100,000 American Airlines Miles & $200 Statement Credit! [Expired]

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: This offer for the Citi American Airlines Executive card in this post is no longer available, but check Hot Deals for the latest offers!Via The Points Guy, you can now get 100,000 American Airlines miles on the Citi American Airlines Executive card + up to $200 in statement credits after spending $10,000 within 3 months.

This is the best deal which I’ve seen in the last year!

This is 40,000 more miles than the regular offer for 60,000 miles! And 25,000 more American Airlines miles than last week’s offer of 75,000 miles!

The regular offer for the Citi American Airlines Executive card is for 60,000 miles after spending $5,000 within 3 months.

So the 100,000 mile offer gets you an additional 25,000 miles, but you have to spend an extra $2,500 within 3 months. Spending $10,000 within 3 months is a lot of money, so do what you’re comfortable with.And 100,000 miles is certainly better than 60,000 or 75,000 miles!

This FlyerTalk thread also talks about a potential 100,000 mile targeted offer, but there is no direct link to the card.

Citi American Airlines Executive Card

Link: 100,000 Miles Citi American Airlines Executive Card

The 100,000 miles offer is currently the largest sign-up bonus of any publicly available airline credit card.

But the 100,000 miles offer comes with a big string attached – an annual fee of $450 a year – which is NOT waived for the first year. And you have to pay

But you can also get up to $200 in statement credits. The card application page says:

Plus, earn up to $200 in statement credits on purchases within 12 months of account opening.

You can usually buy American Airlines gift cards to get the statement credit. But in this case the fine print doesn’t specify that you have to make American Airlines purchases to get the $200 statement credit.

It seems to suggest that you will get a statement credit for all purchases! That said, I’m not 100% sure what counts towards the statement credit, but will keep you posted!

This is just a terrific deal if you get a $200 statement credit, because you will then pay only $250 for American Airlines lounge access and 100,000 American Airlines miles!

Be Careful

There is a landing page for this offer, but it is supposed to be available only to folks who get an application at an American Airlines lounge. So your miles may vary (YMMV).

That said, you almost always get the bonus (with Citi) as long as you can access the card application page.

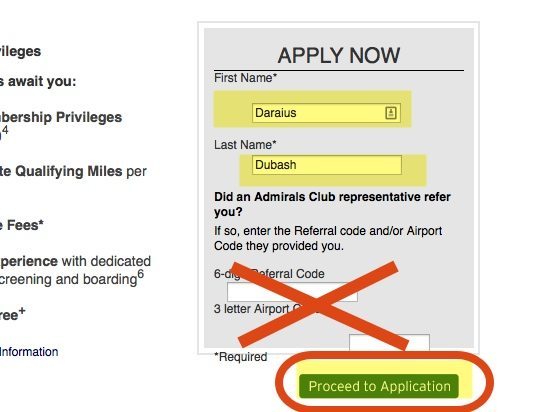

In this case, I was able to enter the card application just by entering my name in the box and clicking “Proceed to Application.” I left the other boxes empty.

Here’s a direct link to the application page for the 100,000 mile offer.

Please take a screenshot of the landing and application page if you do decide to apply!

American Airlines Lounge Access

The $450 annual fee is very expensive but you get an American Airlines lounge membership which costs up to $500.

If you normally buy an American Airlines Admiral’s Club lounge membership, the Citi American Airlines Executive card could definately be worth it. That’s because you not only get 100,000 miles, but you also get lounge membership, and up to $200 in statement credits for purchases on American Airlines!

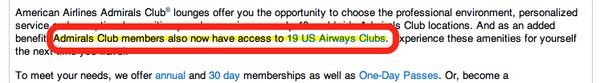

And as an Admirals Club member you also have access to the US Airways Club lounges. That’s because US Airways and American Airlines are merging.

Admirals Club Members Get Access to US Airways Club Lounges

The American Express Platinum card is losing access to American Airlines & US Air lounges on March 22, 2014.

But with an American Airlines Admiral’s Club membership (either paid or from the Citi American Airlines Executive card) you and 2 guests get access to the lounge (they don’t have to be traveling with you) and you don’t have to fly on American Airlines.

Other Card Benefits

In addition to the Admiral’s Club membership, the Citi American Airlines Executive card gets you:

- 2 miles for every $1 spent on American Airlines

- Free checked bag

- Priority check-in (where available)

- Priority boarding

- No foreign transaction fees

- Up to 10,000 Elite Qualifying Miles (EQM) per year after spending $40,000 in a calendar year

Buying American Airlines Miles for 0.25 to 0.45 cents per Mile

If you’re not interested in American Airlines lounge access and are just in it for the miles, this could still be a decent deal.

If you get the full $200 statement credit for buying American Airlines gift cards directly from American Airlines, you are essentially paying 0.25 cents per American Airline mile ($450 annual fee less $200 statement credit / 100,000 American Airlines miles).

This is a terrific deal!

If you don’t get the $200 statement credit, you’re buying American Airlines miles for 0.6 cents per mile ($450 Annual Fee / 100,000 American Airlines miles).

This is much cheaper than buying 100,000 miles directly from American Airlines. It costs $1,804 to buy 75,000 miles (including 15,000 bonus miles) directly from American Airlines (which isn’t a bargain). You would usually pay over $2,000 for 100,000 American Airlines miles.

So getting the 100,000 miles offer is a cheap way to get a bunch of American Airlines miles. 100,000 American Airlines miles will get you 4 domestic coach tickets or a flight to anywhere American Airlines or their partner airlines fly!

I don’t have the Citi Executive card with the $450 annual fee, but readers write that it is considered a different product from the regular Citi American Airlines cards.

So you may be able to apply for the Citi Executive card even if you have a Citi American Airlines credit card. Remember to wait ~10 days between Citi applications, and don’t apply for more than 2 personal cards in a 65 day period.

If you don’t want to pay an annual fee or are new to miles and points, you’re better off with the other offers for 50,000 American Airlines miles which waives the 1st year annual fee.

How to Use American Airlines Miles

Here’s a link to a series on how to use your American Airlines miles. It costs:

- 25,000 American Airlines miles for a round-trip coach award in the US

- 60,000 miles for a round-trip coach award to Europe or South America

- 50,000 miles for a one-way award to Europe or South America in Business Class

For status-chasing Big Spenders, it could be worth spending $40,000 for 10,000 elite qualifying miles towards your American Airlines elite status, but if you aren’t chasing status, big spending on this card isn’t worth it.

But I Just Applied!

Citi usually doesn’t match you to a better offer if you apply for a card with a lower offer and there is a better offer later.

But Citi was matching folks to the better 75,000 mile offer last week. So it doesn’t hurt to ask. Please leave a comment with your experience to help others!

Bottom Line

You can get 100,000 American Airlines miles from the Citi American Airlines Executive card and up to $200 in statement credits after spending $10,000 in the first 3 months.

But you’ll pay a $450 annual fee, so this card isn’t for everyone. That said, I’d gladly pay $450 for 100,000 American Airlines miles and a $200 statement credit!

And here are 40+ ways to meet your minimum spending.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!