Chase’s New Website

Link: Credit Journey

With Chase’s Credit Journey, you can get an estimate of your TransUnion credit score.

Signing-up online is easy, and you do NOT have to be a Chase cardholder to use the service.They’ll ask for things like your name, email, address, and the last 4 digits of your social security number. And then verify your identity with a few questions.

Along with the score estimate, you’ll be able to see what factors are affecting your score, like credit utilization, late payments, opened accounts, and inquiries.

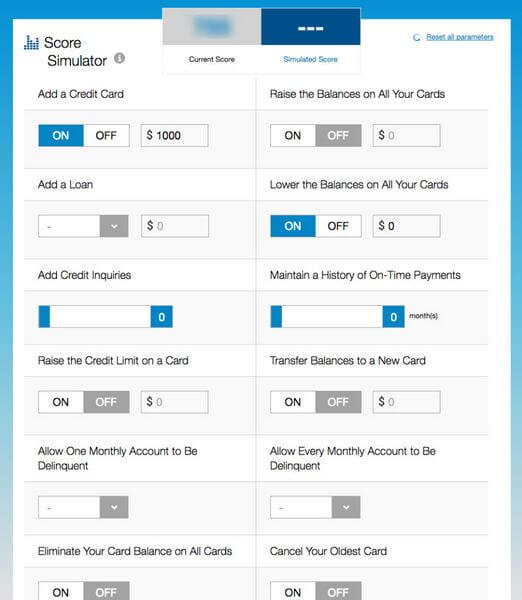

The score simulator is another unique tool that many of the other credit monitoring sites don’t offer. You can see how different changes to your credit report would affect your score.

Just be aware, this is a FAKO score NOT a FICO score.

FAKO scores are based on information from your credit report, but they use different scoring criteria than FICO. Because they aren’t regulated like FICO scores are. So this tool is only good for getting an estimate of your score.

Lenders use FICO scores when making credit and lending decisions.

Is This Different From Other Credit Monitoring Sites?

Chase’s Credit Journey is similar to sites like CreditKarma and Credit Sesame, in that they allow you to view your credit data and offer estimates of your scores (FAKO scores).

Credit Journey pulls data from TransUnion, CreditKarma estimates your scores with data from Equifax and TransUnion, and Credit Sesame uses information from Experian.

Discover’s Credit Scorecard, on the other hand, gives you your actual FICO score from Experian.

Different banks pull scores from different bureaus when you apply for new cards, so it’s something to watch for when you sign-up.

Other Ways to Get Your Free FICO Score

AnnualCreditReport.com will give you a free credit report from each credit bureau once every 12 months. But it won’t include your actual FICO score. Luckily, there are a number of credit cards that offer folks free FICO scores from all 3 credit bureaus. For example, anyone with a personal card from American Express, like the AMEX Starwood card or Premier Rewards Gold Card from American Express, gets access to their score from Experian.And you can get your Experian FICO score with the Chase Slate card.

And Citi cards like the Citi Prestige Card, Citi ThankYou Premier Card, and Citi ThankYou Preferred Card allow cardholders to view their free FICO score from Equifax.Why Your Credit Score Matters

Read about why you should apply for cards from different banks and the factors that affect your credit score. You’ll learn how your credit score is calculated and why it matters when you’re applying for credit cards.

Also, check out my post on how to boost your credit score!Bottom Line

Chase’s Credit Journey tool will give you an estimate of your TransUnion credit score.

The good news is, you don’t have to be a Chase cardholder to use the service. Just remember, this is a FAKO score and not a FICO score, that lenders use when making lending decisions.

Plus, there are certain credit cards offer free FICO scores from the 3 credit bureaus (Equifax, TransUnion, and Experian). So this tool may not be worth it to some folks.

Let me know what you think of Chase’s new credit monitoring service!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!