New Rules for Transferring Chase Ultimate Rewards Points

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Effective immediately, Chase has updated its rules about transferring Chase Ultimate Rewards points.

It looks to be a littler easier to share your Chase Ultimate Rewards points. But a bit more cumbersome to transfer your Chase Ultimate Rewards points to someone else’s airline or hotel account.

There are also differences when you’re transferring from a personal or small business credit card.

I’ll let you know what these changes mean. And show you how to add an authorized user to your account.

What’s Going On?

Link: Chase Ultimate Rewards Transfer Partners

Chase recently updated the rules on transferring Chase Ultimate Rewards points to another person’s Ultimate Rewards account or loyalty program account. And the rules vary depending on whether you have a Chase personal or small business credit card.

Personal Cards

For Chase personal credit cards that earn Ultimate Rewards points, like Chase Sapphire Preferred and Chase Freedom, you can transfer to another person’s Ultimate Rewards account or loyalty program (airlines & hotels) account.

There are separate rules for each.

When you transfer your Ultimate Rewards points to another person’s Ultimate Rewards account, Chase only requires they are a household member.

Previously, you could only transfer your points to a spouse or domestic partner.

But now, you can transfer to anyone in your household.

Small Business Cards

Chase business cards that earn Chase Ultimate Rewards points are the Chase Ink Plus, Chase Ink Bold, and Chase Ink Business Cash Credit Card. You can transfer your points to folks who are either household members or to another owner of the company.

I asked a couple of Chase representatives what was meant by “company owner” and they told me company employees were eligible as long as the travel is for company purposes.

Like the rules for personal accounts, Chase does NOT mention authorized users when you transfer Ultimate Rewards points to another Ultimate Rewards account. And, they add you can transfer to a household member OR company owner.

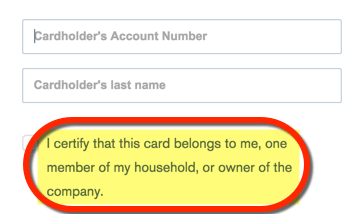

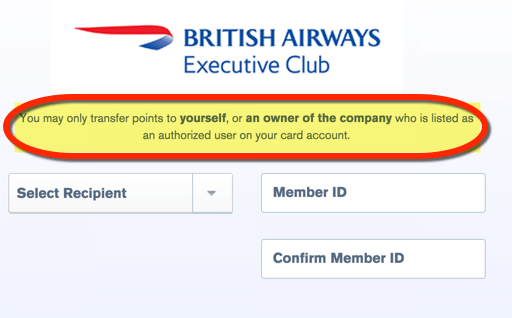

But for Chase small business credit card accounts with Ultimate Rewards points, there are different rules to transfer to another person’s loyalty accounts. They must be a company owner AND an authorized user. Household members are excluded here.

The Chase representatives I spoke with told me you can transfer your points to a company employee’s loyalty account as long as they are traveling for company business.

What’s Not Changing

You can still combine Ultimate Rewards points in your own accounts, and the way to transfer your own points to your travel partner accounts is not changing.

What Does It Mean?

If you want to share your points with someone else, there are a couple of things to watch out for.

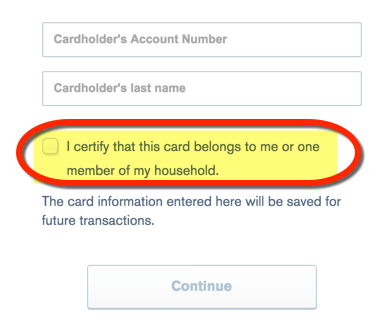

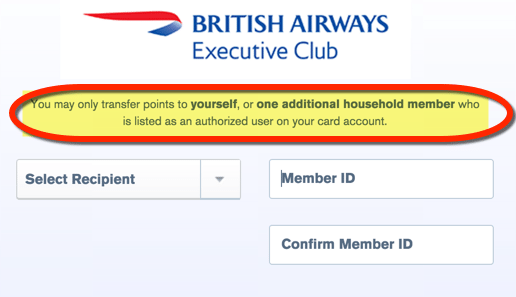

You can transfer to another person’s Ultimate Rewards account as long as they are in the same household. But if you want to transfer to someone else’s frequent flyer or frequent hotel guest program, you’ll need to take the added step of adding them as an authorized user to your account.

For Chase small business cards, make sure you only transfer to the loyalty accounts of your employees for business purposes, or to another company owner’s accounts.

A good change with these new rules is that you can transfer to folks who are NOT your spouse or domestic partner, including roommates, or a child, sibling, or parent who lives in the same household.

It seems business owners will have to be more careful, because if Chase looks into your transfer history your account could be compromised.

Remember, you can always transfer your Chase Ultimate Rewards points to your own loyalty program accounts, and then book hotels rooms or flights for anyone you choose.

How to Add an Authorized User

Chase makes it simple to add an authorized user. You can call Chase, or set it up through the Chase website.

