How to Use The US Bank Visa Buxx Prepaid Card to Complete Minimum Spending Requirements & Increase Credit Card Spending

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Don’t forget to follow me on Facebook or Twitter!

Introduction

Credit card minimum spending requirements are always increasing. For example, you currently have to spend $10,000 within 3 months to get the full 50,000 Ultimate Rewards points sign-up bonus on the Chase Ink Bold or Ink Plus.

After Amazon Payments, prepaid debit cards offer some of the best ways to creatively meet credit card minimum spending requirements. You can also use prepaid debit cards to generate spending to earn extra perks on credit cards.

I wrote an eight part series on the perks of Big Spending on a credit card – from hotel elite status, bonus points, airline elite status to companion passes. Check it out to see which perk matters the most to you and use that credit card when you fund your prepaid debit card.

However, be careful to avoid using Citi credit cards when buying a prepaid debit card directly from a bank because they usually code purchases from other financial institutions such as banks as cash advances which mean high cash advance fees and interest.

how it works

Certain prepaid debit cards can be funded or loaded with a credit card. This means that you usually will earn miles or points when you fund or load your prepaid debit card using a credit card.

You can then use your prepaid debit card for regular purchases, but you can also use it to withdraw money at the ATM. There are usually small fees associated with either loading and/or withdrawing money at the ATM. But these fees could make sense if you have no other way to hit the minimum spending requirements on credit cards to get the sign-up bonus or if you want to get a perk for spending on your credit card.

Some prepaid debit cards (not all of them) also let you get cash back from the store, so you could buy $10 worth of groceries and get $200 cash back. Or you could buy money orders from Wal-Mart, grocery stores, or US Post Offices and then deposit those money orders into your bank account.

You may even be able to link certain prepaid debit cards to your Venmo account, and transfer money directly to your checking account for free.

The Risks

I can’t tell you what to do or how far to go with pre-paid cards. You’ve got to assess the risk for yourself. As always, do what is comfortable for you.

1. Cash Advance Fees. The most obvious risk is that the purchase or funding of prepaid debit cards will be coded as a cash advance and you will pay extremely high cash advance fees and interest. This is almost always the case with Citi cards so don’t use them to purchase products directly from a financial institution like a bank.However, purchasing, say, a Visa gift card at a grocery store is okay since that will be coded as a purchase from a grocery store, and banks currently don’t charge cash advance fees for that!

2. Won’t Earn Points. You may earn miles and points the 1st time you buy or load a prepaid debit card with a credit card, but may not earn miles the 3rd or 4th time.That’s because banks could change the coding for the purchase or loading of pre-paid debit cards at any time. This recently happened with Bank of America and the Wells Fargo pre-paid debit card (review coming soon).

3. Hard to Keep Track of Fees & Limits. The different pre-paid debit cards have different fees for loading and withdrawing. They also have different limits on the amount you can load and withdraw on a daily, weekly and monthly basis.Keeping track of all this can be tough, so I suggest using a spreadsheet which lists the various limits and when you fund or withdraw money from the card.

4. Account Closures. Your prepaid debit card could get suspended or closed if the issuer suspects fraudulent activity. In that case, it could take a few weeks (perhaps longer) to get your money back, so don’t fund your pre-paid debit card if you can’t do without the money for a few weeks. 5. Credit Card Closures. The most significant risk is that your bank could close your credit card account and not approve you for future applications. I haven’t heard of this happening to anyone (yet), but it could happen if you push this to the extreme.US Bank VisaBUXX Card

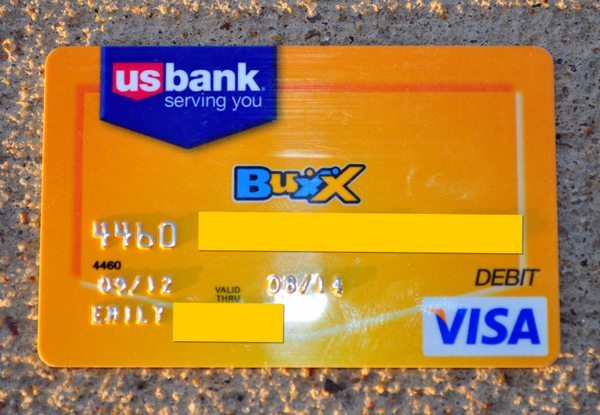

Link: US Bank Visa Buxx

Link: US Bank Visa Buxx terms, conditions & fees

The US Bank Visa Buxx card is supposed to be a debit card which parents load with money and then give to their teenagers to use.

However, I applied for a Visa Buxx card and entered Emily’s information in the “Teen Information” field to test the card for the blog. Emily isn’t a teen, but was approved for a card!

However, the terms (in my interpretation) don’t say that the Visa Buxx card is exclusively for teenagers. The terms say (bolding mine):

Your Card accesses the Account we have opened for your personal use, and the personal use of your teen child who is authorized to use the Card to access the funds in such Account.

