Do You Know About the 140,000 Points Ritz-Carlton Card?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.If you are planning award stays at Ritz-Carlton or Marriott hotels, now is a great time to apply for the Chase Ritz-Carlton Rewards card. There are 4 different offers available now, and some of them are very good!

One of these offers has a sign-up bonus of 140,000 points! That’s enough for 2 nights in a top-tier Ritz-Carlton hotel, or 7 nights in a middle category Marriott hotel. You could even stretch the points to get 23 PointSaver nights in a category 1 Marriott!

And if a couple each get the 140,000 point card, they could combine points and have enough to access Marriott Hotel + Air Packages, which can get you a 7-night hotel stay and airline miles! I’ll explain how!

What’s the Deal?

Link: Ritz-Carlton Rewards

Link: Marriott Rewards

Marriott and Ritz-Carlton hotels are partners, which means points earned in either of their frequent guest programs can be used for stays at both hotel brands.

So whether you want to treat yourself to a fancy Ritz-Carlton, or make your points last by using them for Marriott stays, you might find an offer that’s good for you!

If you already have a Marriott account, convert the Marriott account to a Ritz-Carlton account before applying for the Ritz-Carlton Rewards card. Because you can’t have both a Marriott and Ritz-Carlton account at the same time. Just call Marriott Customer Service at 801-468-4000.

But you’ll be able to use your points for both Ritz-Carlton and Marriott award stays.

Emily and I do NOT earn a commission from any of these cards, but we’ll always tell you about the best offers, even when they don’t earn us a commission!

1. Ritz-Carlton 1 Free Night, Annual Fee $395

Link: Ritz-Carlton Rewards Free Night With Annual Fee

The regular public offer for the Chase Ritz-Carlton Rewards card gets you a free night certificate for a tier 1 to 4 Ritz-Carlton hotel after you spend $2,000 in the 1st 3 months.

A night in a tier 1 hotel, like The Ritz-Carlton Tysons Corner in Virginia, costs 30,000 points per night. And a night in a tier 4 hotel, like The Ritz-Carlton Kapalua in Maui, costs 60,000 points per night.

So you can look at this as a sign-up bonus of 30,000 to 60,000 points, depending on where you use the certificate.

Because you’re getting a free night certificate (and not points), you can’t use the sign-up bonus for a stay at a Marriott hotel. So this would only be good for folks who want to splurge on a stay at a Ritz-Carlton hotel.

This card also gets you:

- 5 points per $1 you spend at Ritz-Carlton and Marriott hotels

- 2 points per $1 you spend on airline tickets (bought directly from the airline), rental cars, and restaurants

- 1 point per $1 you spend on everything else

- 10% annual points bonus based on points earned through card purchases over the year

- $100 hotel credit on paid stays of 2 nights or more

- $300 annual travel statement credit (airline lounge passes or membership, seat upgrades, baggage fees, in-flight internet or entertainment, in-flight meals, Global Entry fees)

- 3 upgrades to a Club Level room each year (on stays of up to 7 nights)

- Gold elite status at Ritz-Carlton and Marriott hotels (free internet, upgrades when available, lounge access and free breakfast at certain hotels)

- Lounge Club membership (free access to hundreds of airport lounges around the world)

- Platinum elite status if you spend over $75,000 in a year

- No foreign currency fees

- Annual fee of $395, NOT waived for the 1st year

While the annual fee seems steep, if you use all the hotel and travel credits, you’ll more than make up for the fee. Plus, elite status and Lounge Club membership could save you even more money.

And the 3 Club Level upgrades could be very valuable! Ritz-Carlton hotels aren’t cheap, but if you’re paying for a stay anyway, you’ll save money on the upgrade plus get extra perks like meals, snacks, and drinks in the lounge (and a nicer room!).

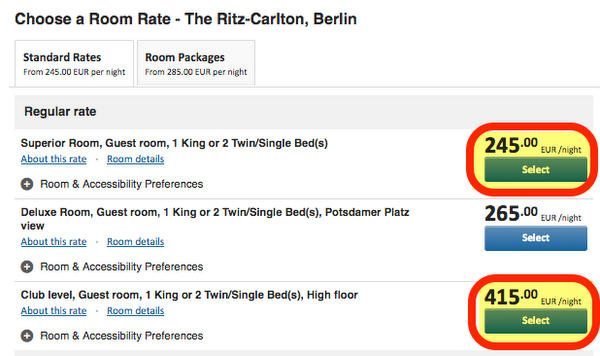

For example, the cheapest regular room rate at The Ritz-Carlton, Berlin is 245 Euros per night (~$326). And the cheapest Club Level room is 415 Euros per night (~$553).

