Now Earn 75,000 American Airlines Miles With Citi AAdvantage Executive Card! [Expired]

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Via Mommy Points, the sign-up bonus on the Citi® / AAdvantage® Executive World Elite™ Mastercard® has been increased to 75,000 American Airlines miles after you spend $7,500 on purchases in the 1st 3 months of opening your account.

The $450 annual fee is NOT waived for the 1st year.

While this isn’t as good as last year’s 100,000 American Airlines mile sign-up bonus, it’s still a much better offer than the usual 50,000 mile sign-up bonus (which has a lower minimum spending requirement).

Let’s see what you get with the Citi AAdvantage Executive card and if it’s worth applying!

What’s the Deal?

Link: Citi AAdvantage Executive World Elite Mastercard

Link: My Review of the Citi AAdvantage Executive

Last year, the Citi AAdvantage Executive card had a big 100,000 American Airlines mile sign-up bonus. Many folks earned lots of miles with this card (sometimes more than once!).

But Citi reduced the bonus to 50,000 American Airlines miles after meeting minimum spending requirements.

So this new 75,000 mile offer is a much better deal. If you didn’t get in on the 100,000 mile offer last year, this is a great opportunity to earn a lot of American Airlines miles!

To earn the bonus, you’ll have to spend $7,500 on purchases in the 1st 3 months of opening your account. But there are lots of ways to meet minimum spending requirements!

With this card, you’ll also get:

- American Airlines Admirals Club membership (worth up to $500) – access Admirals Club lounges, and bring your immediate family or up to 2 guests traveling with you. You do NOT have to be flying American Airlines to enter the lounge!

- Up to $100 Global Entry or TSA PreCheck application fee credit (every 5 years)

- First checked bag free (for you and up to 8 companions traveling on the same reservation) on American Airlines and US Airways flights

- 25% discount on in-flight purchases (like food, drink, and headsets) on American Airlines and US Airways flights

- Priority check-in, security (where available), and boarding

- 10,000 elite-qualifying miles if you spend $40,000 or more on the card in a calendar year

- 2 American Airlines miles per $1 you spend on American Airlines

- 1 American Airlines mile per $1 you spend on everything else

- No foreign transaction fees

This could be a great deal if you can use the $100 Global Entry or TSA PreCheck credit to off-set the annual fee. And you can get lots of Big Travel with the sign-up bonus!

What Can You Do With 75,000 American Airlines Miles?

Link: American Airlines Award Chart

Link: American Airlines Partner Award Chart

You could use 75,000 American Airlines miles for 3 round-trip coach tickets within the mainland US and Canada. That alone could be worth ~$1,500 or more!

But I like using American Airlines miles for expensive award tickets on American Airlines, US Airways, oneworld alliance airlines, or partner airlines like Etihad.

For example, you could use the sign-up bonus for a round-trip, First Class ticket on American Airlines between the US mainland and Hawaii. Award flights cost 75,000 American Airlines miles for First Class (on airplanes with coach and First Class only)

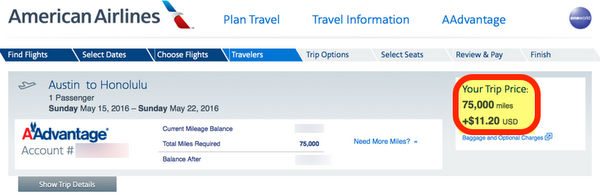

I searched for flights between Austin and Honolulu next spring. You’d pay 75,000 American Airlines miles and ~$11.

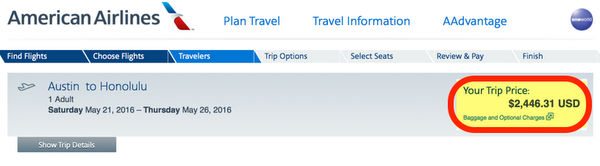

If you paid cash, the same flight would cost ~$2,446!

That’s a terrific deal from 1 credit card sign-up bonus. And well worth the $450 annual fee, especially since you get lots of other perks (like lounge access) with the card.

That said, you can earn 50,000 American Airlines miles with the Citi® / AAdvantage® Platinum Select® World Elite™ Mastercard® after meeting minimum spending requirements. The information for the Citi AAdvantage Platinum Select card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

You won’t get lounge access or the Global Entry / TSA PreCheck credit, but the annual fee is only $95 and is waived for the 1st year.

Bottom Line

The sign-up bonus on the Citi AAdvantage Executive card has been increased to 75,000 American Airlines miles after you spend $7,500 on purchases in the first 3 months of opening your account.

That’s a much better deal than the usual 50,000 mile sign-up bonus. But the minimum spending is higher and you’ll still have to pay the $450 annual fee (NOT waived for the 1st year).

Folks who didn’t apply for the 100,000 mile Citi AAdvantage Executive offer last year might consider this deal, if they’ll use the $100 Global Entry or TSA PreCheck credit and are able to make the most of the American Airlines Admirals Club membership.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!