Targeted: Cheaper 1.25% Fees on Plastiq Payments With a Mastercard

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Here’s an easy way to meet minimum spending requirements, or make a little cash for doing nothing other than paying your bills. Check your email to see if you were targeted.

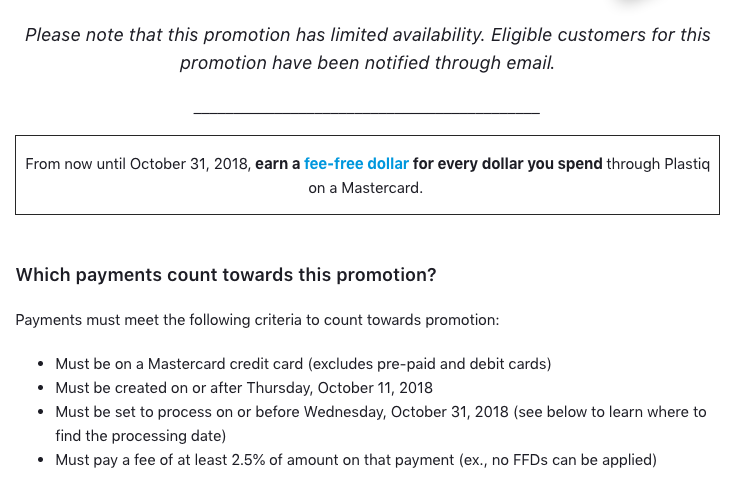

When you make a Plastiq payment by October 31, 2018, and pay the 2.5% fee, you’ll get 1 fee-free dollar to use later for every dollar you spend! This brings the fee down to 1.25% overall (pay 2.5% now, then 0% later).

If you have a Mastercard you need to spend with to earn a sign-up bonus, or a 2% cash back Mastercard, you can come out ahead with this promotion.

I’ll share how it works!

Get an Effective 1.25% Fee on Plastiq Payments With a Mastercard

Link: Plastiq MasterCard Promotion Details

Link: Sign-Up for Plastiq

Here’s a nice deal if you got the targeted email. Look for the subject line “Earn FFDs when you pay with Mastercard.”

When you use a Mastercard to make a Plastiq payment through October 31, 2018, you’ll get 1 fee-free dollar for every $1 you spend, if you pay the 2.5% fee up-front.

The fee-free dollars will post to your account on November 1, 2018. So you don’t have to wait long to get your reward.

The fee effectively drops to 1.25% because you pay the 2.5% fee now, then get 0% fees on the same dollar amount later. If you were planning to make payments anyway, you might consider using a Mastercard to take advantage of this deal before it’s over.

There doesn’t seem to be a limit on how many fee-free dollars you can earn with this promotion. So if you’re looking to meet the minimum spending requirements on a new Mastercard, this could be an easy way.

Which Cards Work for This Deal?

You can use any Mastercard credit card – not a debit or pre-paid card. Barclays and Citi issue lots of Mastercards, and many have decent-sized minimum spending requirements.

For example, you can earn:

- Barclaycard Arrival® Plus World Elite Mastercard® – 60,000 miles after spending $5,000 within the first 90 days of opening your account

- American Airlines AAdvantage MileUp℠ Card – 10,000 American Airlines miles and receive a $50 statement credit after making $500 in purchases within the first 3 months of account opening (no annual fee!)

- Citi Premier℠ Card – 50,000 Citi ThankYou points after you spend $4,000 in purchases within the first 3 months of account opening

Chase also has the IHG® Rewards Club Premier Credit Card, which is a Mastercard.

Did you get the offer email? If so, will you pay a few bills through Plastiq to earn rewards?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!