If you were paying to stay anyway, you’d save ~$227 per night on a Club Level room and get perks like free food and drink and extra amenities!

2. Ritz-Carlton 70,000 Points + $200 Gift Card, Annual Fee $395

Link: Ritz-Carlton Rewards 70,000 Points and $200 Gift Card

A better offer for the Ritz-Carlton Rewards card gets you 70,000 points (enough for a free night at any Ritz-Carlton, not just category 1 to 4) after you spend $2,000 in the 1st 3 months. Plus, you get a $200 Ritz-Carlton gift card after your 1st purchase!

The annual fee of $395 is NOT waived for the 1st year.

While the sign-up bonus is advertised as “A Complimentary Night Stay at The Ritz-Carlton,” the terms and conditions say that you’ll get 70,000 points deposited into your account. This means you can use the sign-up bonus for Marriott hotels, too.

And the $200 gift card would be great for folks that are planning to stay at a Ritz-Carlton hotel anyway.

This card gives you similar benefits as the regular public offer (see #1 above), with a couple of exceptions:

- The airline incidental statement credit is $100 lower ($200 instead of $300), and you can use it for “non-ticket purchases” on airlines (gift cards don’t count!)

- There’s NO way to get Platinum Elite status, no matter how big a spender you are

- You will NOT get a 10% point bonus every year

But because you get a $200 gift card, most folks will like this sign-up bonus better!

3. Ritz-Carlton 70,000 Points, Annual Fee $395, Waived for 1st Year

Link: FlyerTalk Ritz-Carlton Rewards Card Thread

There’s a targeted offer for the Ritz-Carlton Rewards card with almost the same terms as offer #2, except instead of getting a $200 gift card, the annual fee of $395 is waived for the 1st year!

You’ll still get the same 70,000 point bonus after spending $2,000 in the 1st 3 months.

In the past you could apply for this offer online, but the application link no longer works. However, folks on FlyerTalk confirm that you can still get the offer over the phone.

The number to call is 888-846-7004. It’s a targeted offer, so you’ll need to quote RSVP code F53K. I called to double-check and I can confirm the offer is still available!

So you get the sign-up bonus, plus airline incidental credit of $200 a year, a $100 hotel credit, elite status, Lounge Club membership, and upgrades on paid stays – for NO annual fee the 1st year!

And because the airline incidental credit is per calendar year, if you applied now you’d get a credit of $200 for 2014, and another for 2015. So you’d get a total of $400 in airline incidental credits in your 1st year of having the card, without paying an annual fee.

This is a great deal!

4. Ritz-Carlton 140,000 Points, Annual Fee $395

Link: FlyerTalk Ritz-Carlton Rewards Card Thread

If you don’t mind paying an annual fee to get an extra 70,000 Ritz-Carlton points, there’s another targeted offer with a sign-up bonus of 140,000 points after spending $2,000 in the 1st 3 months.

You can’t apply online for this card, but if you call Chase at 888-846-7004 and quote RSVP code F5BP, you should be able to get the offer! I called to confirm and the code is still working.

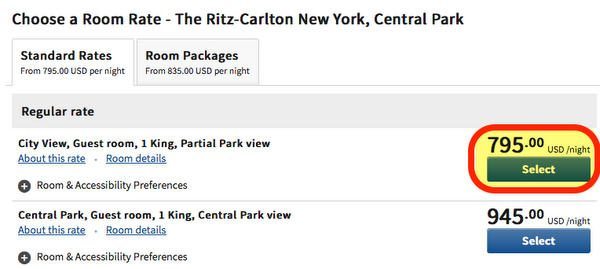

140,000 Ritz-Carlton points can get you a lot of Big Travel with Small Money! This is a fantastic deal, even if you have to pay the annual fee.You could get 2 nights at a top tier Ritz-Carlton hotel, like The Ritz-Carlton New York, Central Park.

Rooms at the Ritz-Carlton New York can cost upwards of almost $800 per night (even more during peak times)! So you’d be getting great value out of the card, even with the $395 annual fee!

Or if you’re feeling more frugal, you could stretch the 140,000 points into ~23 PointSavers award nights (6,000 points per night) at a category 1 Marriott hotel, like the Courtyard Pilsen in the Czech Republic.

And remember with Marriott hotels, you’ll get the 5th night free on stays of 5 nights or more.

