The Best Personal Finance Tool: Unlock the Power of Mint.com

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Team member Harlan told me how he uses Mint.com to track spending, make sure his bills are paid, and monitor transactions on all his accounts. So I asked him to tell you how this useful tool works!

Harlan: I dutifully check my Mint.com account every day! I’ve used the service for years to track my checking accounts, credit cards, investments, loans, and even the value of my property.

I’ll give you a brief overview of how it works. And why you might want to give it a try!

How to Use Mint.com to Track Your Financial Life

Link: Mint.com

Mint.com is a site that can help you track your money in a variety of ways. I use it to help in nearly every part of managing my finances. I’ll show you what it can do!1. Get an Overview of Your Money

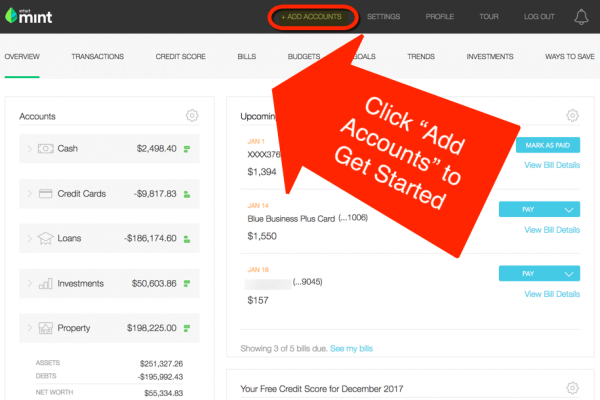

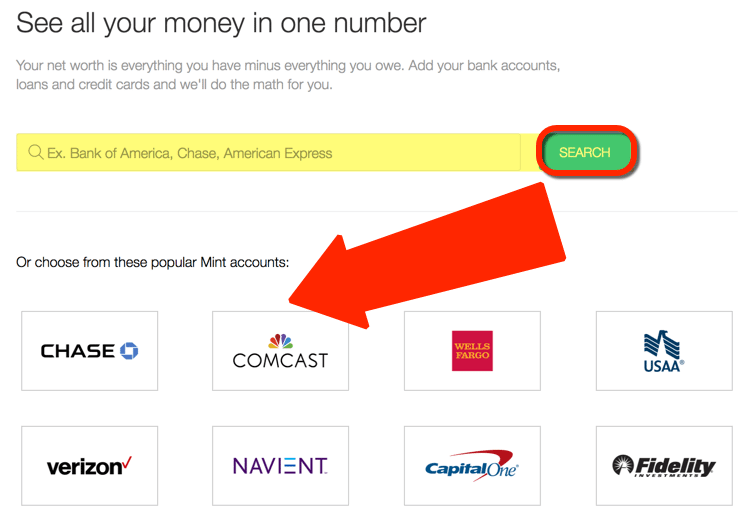

To start, you’ll need to add the accounts you want to track. Mint.com supports nearly every bank, large or small.

You can type the name of your bank to search for it. Or, select from the most popular accounts.

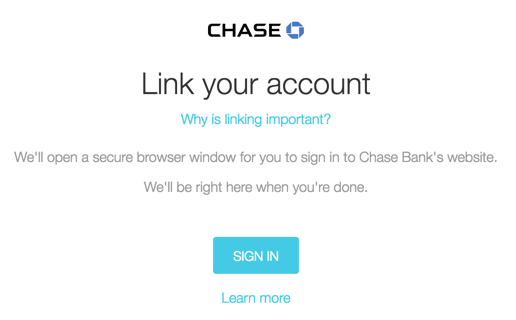

Click the merchant’s name to add your log-in information.

Then, you’ll link each account with the same log-in credentials you normally use. This allows Mint.com to pull your transactions, due dates, and history. And it’s how Mint.com generates the rest of your data.

