Which Cards Give the Best Exchange Rate on Foreign Transactions?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers. This page includes information about the Discover it® Cash Back that is not currently available on Million Mile Secrets and may be out of date.When you travel abroad, you’ll save money by using cards that don’t add foreign transaction fees. Otherwise you’ll be charged an extra ~1% to ~3% on each purchase!

But did you know you’ll usually pay a different exchange rate depending on the card issuer? Milevalue, One Mile at a Time, and View From the Wing suggest MasterCard offers the best rates.

So I decided to run an experiment with the help of a Million Mile Secrets team member who recently traveled to Canada.

I’ll let you know what we found out!

Are All No-Foreign-Transaction-Fee Cards the Same?

Link: MasterCard Currency Conversion Tool

Link: Visa Currency Conversion Tool

Even though there are lots of great cards that don’t charge foreign transaction fees, including some with no annual fee, there is a difference in the exchange rate you’ll pay between certain cards.

And if you spend a lot overseas, using cards with a better exchange rate can mean a substantial savings.

While Visa and MasterCard offer currency conversion tools online, folks report there’s no guarantee they’ll use those exact rates on the date of your transaction.

I wanted to see for myself, so I asked a team member to visit a store in Canada to make purchases of the same amount, at the same time, with different cards. And see which issuers gave the best (and worst!) exchange rates!

The results are in!

MasterCard Comes Out on Top!

As folks have suspected, MasterCard had the most favorable rate.

Here are the cards we tested:

- The Platinum Card® from American Express Exclusively for Mercedes-Benz

- American Express Starwood Preferred Guest (Small Business)

- Chase Sapphire Preferred (Visa)

- Chase Ink Plus (Visa)

- Citi Prestige (MasterCard)

- Discover it® Cash Back

Each transaction was for 25 Canadian dollars.

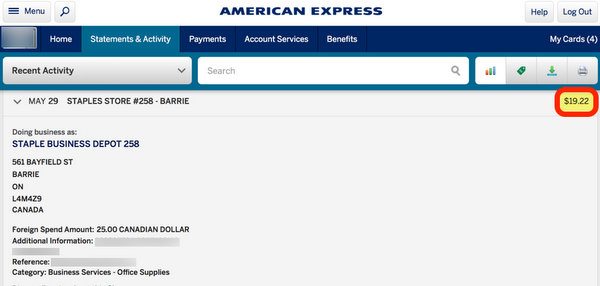

1. American Express Mercedes-Benz Platinum

American Express converted 25 Canadian dollars to $19.22 using the American Express Mercedes-Benz Platinum card. That works out to an exchange rate of $1 = ~1.3007 Canadian dollars.

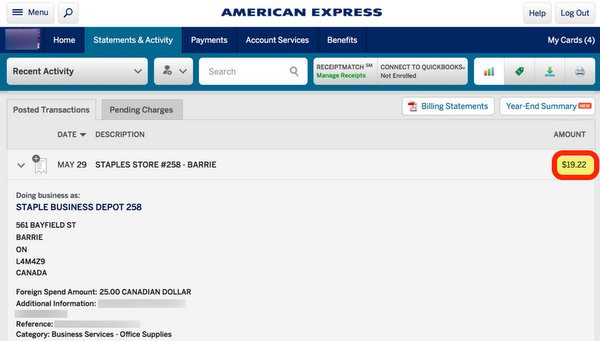

2. American Express Starwood Preferred Guest (Small Business

Using an American Express small business card did NOT make a difference in the exchange rate. The American Express Starwood Preferred Guest Small Business card rate was the same as the American Express Mercedes-Benz Platinum, $1 = ~1.3007 Canadian dollars.

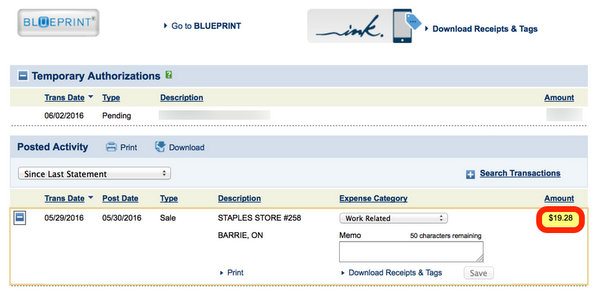

3. Chase Ink Plus

The Chase Ink Plus is a Visa small business card, and the 25 Canadian dollar purchase posted as $19.28. That’s a rate of $1 = ~1.2967 Canadian dollars.

This was the worst rate of the experiment!

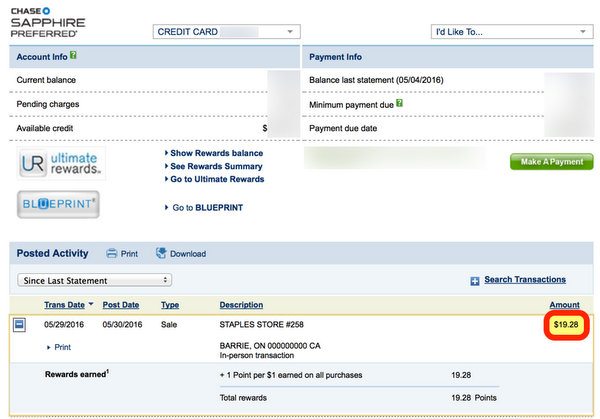

4. Chase Sapphire Preferred

Using a personal Visa card did NOT make a difference. The Chase Sapphire Preferred also posted the transaction as $19.28.