Some will feel uncomfortable with this, so only do what you feel comfortable with.

You have to enter social security number in the application, but I didn’t get a hard credit inquiry for the card.

You can load up to $2,000 on the card per month, and you pay $2.50 per $500 load. So you’re spending $10 to generate $2,000 in credit card spending, assuming you have access to a fee free US Bank ATM.

Just like you can have more than 1 teenager, you can have more than 1 US Bank Visa Buxx card!

1. Fees. You pay $2.50 per funding load with a non-US Bank credit. The maximum load is $500 at a time, so you’ll pay ~$50 in fees to fund, say, $10,000 in minimum spending.You will also pay $15 to sign up for the card unless you buy & fund it from a US Bank Source, in which case the fees are $10.

There is also a 3% foreign transaction fee among other fees.

2. Funding. Here’s my experience trying different ways to fund my US Bank VisaBuxx card:A. Credit Cards. You can’t use an American Express card to fund the US Bank Visa Buxx, but you can use a Visa or MasterCard to fund the US Bank VisaBuxx card.

I experimented with a Chase Ink Bold, Bank of Hawaii Hawaiian Airline card, and a Citi Thank You premier and earned miles and points with each of them and wasn’t charged cash advance fees because the transaction posted as a purchase. Million Mile Secrets reader PatMike used a US Bank Flexperks card, but did NOT receive any points for the funding.

You can fund the US Bank Visa Buxx card online when you log into your account.

However, I was charged a $2.50 load fee for loading the Visa Buxx card with a non-US Bank credit card.

So you’re spending $10 to generate $2,000 in monthly credit card spending, assuming you have access to a fee free US Bank ATM.

I was *shocked* when I wasn’t charged cash advance fees on my Citi Thank You card, because Citi usually codes almost every direct purchase from a financial institution as a cash advance. However, I would NOT recommend using a Citi card, because they could start charging cash advance fees at ANY time.

B. Gift Cards. I was not able to fund the US Bank Visa Buxx card with a Visa or MasterCard gift card.

3. ATM Withdrawal Limits. There is a daily limit of 3 ATM withdrawals of up to $200 per withdrawal. ATM withdrawals at US Bank ATMs are free, so this will be useful to folks who live close to a US Bank ATM.Here’s a link to see if there is a US Bank ATM near you.

But you will pay $1.50 per ATM withdrawal at a non-US Bank ATM in ADDITION to fees charged by the ATM owner. This can get expensive quickly, so it likely doesn’t make sense to withdraw money at a non US Bank ATM to regularly earn miles and points, but could make sense to complete minimum spending requirements.

4. Funding Limits. The terms say that you can load only $500 per transaction and the maximum value on the card is $2,000. You are also limited to loading $2,000 per month on the US Bank Visa Buxx card.So the maximum spending which you can generate with 1 US Bank Visa Buxx card is $24,000 per year in 48 loads of $500 each. This will cost $120 ($2.50 funding per load X 48 loads).

5. Money Orders. The US Bank Visa Buxx has a PIN number, but I wasn’t able to use it to get cash back or to buy money orders. The PIN only worked for ATM withdrawals. 6. Multiple Cards. You can have multiple cards for different teenagers or non teens since you can enter the date of birth for a person who is not a teenager and get approved. 7. Changing Funding Source. I was able to change the funding source online 6 times, but never more than twice in 1 day. 8. Fund Other Cards. I wasn’t able to use the US Bank Visa Buxx to fund my American Express Bluebird as a debit card load at Wal-Mart. This would have been useful for folks who don’t have access to Vanilla Reloads cards. 9. Venmo. I didn’t check to see if you can use Venmo to transfer money from the US Bank VisaBuxx card directly to your checking account for free. This would be much easier than making ATM withdrawals.There is a $2,000 monthly limit on the amount you can transfer using a debit card with a Venmo account for free, which matches perfectly the monthly amount you can load on your US Bank Visa Buxx card!

Venmo recently started accepting debit cards and they do not charge a fee for “Debit cards issued by major banks.” They do charge a 3% fee for debit cards issued by smaller banks. However, this page says that using debit cards is always free, so I’m not sure which page is accurate.

Please comment if you’ve successfully used Venmo with the US Bank Visa Buxx card. Using Venmo makes it much easier, since you can fund your US Bank Visa Buxx card with a credit card from your computer and withdraw money from Venmo to your bank account from your computer as well!

Bottom Line

The US Bank Visa Buxx card is another tool to use to help meet minimum spending requirements even if you don’t have access to a US Bank ATM.

But it is time consuming to go to a US Bank ATM and the fees at non-US Bank ATMs don’t make it worthwhile to use unless you have a minimum spending requirement or really want to hit a spending target on a credit card.

If you do have access to a US Bank ATM, you could use this not only to meet minimum spending requirements, but also to hit a spending target on a credit card. Please read “The Risk” section above before using prepaid debit cards to meet minimum spending requirements on credit cards.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!