Is Go Bank Better Than American Express Bluebird?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Link: Go Bank Application

Go Bank is a new checking account alternative which is very similar (and perhaps better?) than American Express Bluebird.

You can:

- Load your Go Bank debit card at Wal-Mart with a Visa or MasterCard gift card with a PIN

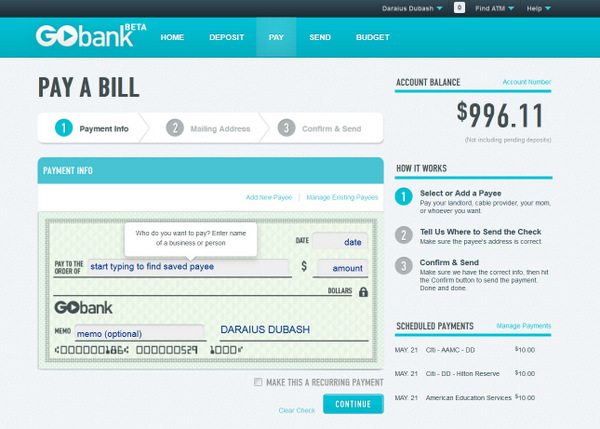

- Pay bills through their online Bill Pay service

- Withdraw money free via 40,000 ATMs

- Get Cash Back when you shop at a store

- Buy Money Orders

- Load your Go Bank debit card with a GreenDot MoneyPak

The Go Bank debit card has the potential to turbo charge the way we earn miles and points. You can pay rent, utilities college tuition, mortgages, and even credit card bills and potentially earn lots of miles and points!

For example, say you have to spend $3,000 within 3 months on a credit card. You can buy Visa Gift Cards with a PIN with your credit card (from grocery stores, gas stations, drugstores etc.) and load them on your Go Bank debit card. You will pay a $5 to $6 fee for the gift card.

Buying the Gift Cards with a PIN with your credit card will count towards the spending requirement on your credit card and earn miles and points. You then use your Go Bank card to pay your loans such as your mortgage, student loans, rent etc. or to get cash back which you can’t usually do with a credit card.

I prefer the Go Bank Bill Pay (you can set up recurring payments unlike with Bluebird and the monthly limit is higher) and customer support to that of American Express Bluebird. The Go Bank interface seems much better designed than the American Express Bluebird interface.

But Go Bank is owned by GreenDot, which arbitrarily closes accounts, so please read the warning at the end of the post. This isn’t for everyone!

Go Bank

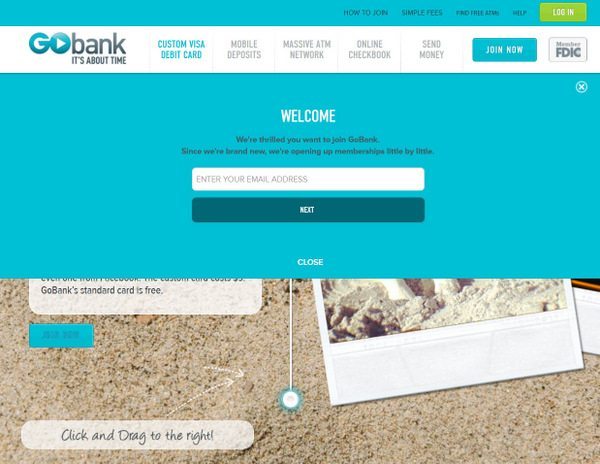

Go Bank is run by Greendot (a prepaid card issuer) and is an FDIC insured on-line bank. You can’t immediately open an account because Go Bank is limiting the number of sign-ups. But I received my invitation in about 3 to 4 weeks after requesting an invitation.

You can request an invitation for a Go Bank account via this link.

My Experience

3 to 4 weeks after requesting an invite, I received an invite and signed up for a Go Bank card. I deposited the $50 needed to order a debit card, but I could not order a custom debit card with one of our pictures from Hawaii!

I called customer service, and was almost immediately connected with a US based representative. She explained that there was nothing which she could do, but that I’d be automatically sent a regular debit card because my custom image was not accepted. About a week later, I received my Go Bank card.

The cashier was a little hesitant at first because she had never seen a Go Bank card, but I asked her if she could try and sure enough I was able to load it with my Visa gift card with no fees charged at Wal-Mart!

But my Go Bank balance, (printed on the receipt) didn’t increase with my 2nd and 3rd reload at Wal-Mart. But I checked the online app and my Go Bank balance had increased.

What are the odds that I would bump into a Million Mile Secret reader loading his Bluebird card at Wal-Mart as well!

2. ATM Withdrawal. I withdrew $100 from a US Bank ATM which was one of the fee-free ATMs, and verified that I wasn’t charged a fee!

