Stay-at-Home Partners Can Get Credit Cards Again!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.The CARD Act of 2009 prevented many stay-at-home partners from getting credit cards. But a rule has changed that!

The Card Act

Link: CARD Act Rules

The CARD Act required banks to evaluate borrowers based on their own income instead of household income or income from others.

This unfortunately meant that stay-at-home partners, graduate students with student loans – or anyone who relied on someone else for their income – were having trouble getting their own credit cards and the sign-up bonus and perks that come along with credit cards.

But this rule from the Consumer Financial Protection Bureau (CFPB) has amended the CARD Act.The new rule says that banks can consider any “income or assets to which consumers have a reasonable expectation of access.“

Note that this change applies only to folks 21 years and older.

What Does This Mean?

Let’s say that you’re a stay-at-home partner with a joint checking account or investment account. You can now list these accounts in the application as an asset because you have access the funds in the accounts.Or you can list the portion of income from your wage-earning partner’s account, which you can use to pay back your debts.

This could even be your partner’s ENTIRE income!

The banks had 6 months from April 2013 to implement the rule, and to make changes to how they qualify credit card applicants.

Now that 6 months have past, all banks should have changed their policies so that stay-at-home partners & others can apply for credit cards on their own.

Remember that you can double your credit card sign-up bonuses if your partner applies for cards. Your partner can get the sign-up bonus on cards even if they are an authorized user on your credit cards!What do Bank Applications Say?

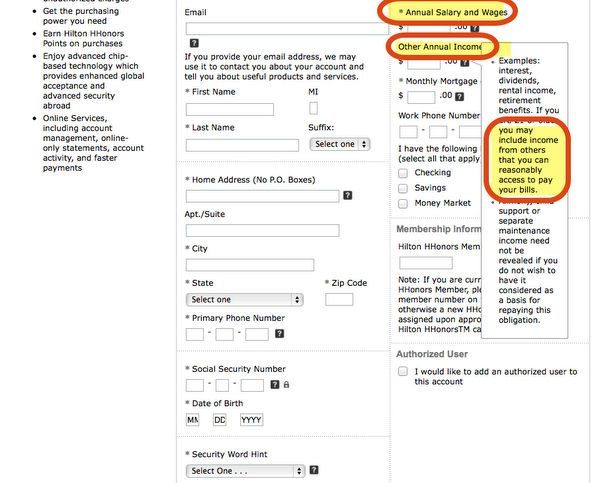

1. Citi

Here’s the application from the Citi Hilton HHonors Reserve Card which offers 2 free weekend nights after completing the minimum spending requirement.

The Citi application still asks for “Annual Salary and Wages.“But the box below asks for “Other Annual Income“ which says:

…you may include income from others that you can reasonable access to pay your bills

It doesn’t get clearer than this because the application says that you can include income “from others.”

I interpret this to mean that you can include any income on the application as long as you can use it to pay your credit card bill.

This could mean your partner’s entire income or even an allowance from a parent!