This card comes with a $300 airline incidental credit. And over on FlyerTalk, some folks say they’ve been able to get matched to this 140,000 point offer (after getting approved for a 70,000 point card) by sending a secure message. However, you’ll still pay the $395 annual fee.

There’s an added bonus to this card, though. If you and your partner both apply for the card, you’ll get 280,000 points which can be combined. And then you’ll have enough points to book Marriott Hotel + Air Packages, which can be an amazing deal.

How to Make the Most of the 140,000 Point Offer

Link: Marriott Hotel + Air Packages

Via The Miles Professor, if you have more than 200,000 Marriott or Ritz-Carlton points, you can book Marriott Hotel + Air Packages. These awards include 7 nights in a Marriott or Ritz-Carlton hotel, plus airline miles!

If you and your spouse or partner both apply for a 140,000 point Ritz-Carlton card, you’ll have enough points to book a Marriott Hotel + Air Package!

The number of airline miles you get varies depending on the category of hotel and airline you choose. There are dozens of airlines to choose from, but some of the more appealing ones include:

- Alaska Airlines

- American Airlines

- British Airways

- Delta

- Hawaiian Airlines

- Southwest

- United Airlines (you’ll get 10% more miles if you transfer to United Airlines because of their partnership with Marriott)

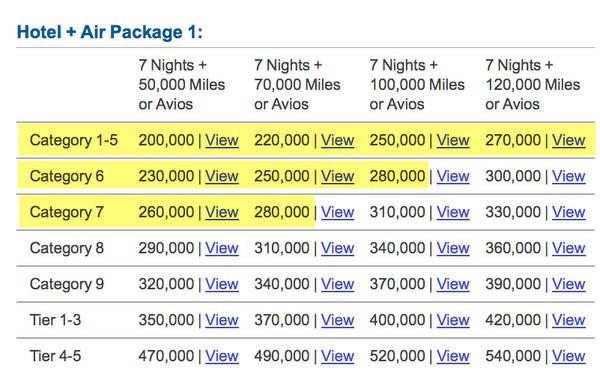

Here’s the award chart for redeeming on airlines like Alaska Airlines, British Airways, American Airlines, Delta, Hawaiian Airlines, and US Airways.

Normally, you can transfer Marriott or Ritz-Carlton points to airline miles directly, but the transfer ratios aren’t very good (usually around 3:1 or worse). But with this deal, you can get a hotel stay plus transfer points to airline miles at a 1:1 ratio or better.

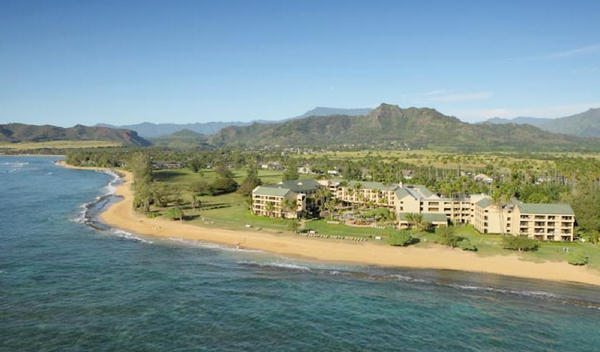

For example, suppose you wanted to book 7 nights at the Courtyard Kauai Coconut Beach. This hotel costs 30,000 points per night (but you get the 5th night free), so 7 nights would normally cost 180,000 points (6 nights x 30,000 points per night).

It’s a category 6 hotel, so for a Hotel + Air Package booking, you could pay:

- 230,000 points for 7 nights and 50,000 airline miles

- 250,000 points for 7 nights and 70,000 airline miles

- 280,000 points for 7 nights and 100,000 airline miles

- 300,000 points for 7 nights and 120,000 airline miles

A 7-night stay would normally cost 180,000 points, so the extra points you pay are a 1:1 transfer to airline miles.

If you used the 280,000 points from 2 sign-up bonuses, you’d get a 7-night stay and 100,000 airline miles (10% more if you choose United Airlines). This is a very good deal because you can’t normally transfer Marriott or Ritz-Carlton points at such a good ratio! And airline miles are generally much more valuable than hotel points!