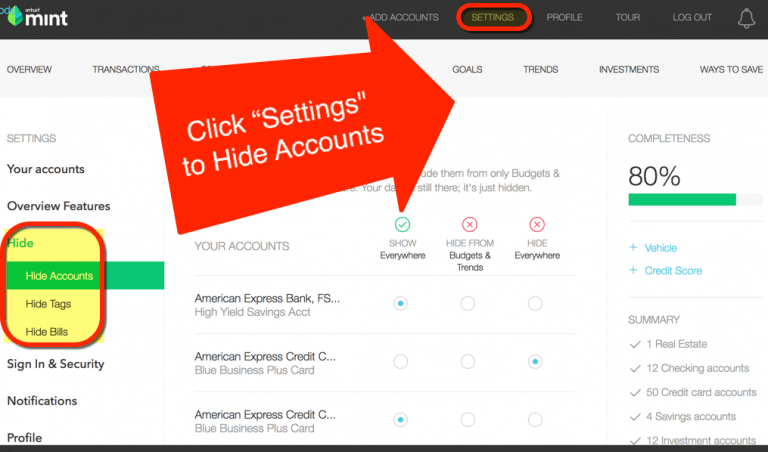

If there are certain accounts you do NOT want to include, like employee credit cards, savings accounts, or a shared checking account, you can hide them. Just click “Settings” at the top, and then “Hide” on the left. You can hide entire accounts, spending in certain categories, or bills that are on auto-pay.

When you’re done, click “Overview” to see your finances from a bird’s-eye view!

2. Monitor Transactions

I look at my transactions every day. I want to see what charges have cleared, and when. A couple of times, I’ve found suspicious charges in my Mint.com account. And then went to verify them on the bank’s website.This has helped me proactively control fraud and unauthorized charges!

I also use this tab to see when dividends are paid on my investments.

And, I check here to see when payments post. I like the security of knowing everything is in order!

3. Get Bill Due Dates

Once you plug-in your accounts, Mint.com will populate your due dates into the system. For example, my mortgage payment is due by the 1st of each month. But my car note is due on the 12th. My credit card due dates are scattered throughout the month.

Instead of having to remember every date, I let Mint.com do it for me. And I can see at a glance what’s due next, which helps me to budget my funds for the month. Which leads us to…

4. Make a Budget

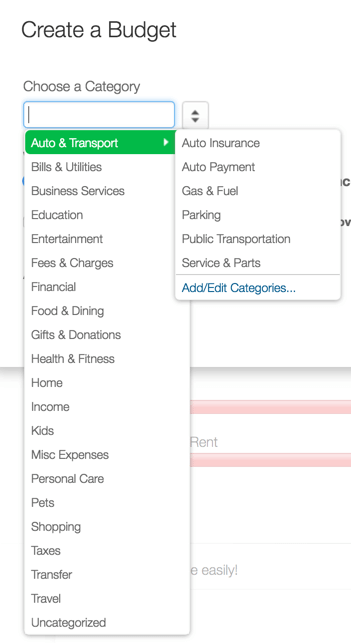

Here’s where Mint.com starts to get highly customizable. You can make your own budget!

To start, click the “Budgets” tab and then select the “Create a Budget” button. You can add anything you want!

You could track things like:

- Your rent or mortgage payment

- How much you spend dining out

- How much you spend on entertainment (movies, concerts, etc.)

- Your kid’s allowance

- Charity donations

- How much you paid in taxes

- Travel expenses

You can also add custom categories, so the possibilities are endless!

In the “Overview” tab, Mint.com shows how close you are to your monthly or quarterly budgeting goals. Or if you’re already over them! That way, you know how much is still safe to spend. Or if you need to reign in your expenses.

5. Set Financial Goals

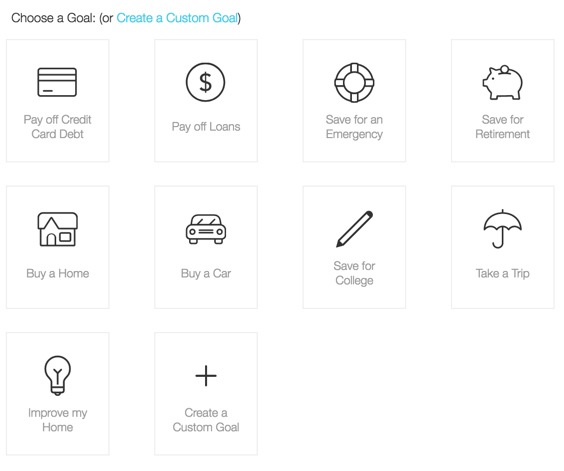

Another fun part of the site is the “Goals” tab. To add a goal, click to the section, like “Pay off Loans” or “Take a Trip,” and then click “Add a Goal.”

