Expedia+ Credit Cards and Rewards Program: Worth It or Not?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Million Mile Secrets reader Joe commented:

Hey Daraius, would be cool if you could do a write up on using Expedia points.There are 2 credit card offers: 15,000 and 25,000 points. Thinking you could stagger the 2, i.e. get the 15,000 1st then later get the 25,000.

However, not sure what the value of 40,000 Expedia points would be. Their site seems way more focused on how you earn the points than how you actually use them. Would love to hear if you had any experience with this.

Joe is referring to the Expedia+ Voyager Card from Citi and Expedia+ Card from Citi cards. They earn Expedia+ Rewards points, which can be redeemed for flights, coupons to use for hotel stays, or donated to charity.

Expedia+ Rewards is the loyalty program for Expedia, an online travel agency where you can search for and purchase flights, hotel stays, vacation packages, cruises, and more.Let’s look at the Expedia+ Rewards program and see if it’s worth considering these cards!

Expedia+ Rewards Program

Link: Expedia

Link: Expedia+ Rewards

Link: Expedia+ Rewards Sign-Up

1. Earning Points

The Expedia+ Rewards program allows folks to earn points on hotels, flights, packages with a hotel, activities, and flight + car packages purchased through Expedia. And you’ll earn bonus points if you have elite status.

Usually, you’ll earn elite status by achieving the following in a calendar year:

- Spending $5,000 in eligible bookings or staying 7 qualifying hotel nights (+silver status)

- Spending $10,000 in eligible bookings or staying 15 qualifying hotel nights (+gold status)

The point earning structure is a little complicated. You’ll earn:

- 2 points per $1 you spend on hotels, packages with a hotel, activities, and cruises

- 1 point per $5 you spend on flights (in addition to your regular frequent flyer miles)

- 1 point per $1 you spend on flight + car packages

- 30% extra points if you have +gold status, 10% extra if you have +silver status

- 250 bonus points for +VIP Access hotel bookings (+silver and +gold status holders only)

- Bonus points for special offers, like booking through the Expedia app

All members get access to Expedia’s Extended Hotel Price Guarantee. Usually, Expedia will give you a $50 credit if you find a lower price online (with conditions) within 24 hours of booking. With the extended guarantee, you can file a claim up until midnight the day before your stay. The extended guarantee only applies to hotel bookings.

2. Spending Points

Expedia+ Rewards points can be used for hotel stay coupons, flights, or donated to charity (St. Jude Children’s Hospital). There are no blackout dates.

Hotel Coupons

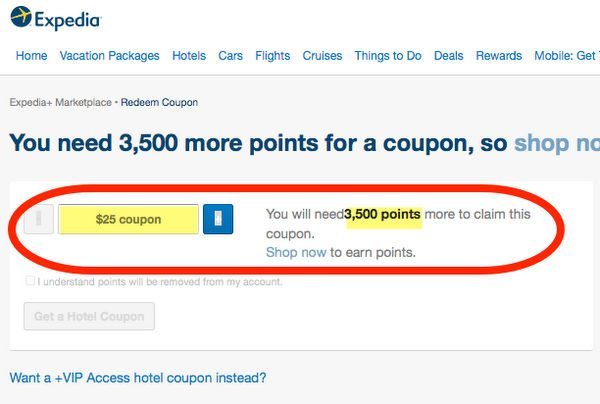

Expedia+ Rewards points can be exchanged for hotel coupons (sign-in required) at a rate of 3,500 points to $25 in coupons, which means points are worth ~0.71 cents each ($25 coupon / 3,500 points).

Coupons are available up to $1,000 in value (140,000 points).

You can use coupons for any Expedia Rate hotel, which are hotel rooms Expedia has already bought and sells to customers directly. Most, but not all hotel prices they publish are Expedia rates. You’ll see it indicated under the hotel name when you do a search.

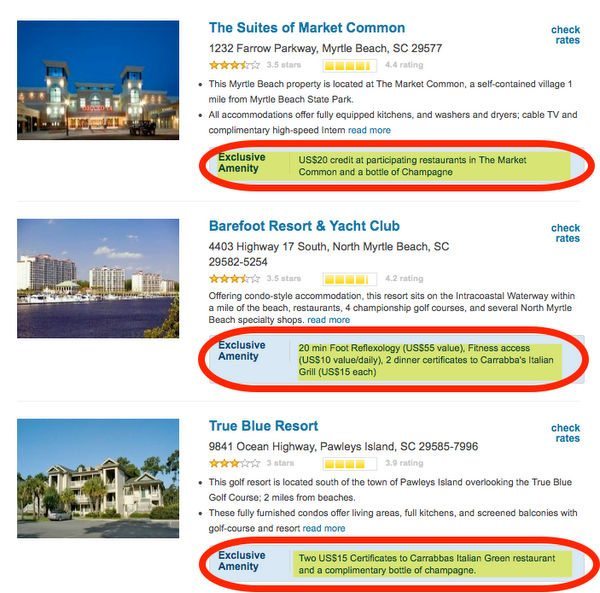

However, Expedia has a selection of over 1,400 high-end hotels called +VIP Access. At these hotels, elite members get VIP offers and extra perks, like waived fees, bottles of wine or dining certificates.

