Pay your rent on a credit card with Williampaid

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Don’t forget to follow me on Facebook or Twitter!

Disclosure: I don’t get paid by Williampaid or anyone else for this post.Update: The credit card processing fee increased from 2.45% to 2.95% on February 2, 2012

Paying a fee to earn miles or points on a credit card is often a poor value. That’s because the miles and points are worth much less than the (2% or higher) credit card convenience fee.

For example, you pay a 3% fee on your New York apartment rental of $2,500, but earn 2,500 American Airline miles.

You’ve effectively paid $75 (3% X $2,500) for 2,500 miles. This is not a good deal because you wouldn’t normally pay that price (3 cents per mile) for an American Airline mile.

Minimum SpendingHowever, paying the fee is worth it if you have no other way of meeting the minimum spending requirement on your new credit card.

For example, paying a 3% fee on the $2,500 minimum spend required to earn 50,000 American Airline miles will cost you $75.

And paying $75 for 50,000 American Airline miles is well worth it.

WilliamPaidI’ve listed Williampaid in my 40+ ways to complete minimum spending requirements, so I thought I’d try it out and post my experience paying my rent.

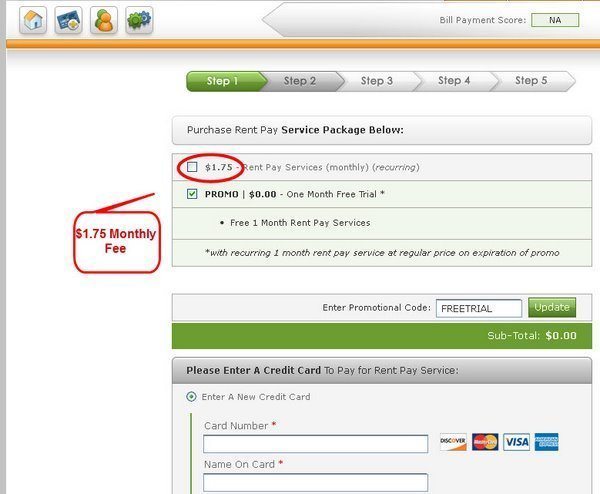

Williampaid does charge a 2.45% credit card convenience fee, but it could be worth it if you have a minimum spending requirement to complete. There is also a $1.75 monthly fee to use the service which is waived for the 1st month.

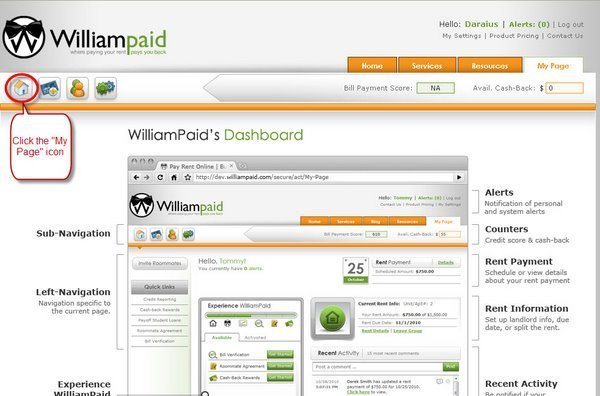

Step 1 – Sign-up Enter your name and email and select a password. Step 2.Click on My Page (the home icon on the top left).

Click on “Add your Rent Information” in the dashboard and follow the prompts to enter in your rent information.

You will be asked to enter your “Rent Due Date” and the “Mail Day” i.e. the date you want the check to be mailed.

You can even split the rent with a roommate.

Step 4Confirm your rental address and your landlord’s information.

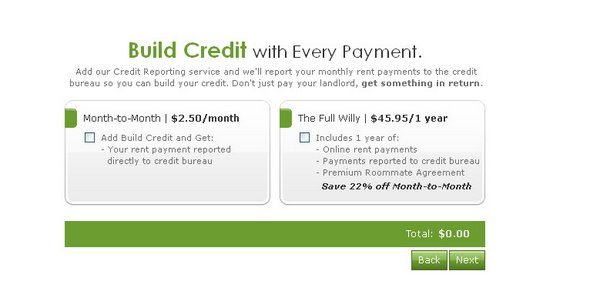

Step 5Enter in your credit card information and skip the $2.5 monthly option to report your payment to credit bureaus. I’m not sure if Williampaid reporting your payments to credit bureaus will have any impact to your credit score, unless you have no credit history.

You also have to agree to a recurring monthly charge of $1.75 (waived for the 1st month) to use the service.

Annoyingly, you have to schedule your rent payment after signing up and provide your social security number (supposedly to prevent money laundering etc.).

You also have the option of splitting the payment between 2 or more credit cards.

Step 7 – ConfirmationI got a confirmation that my rent was scheduled and I checked with my apartment and they did get paid.

I was very frustrated when I couldn’t cancel online, so I sent Williampaid a message, and within a few hours I got a reply that my account was cancelled.

But I’m still frustrated that I couldn’t cancel it myself. I like to be in control. 🙂

RestrictionsThe terms of use restrict you from making a payment more than $2,500 in a 24 hour period or more than $5,000 in a month unless you request approval.

They also restrict you from using the service to make cash advances or to liquidate gift cards. 🙂

Bottom Line: It was pretty easy to set up my rent payment using Williampaid.I didn’t like paying the 2.45% convenience fee, and wouldn’t do this on a regular basis, but it does help complete minimum spending for credit card sign up bonuses!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!