Whether your goal is to start an emergency fund, take a trip, save for a home, or pay down debt, you can start tracking it right away. You can even create a custom goal if you don’t see what you’re looking for.

Goal-setting is a huge part of any success. So I really like this part of the site! 🙂6. See How Much You Really Spend

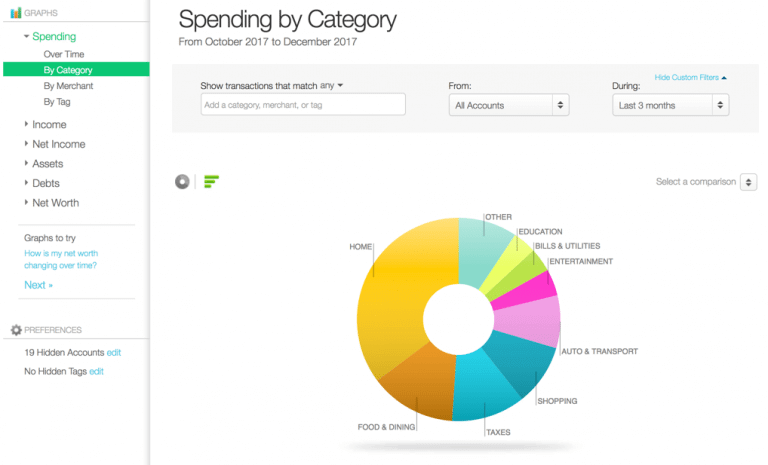

The “Trends” tab is neat because it lets you select any account (or all of them) and create custom graphs based on your actual spending.

You can set custom durations, or select the current month, last month, or the past few months combined. The results might be shocking. For example, I spend almost half my income on my house payment and eating out. Maybe I should buy groceries and eat in more often!

This is great to compare with your budget. Because you can see where your money really went. And what categories might actually be a huge sinkhole for your money!

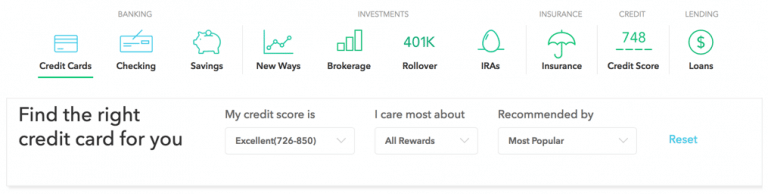

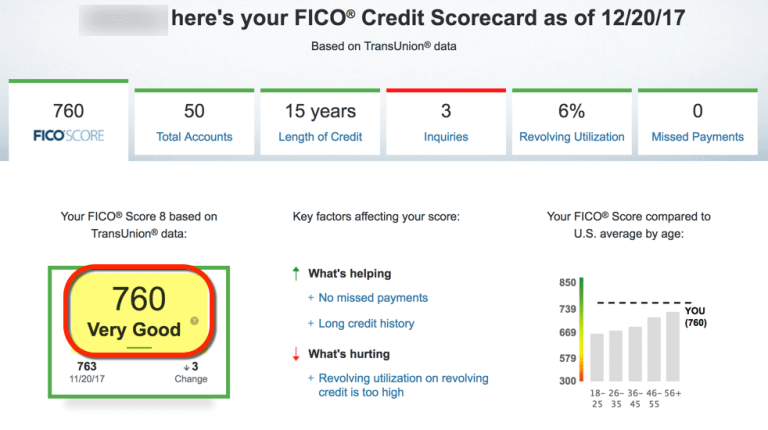

7. Track Investments, See Where You Can Save, and Find Your Credit Score

Like I said, Mint.com is robust! You can click the “Investments” tab to see how your stocks and bonds are performing over time. There are lots of other websites that aim to track this. But it’s a nice part of Mint.com if you have time to explore. Or if you have a lot of investment accounts.

“Ways to Save” gives you exactly that – recommendations based on the data Mint.com can see.

However, I take this information with a grain of salt.

For example, when I clicked “Savings,” Mint.com recommend a Chase savings account with a 0.01% APY ahead of other accounts with 1.3% or 1.4% APYs. And claimed my savings would be higher overall! So I don’t know how they compute these numbers.

