Virgin America Credit Cards Relaunched

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Barclaycard lost the contract to issue the Virgin America credit card, so Comenity Capital Bank started issuing 2 Virgin America credit cards.

Comenity issues credit cards for popular stores such as Victoria’s Secret, Eddie Bauer etc.

You can get 15,000 points on the Virgin America Premium Visa Signature card and 10,000 points on the Virgin America card.

These cards don’t have the best sign-up bonus, but could be useful for some folks. I’m pretty sure that not many of us have other cards issued by Comenity bank!

Virgin America Credit Cards

Link: Virgin America Credit Cards

You can earn 15,000 points from the Virgin America Premium Visa Signature card after spending $1,000 in the first 90 days.

The link above isn’t a direct link to the credit card application. That’s because you have to sign into your Virgin America account to be able to apply for the cards.

The $149 annual fee is NOT waived for the first year. And you pay the annual fee after you’ve been approved for the card.

You earn 3 extra points per $1 you spend on Virgin America tickets with the credit card. So that’s a total of 8 Virgin America points (5 Virgin America points for every $1 spent on Virgin America tickets + 3 Virgin America points for using the Virgin America credit card).

You also get a 20 percent discount on Virgin America inflight purchases as a statement credit.

If you’re a Big Spender, you will earn 5,000 Virgin America elite status points per $10,000 spent on your card. So $30,000 in spending gets you 15,000 elite status points. You can earn a maximum of 15,000 elite status points each year and the points carryover to the following year.

I liked that folks won’t pay any change or cancelation fees if they have the Virgin America Signature credit card. This could save you quite a bit of money & could be worth the $149 annual fee for the convenience of being able to make changes for free.

You also get the first checked bag, which usually costs ~$25, for free, so this could add up!

Lastly, you also get $150 off a companion ticket on Virgin America flights every calendar year (January to December). This is valid only on paid tickets, and NOT on award tickets.

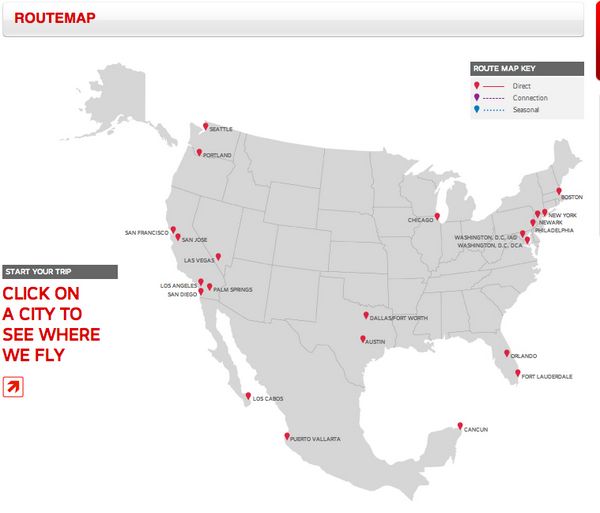

Virgin America only flies to select cities, so the companion ticket could only be worth it for some folks.

Virgin America Visa Signature Card

Link: Virgin America Visa Signature Card

There’s another version of the Virgin America card which offers 10,000 points after spending $1,000 in the first 90 days. 10,000 Virgin America points are worth ~$200 in flights, so this isn’t the most lucrative offer!

This card is very similar to the Virgin America Premium Visa Signature card except that Big Spenders don’t earn elite status points and the card doesn’t waive change fees.

But the annual fee is only $49 compared to $149 for the Premium card.

If you aren’t planning on flying Virgin America and only want to use the points for an award ticket or for the $150 discount for a companion, it could make sense to apply for the Virgin America Visa Signature card instead of the Premium card.

Using Virgin America Points

Virgin America points are worth ~2 cents when redeemed for flights, so 15,000 points gets you ~$300 in travel & 10,000 points gets you ~$200 in travel!

You can use Virgin America points for travel on other airlines such as Virgin Atlantic, Virgin Australia, Singapore Airlines, and Hawaiian Airlines.

But many of them will charge fuel surcharges in addition to points for an award ticket. You can use the Virgin America rewards calculator tool to see how many points you need for an award ticket.

Bottom Line

You can get 15,000 points (~$300) with the Virgin America Premium Visa Signature card or 10,000 points (~$200) with the Virgin America Visa Signature card.

The annual fee is due at the time you apply so you’re paying $149 for 15,000 points or $49 for 10,000 points.

I don’t see these as particularly lucrative offers, but they could be worth it to some folks. I’m not applying for these cards now, but am hoping that a better offer comes along!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!