Why I Downgraded This $99 Annual Fee Card (Instead of Canceling)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

I keep several annual fee cards in my wallet year after year. Because the benefits I enjoy (like a free hotel night, bonus points, etc.) are typically worth way more than the fee expense. But I’m always mindful to evaluate when a card’s annual fee hits to see if it’s time to make a change.

And recently the $99 annual fee on my Barclays JetBlue Plus card appeared on my statement. This card offers 5,000 JetBlue points (worth ~$70 in JetBlue flights) each year on your account anniversary. This perk alone nearly offsets the card’s annual fee. But I haven’t been flying JetBlue as often as I used to. So I decided to call Barclays to make a change.

Downgrading a Card Instead of Canceling Can Avoid a Drop in Your Credit Score

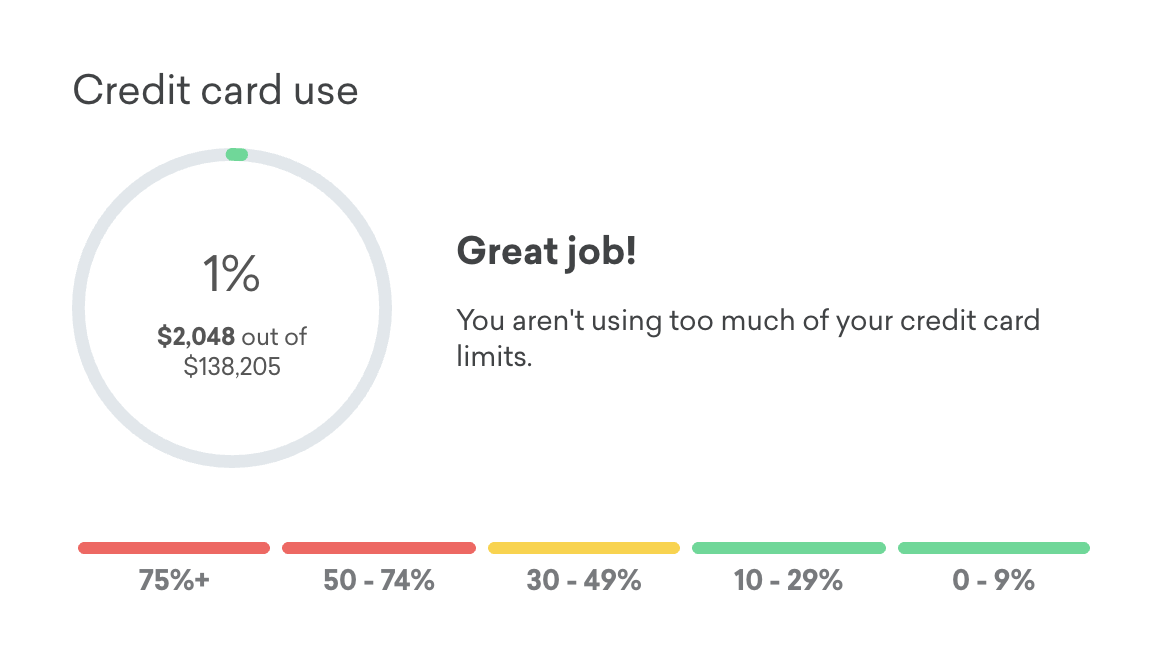

Most folks know that paying your credit card bills on time makes up a large part of your credit score. But some are unaware that another important factor is your credit utilization ratio, which is your current credit card balances divided by your total available credit across all of your cards. According to FICO, credit utilization makes up 30% of your credit score.

Even if you NEVER carry a balance (like most miles & points experts), the banks still report the balance on your card after the statement period ends (or sooner). So if you get a statement and plan to pay it off immediately, chances are the balance has already been reported to the credit agencies.

Here’s an example of why you’re credit utilization matters and how it can fluctuate. Let’s say you have 2 cards with a $10,000 credit limit on each. Perhaps you only use one of the cards to make $1,000 worth of purchases each month. In this case, your credit utilization percentage would be 5% ($1,000 balance / $20,000 total credit limit).

Now, let’s say you cancel the card you’re not using. Your credit utilization DOUBLES to 10%! Because the same $1,000 balance will be divided by a smaller denominator – $1,000 balance / $10,000 credit limit.

Personally, I try to make sure my credit utilization is less than 5%. But less than 10% is typically considered excellent. I wrote about a friend whose credit score dropped 30 points in one month just because his utilization jumped up.

This is exactly why I chose to downgrade by Barclays JetBlue Plus card to the no-annual-fee Barclays JetBlue card. Because the bank just shifted the $14,000 credit limit to the new card and I avoided having to pay an annual fee. Whereas, if I would have canceled the card, my total available credit limit would have decreased by $14,000, which would have increased by credit utilization ratio.

When you call a bank to cancel or downgrade a credit card, they’ll sometimes offer bonus points or a statement credit as an incentive to keep the card open another year. This is another tip to keep in mind when you’re considering making a change to your wallet.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!