However, the terms say that you can’t use the Bill Pay service to make tax payments.

Go Bank Fees

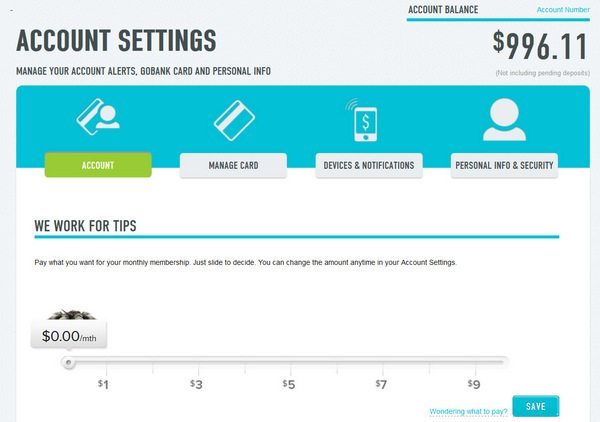

Go Bank will make its money from interchange fees (the fee which shops pay to banks whenever a customer uses a card for a purchase) and interest in Go Bank accounts. They also claim that customers will love their Go Bank account so much that they will voluntarily pay a fee of $0 to $9 per month!

There is NO fee for joining or using GoBank. You can customize a debit card for a $9 one-time fee, but I wasn’t able to submit a picture for my debit card.

1. ATM Fees. There is no fee for withdrawing money from a network of 40,000 ATMs. There is a $2.50 fee in addition to fees charged by the ATM owner if you use any other ATM.You can find a free ATM via this page on the Go Bank website. Or you can use their app to very easily find an ATM when you are out.

However there is a 3% foreign transaction fee (in addition to the $2.50 Go Bank fee and the fee charged by the ATM owner) for using an ATM outside the US.

2. Foreign Transaction Fee. Unfortunately, there is a 3% foreign transaction fee for charges which are not in US dollars. American Express Bluebird doesn’t charge a foreign transaction fee, so this is the one area where Bluebird could be better. 3. Bill Pay Fees. There is NO fee for making bill payments such as mortgage or loan payments, paying your rent, etc.This means that you can buy a Visa gift card with a PIN at a grocery store or drug store or office supply store with a miles earning credit card. You will earn miles or points for buying the gift card.

You can then load your Go Bank card at Wal-Mart with the gift card card and use Go Bank’s Bill Pay to pay your mortgage or other bills and earn miles and points!

4. Monthly Fees. Go Bank doesn’t charge a monthly fee, but gives you the option to pay from $0 to $9 per month. If you like their service and product, you could consider sending them a few dollars each month!

GO Bank Limits

I haven’t personally verified the limits below.

1. Daily Spending Limits. You can spend up to $3,000 per day. This includes the ATM withdrawal limit of $500 per day.The limits reset at 12 midnight Pacific Standard Time.

2. Daily Load Limits. You can load up to $2,500 per day and the maximum load is $1,100 per transaction or load.The limits reset at 12 midnight Pacific Standard Time.

3. Bill Pay Limits. There is a limit of $5,000 per bill pay transaction.But customer service said that I could send multiple payments in a day if my Go Bank balance was large enough. This is very helpful for folks who want to pay down a large loan balance.

4. Maximum Balance. The maximum balance on your Go Bank card is $50,000.CAUTION

Warning: You should NOT experiment with the Go Bank debit card and reload card if you can’t afford to be without the money loaded in your Go Bank account. Many people complain that Green Dot (which owns Go Bank) arbitrarily closes accounts and that it takes months to get your money back. – Do NOT fund Go Bank and then immediately withdraw money from an ATM or transfer money to your checking account. That is very easy to detect. Withdraw only as much money as an average person would – that is in the hundreds of dollars and NOT thousands of dollars per week. – Use Go Bank for lots of routine transactions as well. If all you do with Go Bank is withdraw money from the ATM or to your bank account, you are likely to be shut down because you are unprofitable for GreenDot. – You WILL get shut down if you try to spend tens of thousands of dollars per month at any store with any one card. – I can’t give you an exact amount and you’ve got to decide for yourself what is a reasonable limit. – Alternate with other credit cards so that you’re not buying too many gift cards with just one credit card.Bottom Line

You can request a Go Bank card online at Go Bank.com.

Go Bank opens up a whole new world of point earning opportunities, but you have to go easy. Otherwise you risk having your Go Bank account shut down. I use my Bluebird and Go Bank to help meet credit card minimum spending requirements and to pay my loans and rent which otherwise wouldn’t earn miles and points.

Stay tuned for more posts on Go Bank!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!