That said, if I were in the market for a new savings account, it’s nice to have a handy list with lots of information. Just keep in mind, Mint.com does NOT show every option. So I’d use this as a jumping-off point.

Definitely do your own research before you commit! (And don’t get me started on the credit card recommendations…)

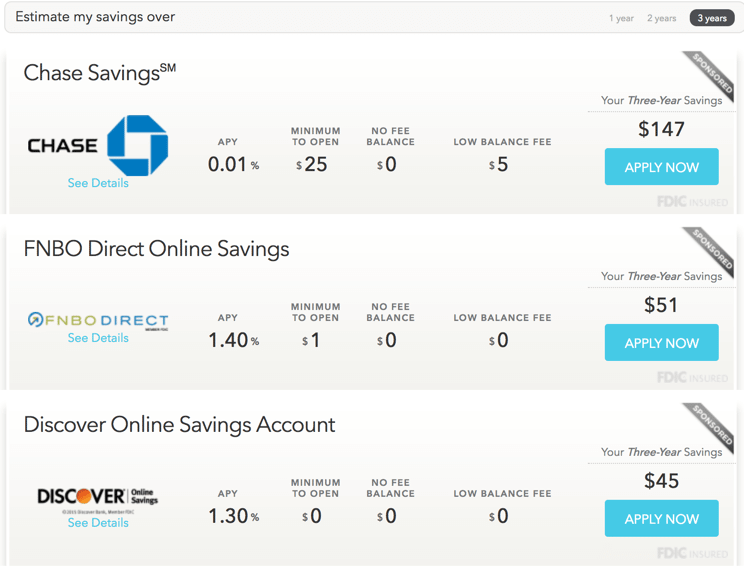

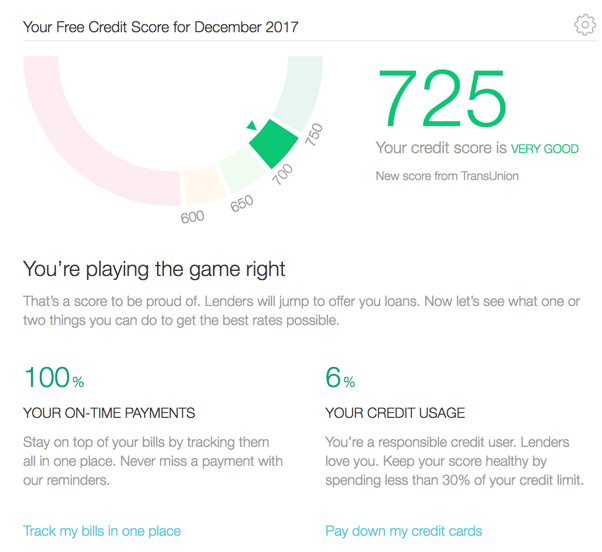

Finally, you can get your credit score with Mint.com, too.

But I wouldn’t completely trust it, because it’s not a real FICO score. Mint.com said my credit score this month was 725, based on data from TransUnion. When I checked my TransUnion FICO score, it was actually 760.

In my case, the score was off by 35 points. That’s a huge margin of error! But it could be helpful to get a starting point for where you stand credit-wise.

What About Security?

Link: Mint.com Security Information

Having airtight security was my biggest concern with using Mint.com. They have a page dedicated to explaining how they make sure your data is safe and secure.

I have personally used Mint.com for 5+ years and have never had an issue stemming from their website. The few run-ins I’ve had with fraudulent activity were, if anything, helped by being able to quickly and accurately track all my transactions with Mint.com.

This is a personal decision, of course. But I’ve always known Mint.com to be a safe website. They let me enable fingerprint ID when accessing the app, which is good enough for me. But definitely something to consider before you sign-up!

Bottom Line

Team member Harlan uses Mint.com to track his finances and overall financial goals. Including everything from checking accounts and credit cards to investments and budgeting.

Mint.com is a useful tool for:- Tracking every transaction

- Seeing bill due dates

- Making a budget

- Setting goals

- Tracking how you spend your money

- And much more!

If you’re concerned about security, here’s an explanation direct from the source. Harlan has used Mint.com for 5+ years and never had a security issue.

There are a lot of parts to the site, so the best way to explore is to sign-up and poke around!

Do you have any neat ways you use Mint.com? I’d love to hear about them!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!