You can get double the value when you redeem Expedia+ Rewards points for +VIP Access hotel coupons. So for 3,500 points, you’ll get a $50 coupon. In this case, your points are worth ~1.43 cents each ($50 coupon / 3,500 points).

Note: Elite +gold members can also get room upgrades if available, plus early check-in and late check-out at +VIP Access hotels.Flights

You can redeem Expedia+ Rewards points for flights offered on Expedia.com. The flight can be for you or for others. But be careful, because once you book, there are no changes or cancellations allowed!

The number of points for an award flight depends on the cost of the paid fare, inclusive of taxes and fees. Expedia points are worth ~0.6 cents each when used for flights.

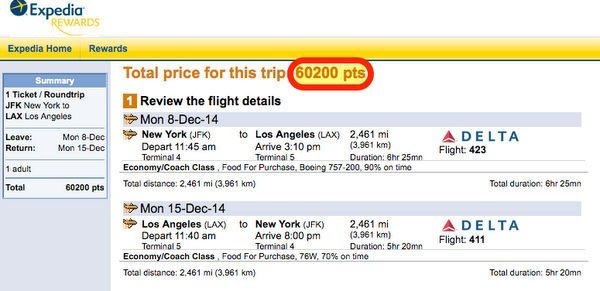

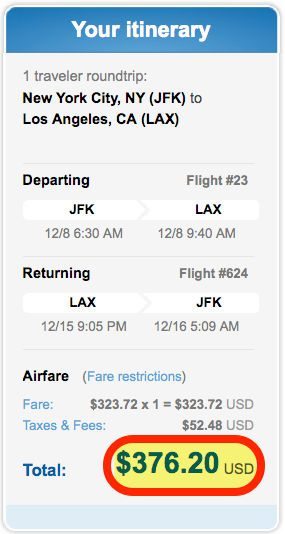

For example, a round-trip flight from New York to Los Angeles on Delta, booked through Expedia+ Rewards, costs 60,200 points.

The same flights on the Delta website cost ~$376. So in this case, your points are worth ~0.62 cents each (~$376 cost of ticket / 60,200 points).

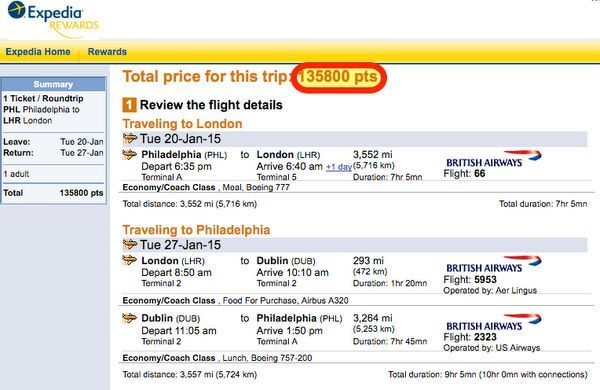

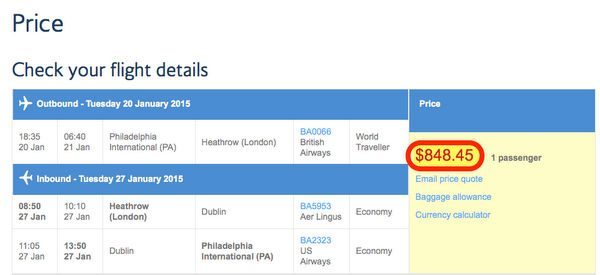

I checked an international flight to see if there was any difference. A round-trip ticket between Philadelphia and London, UK, on British Airways costs 135,800 Expedia+ Rewards points.

The same ticket, booked through British Airways, costs ~$848. In this example, your points are worth ~0.63 cents each (~$848 cost of ticket / 134,600 points).

Redeeming Expedia+ Rewards points for flights at ~0.6 cents per point is not a terribly good value. To compare, Southwest points are worth ~1.43 cents each – more than double!

Or you could book this flight (or any other flight on the Chase Ultimate Rewards travel portal) where 1 Chase Ultimate Rewards point is worth 1.25 cents.

