Free FICO Scores for Citi Cardholders

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers. This page includes information about the Discover it® Cash Back that is not currently available on Million Mile Secrets and may be out of date. Citi is an MMS advertising partner.If you have a Citibank credit card you will soon be able to access your Equifax FICO score for free!

Even if you don’t have a Citi card, I’ll show you how you can monitor your credit for free.

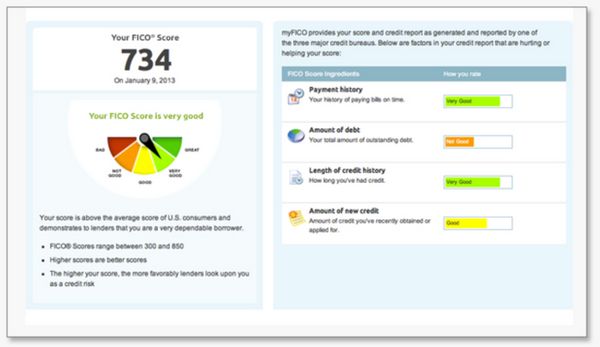

Your credit score is a number that reflects your ability to pack back loans. Banks use your credit score to determine whether or not they should approve you for a credit card, home loan, car loan, and more.

So if you don’t have a good credit score, you won’t be able to enjoy Big Travel with Small Money!

How Is Your FICO Score Determined?

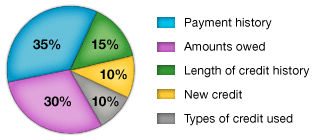

FICO scores are based on the following:

- Payment history

- Amounts owed

- Length of credit history

- New credit

- Types of credit

Learn about how applying for lots of credit cards can impact your score in my series on credit scores.

It’s important to monitor your credit score to check for fraud and identity theft. And you can do this for free, if you have a Citi branded card such as:

- Citi® / AAdvantage® Platinum Select® World Elite™ Mastercard®

- Citi® Double Cash Card — 18 month BT offer

Don’t Have a Citi Card?

If you don’t have a Citi card, you can still check your TransUnion FICO score for free if you have certain Barclaycards. And folks with a Discover card can get their score for free.

Knowing your credit score can help you. But seeing your full credit report can show you if there is anything you believe to be incorrect. That way you can file a dispute to get the mistaken or fraudulent claim removed.

Sites like CreditKarma and Credit Sesame give you access to your credit report in addition to your estimated credit score.

And once every 12 months you can get your credit report from each credit reporting company at AnnualCreditReport.com.

Bottom Line

In the past, the only way you could see your FICO score was if you were denied for a loan. So it’s nice to see banks moving towards more transparency in how they issue credit.

If you have a Citi branded credit card, you will soon be able to check your Equifax FICO score for free. You can also view your TransUnion FICO score for free with certain Barclays cards.

You can view your credit report and your estimated credit score on CreditKarma and Credit Sesame for free. And at AnnualCreditReport.com you can get a free credit report from each credit bureau once every 12 months.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!