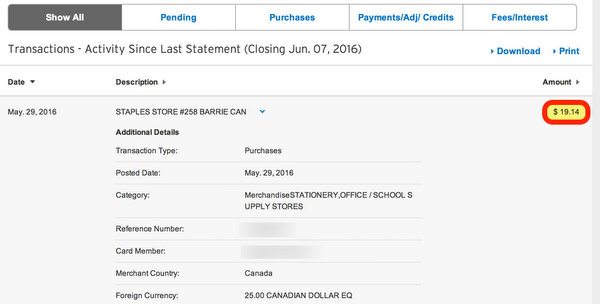

5. Citi Prestige

The Citi Prestige is a MasterCard, and it had the best exchange rate. The 25 Canadian dollar transaction posted as $19.14, or a rate of $1 = ~1.3061 Canadian dollars.

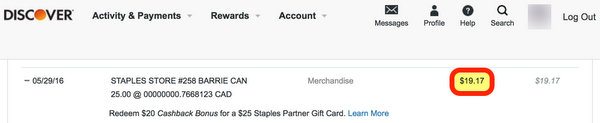

6. Discover it Cash Back

The Discover it Cash Back card came in 2nd place for the best exchange rate. It charged $19.17 for the 25 Canadian dollar purchase, or a rate of $1 = ~1.3041 Canadian dollars.

Putting It All Together

In summary, here’s a list of cards and the rates they charged (in order of best to worst):

| Card Name | 25 Canadian Dollars Converted to US Dollars | Exchange Rate ($1 USD to Canadian Dollars) |

|---|---|---|

| Citi Prestige® Card | $19.14 | ~1.3061 |

| Discover It® | $19.17 | ~1.3041 |

| Starwood Preferred Guest® Business Credit Card from American Express | $19.22 | ~1.3007 |

| The Platinum Card® from American Express Exclusively for Mercedes-Benz | $19.22 | ~1.3007 |

| Ink Plus® Business Credit Card | $19.28 | ~1.2967 |

| Chase Sapphire Preferred® Card | $19.28 | ~1.2967 |

To compare, I checked the Visa and MasterCard online currency conversion tools. MasterCard’s tool did not work for the transaction date, but the Visa tool returned the same rate as the Chase Sapphire Preferred and Chase Ink Plus.

That said, there’s no guarantee these results will apply for every card and with every currency or date. But I was happy to see for myself what other bloggers have already suggested – MasterCard will likely give you the best exchange rate when you travel overseas.

Remember to Factor in Bonus Categories

It might be worth paying a slightly poorer exchange rate if the card you’re using earns bonus miles or points for a purchase. Or if you prefer certain types of miles or points.

Especially for smaller purchases! Let’s look at an example.

Suppose you go out for dinner in Toronto and spend 75 Canadian dollars at a restaurant. And you’re deciding between using your Chase Sapphire Preferred Visa or Citi Prestige MasterCard.

Both cards earn 2X points on dining. And (using the sample exchange rates above) you’d pay:

- ~$57.84 using the Chase Sapphire Preferred ($1 = ~1.2967 Canadian dollars)

- ~$57.42 using the Citi Prestige ($1 = ~1.3061 Canadian dollars)

That’s a difference of 42 cents (not much!). And with either card, you’d earn ~115 points. So it really depends on which program you prefer to earn points in, though I consider Chase Ultimate Rewards points to be most valuable.

That said, if you’re spending hundreds or thousands of dollars, especially in non-bonus categories, it usually makes more sense to use the card with the better exchange rate.

The Reason Visa Seems to Charge a Bit More

According to some, Visa charges ~1% more because, unlike MasterCard, they guarantee the rate on the day of your transaction. You might feel more comfortable knowing how much you’ll pay in US dollars when making a purchase internationally.

On the other hand, the transaction doesn’t post right away. So in that time, the exchange rate can go up or down. So Visa might lose money due to currencies changing values. The extra bit they charge is to guard against that. But what you care about is if YOU pay more! 🙂

Bottom Line

We experimented with different cards with overseas transactions of the same amount, at the same time, to see which issuers gave the best exchange rates. None of the cards tested add foreign transaction fees:

- American Express Mercedes-Benz Platinum

- American Express Starwood Preferred Guest (Small Business)

- Chase Sapphire Preferred (Visa)

- Chase Ink Plus (Visa)

- Citi Prestige (MasterCard)

- Discover it Cash Back

The best exchange rate (as other folks have reported) was with MasterCard. And the least favorable was with Visa. Discover and American Express were in between.

This isn’t a guarantee you’ll always get the best or worst exchange rates with these cards. But the results are in line with what others have suggested – that MasterCard is typically the card with the best rate for overseas purchases.

For smaller purchases, the difference in exchange rates might be insignificant – so choose the card that earns your favorite points (especially if it awards category bonus points for your purchase).

Have you noticed a difference between card exchange rates when you travel? Please share your experiences in the comments!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!