Spending Tracker Added to Chase Credit Card App

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

INSIDER SECRET: The window to meet your Chase credit card minimum spending requirement starts when you’re approved for the card — not when you receive it in the mail.

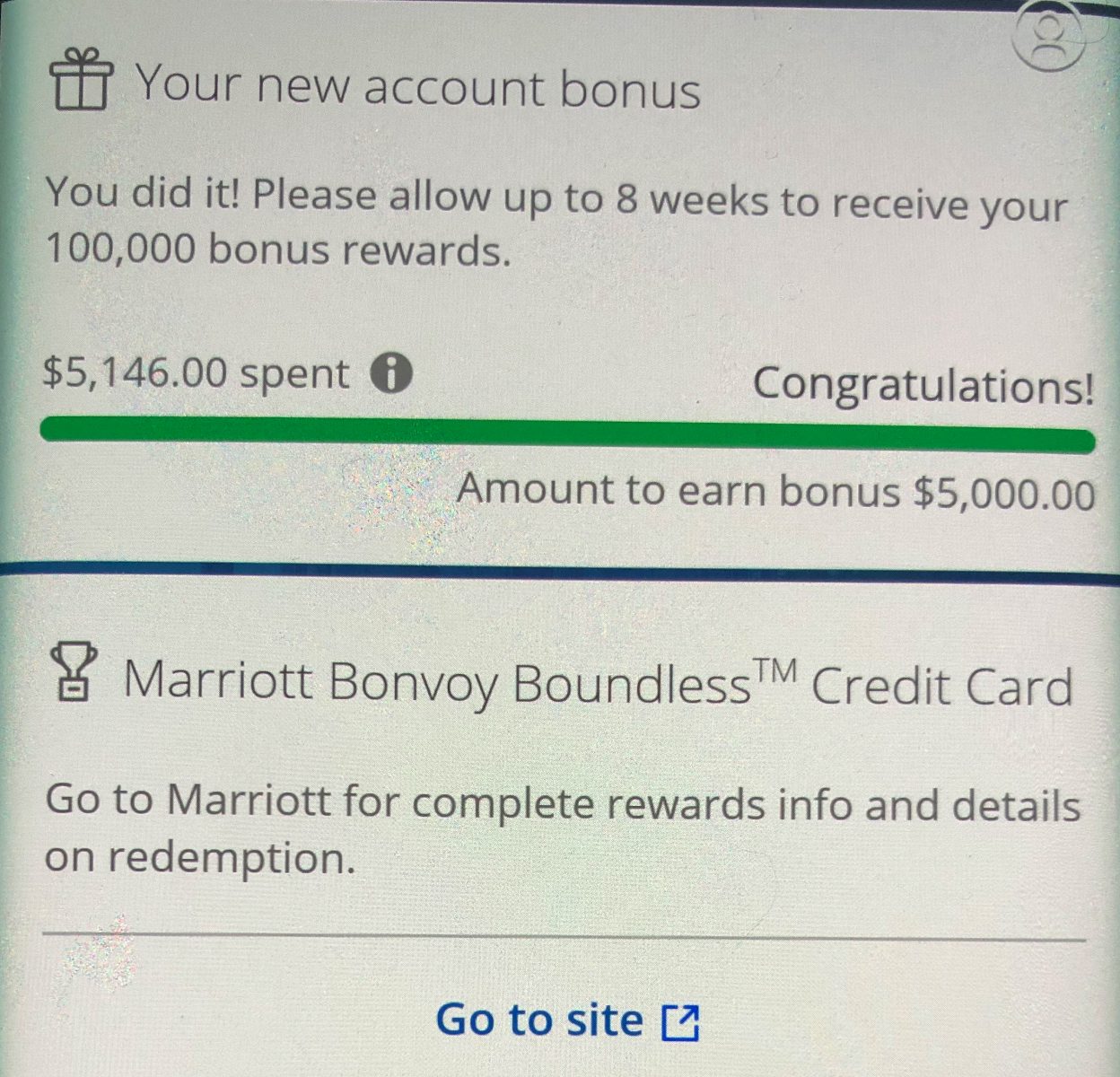

Today Chase made a handful of useful updates to its mobile banking app. The best of these improvements is the new account bonus spend tracker. It can be tricky to know how much more you need to spend to earn your sign-up bonus, because a card’s annual fee won’t count and if you return any purchases those won’t count, either.

Now you’ll know exactly when you’ve earned your bonus points, like I just did recently on my Marriott Bonvoy Boundless Credit Card.

Chase Credit Card App Updates

With this update you’ll be able to rearrange your account tiles however you like. If you’re a Southwest cardholder you’ll be able to see your Rapid Rewards balance in the Chase app.

Chase is also adding the ability to access your Chase Home Lending dashboard in the app (if you have a Chase mortgage) plus a couple of other minor changes.

The addition of a spending tracker is helpful and will save you the extra step of having to add up your purchases to figure out how close you are to earning a welcome offer.

Unfortunately, you still can’t send Chase a secure message through the app, which is a feature I’d like to see added in the future.

For the latest tips and tricks on traveling big without spending a fortune, please subscribe to the Million Mile Secrets daily email newsletter.

Featured image by BestStockFoto/Shutterstock.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!