Confirmed: Citi Executive $200 Statement Credit for ANY Purchase!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: This offer is no longer available. Check our Hot Deals for the latest offers.Many readers have asked if the $200 statement credit on the Citi American Airlines Executive 100,000 mile offer applies only if you buy something directly from American Airlines. That’s because certain previous offers from Citi gave you a statement credit only if you made a purchase from American Airlines.

However, you will get the the $200 statement credit for ANY purchase with the Citi Executive card. The purchase doesn’t have to be with American Airlines!

The Citi Executive AAdvantage WorldElite Mastercard

The Citi Executive card is the best deal I’ve seen for American Airlines miles in a long time.

Link: Citi AAdvantage Executive World Elite Mastercard

This is a good card if you want to earn a lot of American Airlines miles quickly, or want American Airlines airport lounge access. With this card, you’ll get:

- 100,000 miles after spending $10,000 in the 1st 3 months

- $200 in statement credits

- Membership in the Admirals Club, which lets you visit Admirals Club airport lounges for free (~$500)

- Annual fee of $450, NOT waived for the 1st year

Here’s my post about the Citi American Airlines Executive card and information on how to apply.

Some folks might be uncomfortable with spending $10,000 in the 1st 3 months to get the bonus on the card. But read my post on 40+ ways to complete minimum spending requirements and decide what’s right for you.

Emily and I don’t earn a commission on the card, but we’ll always tell you about the best offers, even when we don’t earn a commission.

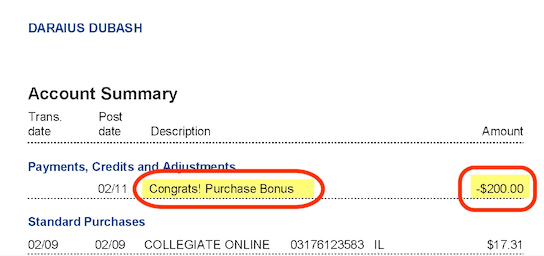

$200 Statement Credit for ANY Purchase

The fine print on the offer doesn’t specify what kinds of purchases qualify for the $200 statement credit. So that’s a good indicator that any purchase (excluding the annual fee etc.) should count.

I applied for the Citi Executive card in January, and got the $200 credit on my statement after spending over $200 on regular purchases.

Many folks on this Flyertalk thread also report receiving the $200 credit for regular purchases.

This Is Really a $250 Annual Fee Card

The annual fee on this card is $450, which is expensive!

But because you get the $200 credit for regular spending, the true cost of the card is $450 Annual Fee – $200 Statement Credit = $250.

So for $250, you’re getting 100,000 American Airlines miles, which can be used for:

- 4 domestic round-trip coach tickets

- 1 round-trip coach ticket to Europe or South America (with 40,000 miles left over)

- 1 round-trip business class ticket to Europe or South America

Here’s a link to my series on how to use American Airlines miles.

You also get Admirals Club lounge access (~$500) and additional perks like early boarding, free 1st checked bag, and priority security screening.

This is a very good deal for $250!

Bottom Line

You’ll get 100,000 American Airlines miles, a $200 statement credit, lounge access, and other perks with the Citi American Airlines Executive card.

The annual fee for the card is $450. But, because you get the $200 statement credit for any spending, the true cost of the card is $250.

Admirals Club membership alone costs $500. And 100,000 American Airlines miles will get you to a lot of places!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!