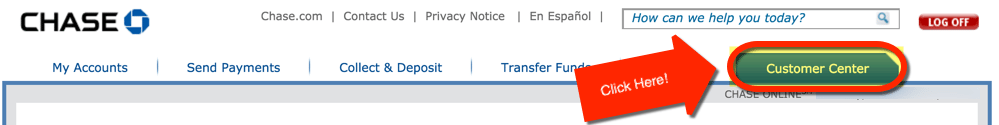

To get started, click the “Customer Center” tab after you log into your account.

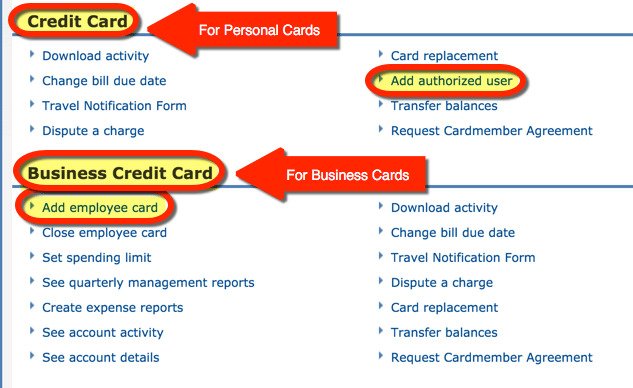

To add a user on a personal card, scroll down to the “Credit Card” section of the page, and click “Add authorized user.“

And for a business card, find the “Business Credit Card” section and click “Add employee card.”

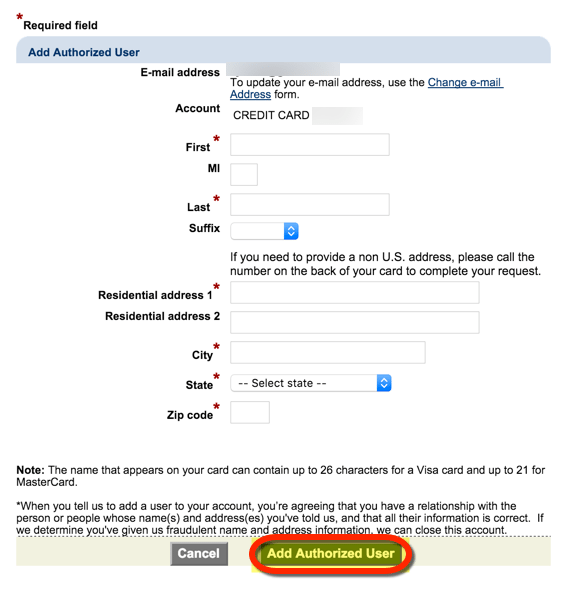

Chase asks for the same information for both types of accounts.

Fill-in the other person’s name and address, and click “Add Authorized User.” That’s it! They should receive their card in about 5 to 7 business days, and note that it will be mailed to the primary cardmember.

Adding an authorized user is a great way to help meet minimum spending requirements.

Be sure you only add someone that you completely trust. They will be linked to your primary account, and ultimately YOU are responsible for any charges that they make.

As always, do what you are comfortable with. And be sure to only add someone you know will pay you back!

Note: If you add someone as an authorized user on your card, they can still sign-up for their own card later on to earn their own sign-up bonus.Bonus Points for Adding an Authorized User

Right now, these Chase cards offer a bonus for adding an authorized user when you open a new account:

- Chase Sapphire Preferred – 5,000 Chase Ultimate Rewards points for adding an authorized user who makes a purchase within the 1st 3 months of opening your account

- Chase Freedom – 2,500 Chase Ultimate Rewards points ($25) for adding an authorized user who makes a purchase within the 1st 3 months of opening your account

- Chase Hyatt – 5,000 bonus points when you add an authorized user who makes a purchase with your card within the 1st 3 months

This is a great way to earn extra points when you sign-up for a card!

You can currently earn 50,000 Chase Ultimate Rewards points when you sign-up for the Chase Sapphire Preferred and spend $4,000 on purchases within the 1st 3 months of opening your account. And the $95 annual fee is waived for the 1st year!And you can now earn 15,000 Chase Ultimate Rewards points ($150) when you sign-up for the Chase Freedom card and spend $500 on purchases within the 1st 3 months of opening your account. There is NO annual fee for this card.

Bottom Line

Moving forward, you can only transfer your Chase Ultimate Rewards points to the airline & hotel loyalty accounts of your authorized users. This applies to personal and business cards.

For business cards, you can transfer to the frequent flyer program or frequent hotel guest program of an employee as long as they are on company business AND an authorized user, according to Chase representatives.

You can transfer your points to another person’s Ultimate Rewards account as long as they are in the same household. And unlike before, Chase does not specify this person has to be a spouse or domestic partner.The changes do NOT affect how you combine Ultimate Rewards points in your own accounts or how you transfer your own points to your travel partner accounts.

Adding an authorized user is a great way to earn extra points or to meet your minimum spending requirements. But be sure you completely trust this person, because you’re responsible for any charges they make!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!