News You Can Use – $50 Off Westin Hotels, 2,000 Southwest Points for Hotel Stays, Save 15% at Wyndham, & More!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

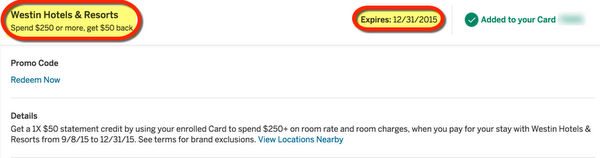

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.1. Get $50 Off a $250+ Stay at Westin Hotels With AMEX Offers

Link: Starwood Preferred Guest® Credit Card from American Express

Link: Starwood Preferred Guest® Business Credit Card from American Express

Via Deals We Like, you can get $50 off a stay of $250+ at Westin hotels when you pay with targeted AMEX cards.

The offer is valid through December 31, 2015. Log into your AMEX account to check if it’s available for any of your cards. Read my post to see how to get AMEX offers more than once if it’s listed on more than 1 of your AMEX cards.

If you recently signed-up for the AMEX Starwood personal or small business card, be sure to check those accounts! Because you’ll earn 2X Starwood points when you use either card to pay for your stays at Westin hotels, like the Westin San Diego Gaslamp Quarter!

Terms and Conditions

- Reservations must be made online at Westin.com, through the Starwood mobile app, or by calling 800-937-8461 (3rd-party bookings do NOT qualify)

- Offer is only valid at Westin hotels in the US and US territories

- You can only get 1 statement credit per AMEX card

- Enrollment is limited

This is an easy way to save money if you have a stay at a Westin hotel coming up before the end of this year!

2. AMEX Membership Rewards Points to Best Western Ending at the End of 2015

Via Travel With Grant, you won’t be able to transfer your AMEX Membership Rewards points to Best Western as of January 1, 2016.

I’ve written about who might consider using Best Western points. They have hotels in many small towns across the US, and in a few desirable tourist areas, like the Best Western Plus Anaheim Inn, which is easy walking distance to Disneyland in California.

If you think you’ll use Best Western points for an upcoming stay, be sure to transfer your points before the end of year!

3. Earn up to 2,000 Southwest Points for Upcoming Hotel Stays

Link: Southwest 2,000 Bonus Points Promotion

Link: Southwest Rapid Rewards® Plus Credit Card

Link: Chase Southwest Premier Credit Card

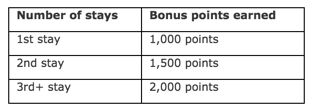

Via Michael W Travels, you can earn up to 2,000 bonus Southwest points when you register for the promotion and book a hotel stay by September 30, 2015.

Eligible stays must be completed by December 31, 2015, and there’s no limit to the number of stays you can book.

You’ll earn:

- 1,000 Southwest points for your 1st stay

- 1,500 Southwest points for your 2nd stay

- 2,000 Southwest points for your 3rd stay, and any others after that!

To earn the bonus points, you must book your stay on Southwest.com.

The downside is these bonus points do NOT count toward Southwest elite status or the Southwest Companion Pass, which is best deal in domestic travel!

But you can earn 2X Southwest points per $1 spent when you pay with your Chase Southwest Plus or Chase Southwest Premier card. And those points DO count toward Southwest elite status AND the Southwest Companion Pass!

If you have hotel stays coming up and want to earn extra Southwest points, be sure to book soon to take part in this promotion!

4. Get 15% Off at Wyndham Hotels and 200 Wyndham Points When You Pre-Pay

Link: Wyndham Pre-Pay Promotion

Link: Join Wyndham Rewards

Link: Barclays Wyndham Rewards

When you book early and pre-pay for your stay at Wyndham hotels, you’ll get 15% off the room rate and receive 200 bonus Wyndham points.

To take part, you must be a Wyndham Rewards member (free to join!) and book your stay 7 or 21 days in advance, depending on the hotel.

If you have a business trip, family vacation, or romantic getaway coming up, this is a great way to save money and get some bonus points!

And remember you’ll earn 5X Wyndham points per $1 you spend at Wyndham hotels when you pay with the Barclays Wyndham Rewards card.

Let me know which of these deals today is your favorite!

Also, you’ve got a few days left to win 10,000 airline miles from Golfmiles. This is only for Million Mile Secrets readers! And on Saturday, 1 of y’all will win enough Starwood points to save $400+ on your next Starwood Cash & Points stay!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!