Should I Renew My US Airways Cards?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Million Mile Secrets reader Billy D emails with a question:

My business and personal US Airways MasterCard cards are up for renewals this month. In light of the merger, should I renew them?

The US Airways cards will soon become Barclaycard AAdvantage Aviator Red cards. So Billy can keep his cards and apply for new US Airways cards (even if he has an open US Airways card) or cancel and reapply.

Billy’s chances of getting approved are better if he cancels his current US Airways card. But he might not want to if it’s his oldest card. Keep reading to find out why.

50,000 US Airways Miles US Airways Card

Link: 50,000 US Airways Miles US Airways card

Link: My review of the Barclaycard US Airways card

Barclaycard is still accepting applications for the US Airways card. So Billy can get 50,000 US Airways miles after his 1st purchase and payment of the $89 annual fee.

But this may be Billy’s last chance to get the sign-up bonus on this card because it will NOT be available once US Airways and American Airlines merge.

If Billy renews his existing US Airways card, he can still apply for another one. Although it will lower his chances of being approved.

To improve his chances for approval (and get the sign-up bonus) he should 1st cancel his existing card and ideally wait 6 months before reapplying.What Happens After the Merger

All US Airways cards will eventually be converted into Barclaycard AAdvantage Aviator Red cards. (That card will NOT be open for new applicants.)

And all of Billy’s US Airway miles will become American Airlines miles.

Note: Barclaycard hasn’t said what will happen to the business version of the US Airways card after the merger. But the same scenario will likely play out.Impact on Credit Score

Billy would be better off if he cancels his US Airways cards to increase his chances of getting approved for the sign-up bonus on a new US Airways card.

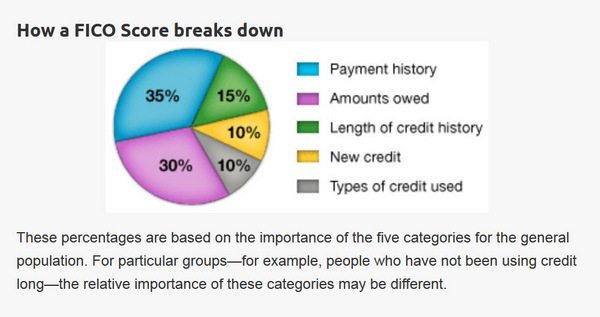

According to the FICO website, Billy’s credit score is determined by:

- 35% Payment History

- 30% Amounts Owed

- 15% Length of Credit History

- 10% New Credit

- 10% Types of Credit

Canceling a personal credit card impacts the Amount Owed & the Length of Credit History which could reduce his credit score.

So Billy shouldn’t cancel his US Airways card IF it’s his oldest card since it helps his credit score by increasing his Length of Credit History.

And canceling cards with a very high credit limit (compared to the total credit available to him) could also impact his credit score.

Bottom Line

If Billy renews his US Airways card, Barclaycard will convert it to the AAdvantage Aviator Red card, which will only be offered to existing US Airways cardholders.

He could apply for a 2nd US Airways card while renewing his original. (Some folks have been approved even if they currently have a US Airways card). But he’ll improve his chances of being approved for a new card and sign-up bonus if he 1st cancels his existing card.

However, if the US Airways card is Billy’s oldest card, he shouldn’t cancel because it could affect his credit score.

What’s your experience with getting a 2nd US Airways card while still having your first?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!