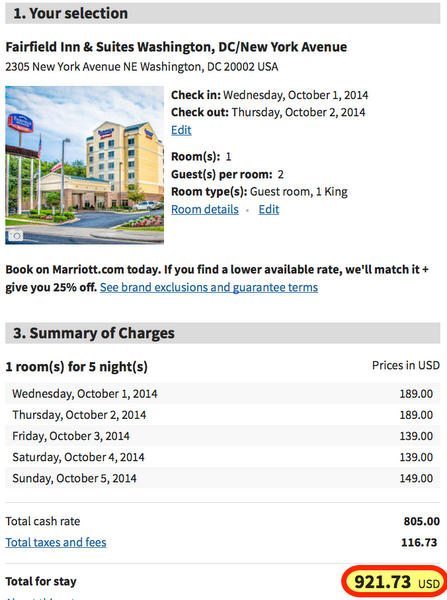

Let’s look at it this way. 100,000 Marriott or Ritz-Carlton points could get you 5 nights in a category 5 Marriott (25,000 points per night with the 5th night free), like the Fairfield Inn and Suites Washington, DC New York Avenue.

A paid 5-night stay at this hotel costs ~$921, depending on the dates.

But if you transferred 280,000 Marriott points to 100,000 airline miles & 7 nights hotel using the Hotel + Air package, you’d get 100,000 airline miles (110,000 if transferring to United Airlines). You could use those miles for:

- 4 round-trip, coach class tickets within North America on most US airlines

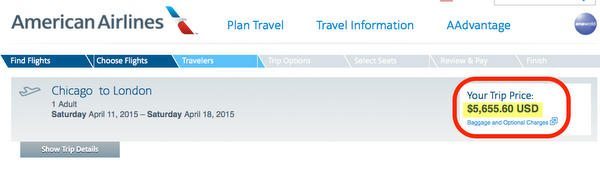

- 1 round-trip Business Class ticket to Europe on American Airlines

- 11 round-trip, short-haul coach class tickets on American Airlines (using British Airways Avios points)

You would definitely get way more than ~$920 in value with 100,000 airline miles. For example, you could get a round-trip Business Class ticket on American Airlines from Chicago to London, UK, for 100,000 miles. The cash price of this ticket is over $5,600!

This could be a very good deal if you’re looking for a week’s vacation and want airline miles as well. Remember, you still have to pay 2 annual fees for a total of $790 ($395 per card x 2 people), but much of that can be offset by the two $300 travel statement credits you get.

A 7-night stay and potentially thousands of dollars worth of airfare is definitely worth it! But as always, do what’s comfortable for you.

Note: Points transfers to Southwest count towards the Companion Pass! This could be a great strategy for earning the Companion Pass. I’ll explore this further in a separate post.How to Do This Deal

Step 1 – Convert Your Marriott Account to a Ritz-Carlton Account

Convert your Marriott account (if you have one) to a Ritz-Carlton account before applying for the Ritz-Carlton Rewards card. Just call Marriott Customer Service at 801-468-4000.

If you don’t have either account, open a Ritz-Carlton account online (or they’ll create 1 for you when you sign-up for the card).

Step 2 – You and Your Partner Sign-Up for the Ritz-Carlton 140,000 Point Card

Again, you can’t sign-up for the 140,000 point Ritz-Carlton card online. Call Chase at 888-846-7004 and quote RSVP code F5BP to apply.

Step 3 – Combine Points and Book a Hotel + Air Package

Only legal spouses or domestic partners can combine miles, and only at the time they’re booking an award. (This post has more details on combining hotel points.)

Choose the Hotel + Air Package you’d prefer, depending on the category of hotel you’d like and the number of airline miles you want. The lowest packages start at 200,000 points for 7 nights in a category 1-5 Marriott. With 280,000 points, you could book as much as a category 7 Marriott and 70,000 miles!

You do NOT have to book your hotel stay right away. You’ll get a certificate good for 7 nights in the category of hotel you’ve chosen (it’s good for 1 year after the date of issue), but you will get your airline points right away (usually within a few days).

Bottom Line

There are 4 different offers currently available for the Chase Ritz-Carlton Rewards card. You can get:

- Ritz-Carlton Rewards Free Night With Annual Fee of $395

- Ritz-Carlton Rewards 70,000 Points and $200 Gift Card, Annual Fee $395

- Ritz-Carlton Rewards 70,000 Points, Annual Fee $395, Waived for 1st Year (call to apply)

- Ritz-Carlton Rewards 140,000 Points, Annual Fee $395 (call to apply)

Even if you don’t plan on staying at Ritz-Carlton hotels, you can use Ritz-Carlton points at Marriott hotels, too, and stretch them even further.

My favorite offer is for 140,000 points. Even though the annual fee is not waived, you can get much more than $395 in value from the extra 70,000 points that come with the card. And if you and your partner each get this card, you can combine your points and get even more Big Travel by redeeming for Marriott Hotel + Miles Packages.

Which of these offers is your favorite and why?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!