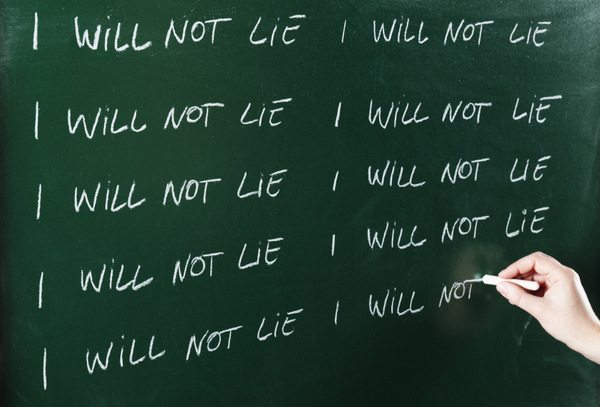

Don’t Lie on Your Credit Card Applications

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Don’t forget to follow me on Facebook or Twitter!

[Disclaimer: I’m not a lawyer, so nothing in this post should be considered as legal advice. Please consult your lawyer for legal advice specific to your situation.]Don’t lie on your credit card, or on any application for credit. It is fraud and you could get prosecuted for it! Sure, the chances of being prosecuted are extremely slim, and likely only if you don’t pay back your credit card debt and declare bankruptcy.

But why take the chance of spending time in jail?

The defendant indicated that his income was anywhere between $90,000 to $122,000 when, in 2006, he reported to the Internal Revenue Service that his income was approximately $12,488. Gaylord ended up leaving outstanding balances on the various lines of credit and filed for bankruptcy.

Gaylord charged up his credit cards, but was unable to pay them back and eventually declared bankruptcy.

He later pleaded guilty to bank loan application fraud which has a penalty of up to 30 years in jail and a $1 million fine. He was actually sentenced to time served and 5 years of supervised release together with $46,914 in restitution.

Here’s a link to the specific section of the US code which makes lying on credit applications an offense. And here’s a link to a study which suggests that 45 million folks (looks too high to me) deliberately manipulate their identity.

What Does This Mean?

Quite simply: don’t lie on your credit card applications. Don’t say you’re employed when you’re not. Or that you earn more than you actually do.

American Express occasionally conducts financial reviews where they will ask you to verify your income by sending them a copy of your tax returns. And if your income doesn’t match your tax returns, they either slash your credit lines or close your credit cards.

Many banks will not prosecute you for fibbing on a credit card application, but they could prosecute to make an example of you or if you don’t pay back your debts and declare bankruptcy.

If you apply for a business credit card, don’t over state your income. Many folks get approved for business credit cards even if they show annual revenue of $0.

Miles and Points are wonderful, but they’re not worth lying about.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!