Is It Worth Considering the Citi Expedia+ Cards?

Link: Citi Expedia+ Voyager Card

Link: Citi Expedia+ Card

Citi has 2 versions of the Expedia+ card, with different sign-up bonuses, benefits, and annual fees.

Citi Expedia+ Voyager

The Citi Expedia+ Voyager gets you:

- 25,000 Expedia+ Rewards points after you spend $2,000 in the 1st 3 months

- $100 annual statement credit for airline incidental fees such as checked bags and Wi-Fi

- 4 points per $1 you spend on Expedia purchases

- 2 points per $1 you spend on dining and entertainment

- 1 point per $1 you spend on everything else

- Free +gold elite status (upgrades and perks at +VIP Access hotels, points earning bonuses)

- 5,000 point anniversary bonus if you spend over $10,000 in a year

- No foreign currency fees

- $95 annual fee, not waived for the 1st year

So what’s the 25,000 point sign-up bonus worth? You’ll get:

- ~$150 worth of flights (25,000 points x ~0.6 cents per point)

- ~$175 worth of Expedia hotel nights @ 3,500 points per $25 coupon (7 coupons)

- ~$350 worth of Expedia +VIP Access hotel nights @ 3,500 points per $50 coupon (7 coupons)

That’s NOT a very good sign-up bonus compared to other Citi cards with similar annual fees, like the Citi® / AAdvantage® Platinum Select® World Elite™ Mastercard® or Citi Hilton HHonors Reserve. You can get potentially hundreds or thousands of dollars more in travel from those cards! The information for the Citi AAdvantage Platinum Select card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

And even though there are bonus spending categories for Expedia purchases, dining, and entertainment, I’d rather spend my money on cards that earn more valuable points, like the Chase Sapphire Preferred or the Chase Ink Plus.

However, this card might be worth getting now, because the $100 annual statement credit for airline incidental fees is per calendar year. So you’d get $100 worth of credits to use until the end of the year, and another $100 starting in January. The statement credit also makes up for the $95 annual fee.

Citi Expedia+ Card

With the Citi Expedia+ Card, you’ll get:

- 15,000 Expedia+ Rewards points after you spend $1,000 in the 1st 3 months

- 3 points per $1 you spend on Expedia purchases

- 1 point per $1 you spend on everything else

- Free +silver elite status (perks at +VIP Access hotels, points earning bonuses)

- 3% foreign currency fee

- No annual fee

The 15,000 point sign-up bonus is worth:

- ~$90 worth of flights (15,000 points x ~0.6 cents per point)

- ~$100 worth of Expedia hotel nights @ 3,500 points per $25 coupon (4 coupons)

- ~$200 worth of Expedia +VIP Access hotel nights @ 3,500 points per $50 coupon (4 coupons)

While it’s hard to complain about getting a sign-up bonus from a card with no annual fee, other fee-free Citi cards, like the Citi Hilton HHonors Visa Signature, have much better offers!

Let’s look at it this way. With the Citi Expedia card you get 3 points per $1 you spend on Expedia. That’s worth ~1.8 cents per $1 you spend (3 points x ~0.6 cents per point when redeemed for flights).

If you used the Barclaycard Arrival Plus World Elite Mastercard (annual fee waived for the 1st year) to book flights on Expedia, you’d earn 2.1 cents per $1 you spend (2 miles per $1 + 5% rebate when redeemed for travel).

Or you could use the Citi Double Cash card (no annual fee) to earn 1% back when you buy the ticket plus another 1% back when you pay the bill. That’s 2 cents per $1 you spend on Expedia purchases.

And the Chase Sapphire Preferred (annual fee waived for the 1st year) earns 2 points per $1 for Expedia bookings. You could then redeem points for travel later at 1.25 cents each through the Chase Ultimate Rewards travel portal. So in effect you could get 2.5 cents per $1 you spend (2 points per $1 x 1.25 cents per point).

That said, if you spend a lot of money on Expedia, or if you’ve run out of Citi cards to apply for, it might be worth considering 1 of these cards. But they’re not at the top of my list!

Bottom Line

The Citi Expedia+ Voyager and Citi Expedia+ cards earn Expedia+ Rewards points, which can be used for flights, coupons to use for hotel stays, or donated to charity.

Expedia+ Rewards points aren’t usually worth as much as other airline and hotel points, and the sign-up bonuses on these cards aren’t great. But they could be useful for folks who spend a lot of money on Expedia, or have run out of Citi cards to apply for.

Emily and I will be skipping these cards, but maybe they’ll be of interest to you.

Do you collect Expedia+ Rewards points? What do you like or dislike about the program?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!