Are Chase Ultimate Rewards Points Better Than Barclaycard Arrival Points?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: A credit card offer in this post may no longer be available, but check the Hot Deals for the latest offers!

Million Mile Secrets reader Don commented:

Which points have the most value? Chase Ultimate Rewards points or Barclaycard Arrival points?

Don wants to know if Chase Ultimate Rewards points or Barclaycard Arrival points are more valuable.

Both Chase Ultimate Rewards points and Barclaycard Arrival points are valuable, it just depends how you use them. I like Barclaycard Arrival points for domestic US travel and Chase Ultimate Rewards for international travel.

And I’ll explain why!

Barclay Arrival Points

Don can earn Arrival points from both the Barclay Arrival Plus card and the Barclay Arrival card.

Link: Barclaycard Arrival Plus® World Elite Mastercard®

Link: Barclaycard Arrival™ World MasterCard®

A. Barclaycard Arrival World MasterCard

Don can get a 20,000 mile sign-up bonus on the Barclaycard Arrival card ($100 in statement credits or $200 when redeemed for travel) after completing the minimum spending.

The Barclaycard Arrival card has no annual fee. But it earns 2X miles only on travel and dining unlike the annual-fee version which earns 2X miles on ALL purchases.

And it’s a Barclaycard and it can be tough to get multiple cards from them. So if I had to pick 1 card, I’d skip this card and choose the Barclaycard Arrival Plus card.

B. Barclaycard Arrival Plus World Elite Mastercard

Don can get a 40,000 mile sign-up bonus on the Barclaycard Arrival Plus card after completing the minimum spending.

The $89 annual fee is waived for the 1st year, so Don gets at least ~$400 in statement credits after spending $3,000 within 3 months.

Barclaycard says Don will earn “miles” but he’s actually earning statement credits because Barclaycard miles can NOT transfer to airlines.

By redeeming for less expensive domestic travel or for travel expenses such as car rentals, taxis, cruises or more, Don can get Big Travel for Small Money because he won’t be spending as much cash.

Don can use Arrival points for statement credits at 0.5 cents per mile (poor value) or more than 1 cent per mile if he redeems for travel.

And Don gets 5% of his miles back when he redeems for travel. So 40,000 miles gets him $400 towards travel and 2,000 miles back (40,000 X 5%). Then Don can redeem the 2,000 miles he got back for another $20 towards travel.

Don earns 2X miles on all purchases, so he’s getting 2% back on every purchase.

You can redeem miles on discount travel sites. The exact sites aren’t specified, but Hotwire, Priceline, and Orbitz should count.

Chase Ultimate Rewards Points

Don can earn Chase Ultimate Rewards points from the following Chase cards:

Link: Chase Sapphire Preferred

Link: Chase Freedom

Link: Chase Ink Bold

Link: Chase Ink Plus

Don gets 1 cent per point redeeming Chase Ultimate Rewards points as a statement credit. For some folks, the statement credit is worth it. But I get more value by transferring my Chase Ultimate Rewards points to airlines of hotels for international travel to places like Italy.

Chase Ultimate Rewards points are worth 1.25 cents when he books travel through the Chase Ultimate Rewards Mall. The advantage of booking travel through the Ultimate Rewards mall is that you can book travel with no restrictions. But if you want to book travel with no restrictions, you’re better off with the Barclaycard Arrival Plus card because you get ~2 cents per Arrival point compared to 1.25 cents with Ultimate Rewards points.

Don can also almost instantly transfer Chase Ultimate Rewards points to certain airlines and hotels.

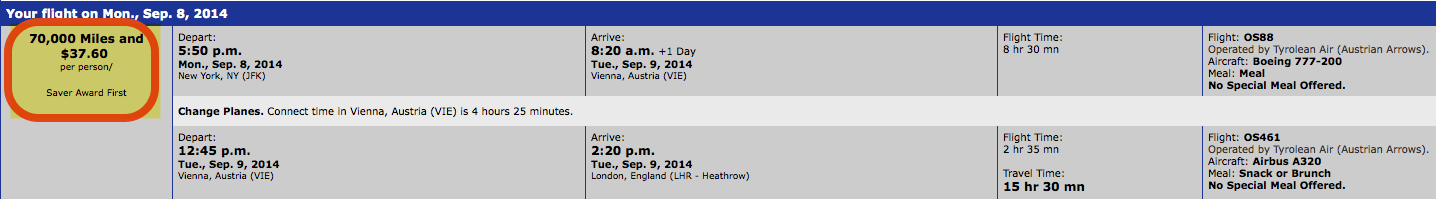

For example, Don can use 70,000 Chase Ultimate Rewards points transferred to United Airlines and fly First Class 1-way from New York to London. The same ticket otherwise sells for ~$13,500!

However, Don’s Chase Ultimate Rewards points earned from the Chase Freedom card can’t be transferred to certain airlines and hotels UNLESS he has the Chase Sapphire Preferred, Chase Ink Bold, or Chase Ink Plus card.

Because Don can transfer his Chase Ultimate Rewards points to certain airlines and hotels, such as United Airlines and Hyatt hotels, he would get more value from his Chase Ultimate Rewards points if he redeems them for international travel.

Bottom Line

Chase Ultimate Rewards points and Barclaycard Arrival points are valuable because they can be redeemed for travel.

Because Barclaycard Arrival points can’t be transferred to airlines, Don should use them to redeem for domestic travel, travel where he has no flexibility or other travel expenses.

And Don could redeem his Chase Ultimate Rewards points for international travel because he can transfer them to certain airlines and hotels. And potentially get a better value than redeeming for statement credits.

It doesn’t hurt to get the sign up bonus for both cards. But after the 1st year Don can pick one card based on his travel goals.

How do you use your Barclay Arrival points and Chase Ultimate Rewards points?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!