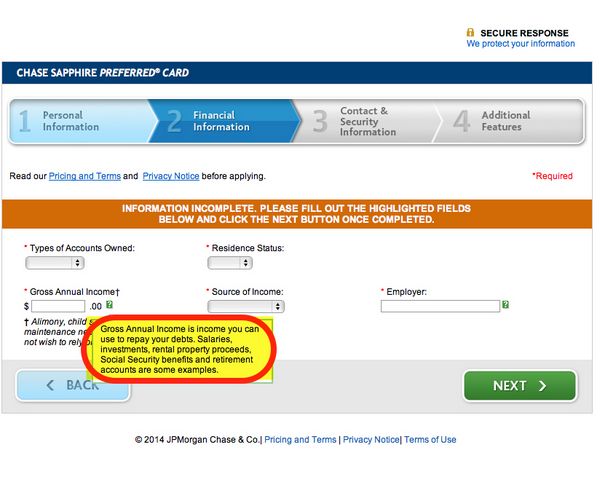

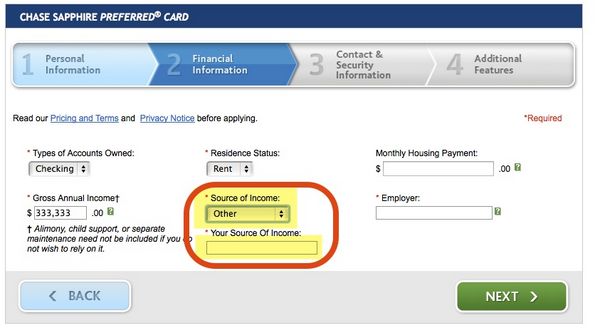

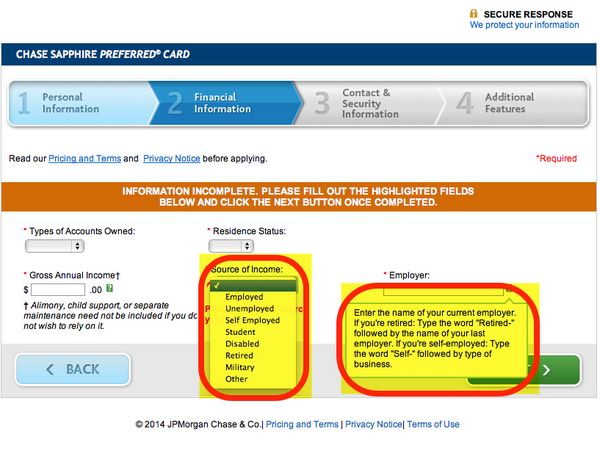

2. Chase

The screenshots below are from the Chase Sapphire Preferred card, which is the best card to have if you can get only 1 travel card and want to earn points which you can transfer to different hotels or airlines.

The Chase application asks for “Gross Annual Income.“

This is defined by Chase as:

…income you can use to repay your debts. Salaries, investments, rental property proceeds, Social Security benefits and retirement accounts are some examples.

So it appears that you can mention amounts as long as you can use it to repay your debts.

You could just write “maintenance” in the box.

The application also asks for the name of your employer.

You could interpret this multiple ways:

- You could list employed and then list your family under “Employer”

- Or you could list self-employed and then list “Childcare” or “Domestic Care” or something similar

- You could also list “Other” and list “Jones Family”

- Or you could list unemployed (my least preferred way of answering the question. I find it distasteful to suggest that someone who slaves away at home is “unemployed.”)

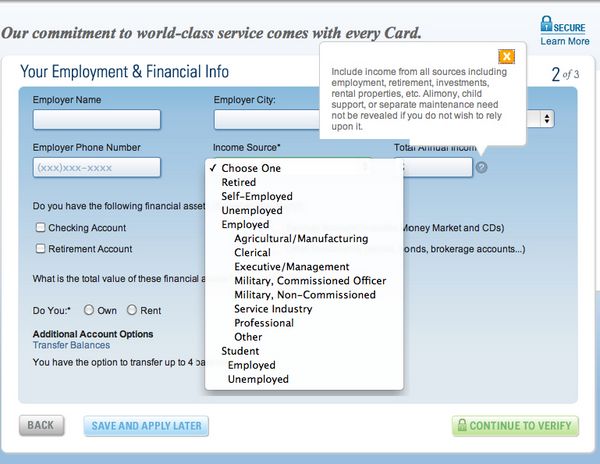

3. American Express

The American Express application asks for “Total Annual Income.“

American Express defines annual income as:

…income from all sources including employment, retirement, investments, rental properties, etc.

And like Chase, they ask you to list the source of your income.

Depending on how you interpret your role at home, you could be employed (other), self-employed, or unemployed.

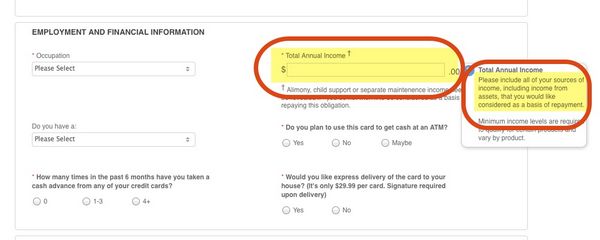

4. Barclaycard

The screenshots below are from the Barclaycard Arrival Card, which is the best card to have if you can get only 1 travel card and want to earn ~2.1% cash back which you can use for ANY travel expense.

The Barclays application asks for “Total Annual Income.”

Barclays defines annual income as:

…all of your sources of income, including income from assets, that you would like considered as a basis for repayment.

Like Citi, I interpret this to mean that you can include any income on the application as long as you can use it to pay your credit card bill.

This includes your partner’s income or an allowance from a parent.

Bottom Line

Stay-at-home partners, graduate students, or folks without a conventional source of income can now apply for credit cards (& the sign-up bonus) again!

Just list your income as “maintenance” income or in the “other” category on the credit card application as long as you can use it to pay back your debt.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!