How to earn 5x points on non-bonus-category spending

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Many of the best credit cards for travel offer one or more bonus categories where you can earn 2x, 3x or even 5x points per $1 spent. Maximizing your spending in these categories is a great way to quickly build up your stash of miles and points. But since most cards only have one or two bonus categories, what about all of your spending in other categories?

In this post, we’ll look at a great strategy using the Ink Business Cash Credit Card to maximize your spending in non-bonus categories.

Use your Ink Business Cash to earn points on non-bonus-category spending

The Chase Ink Business Cash is one of the top business credit cards with no annual fee. Perhaps the most compelling reason to consider getting the Ink Cash is the card’s earning rate at office supply stores, where you’ll get 5% cash back (5x Chase Ultimate Rewards points per $1) on the first $25,000 spent in combined purchases at office supply stores and on phone, internet, and cable TV services each account anniversary year.

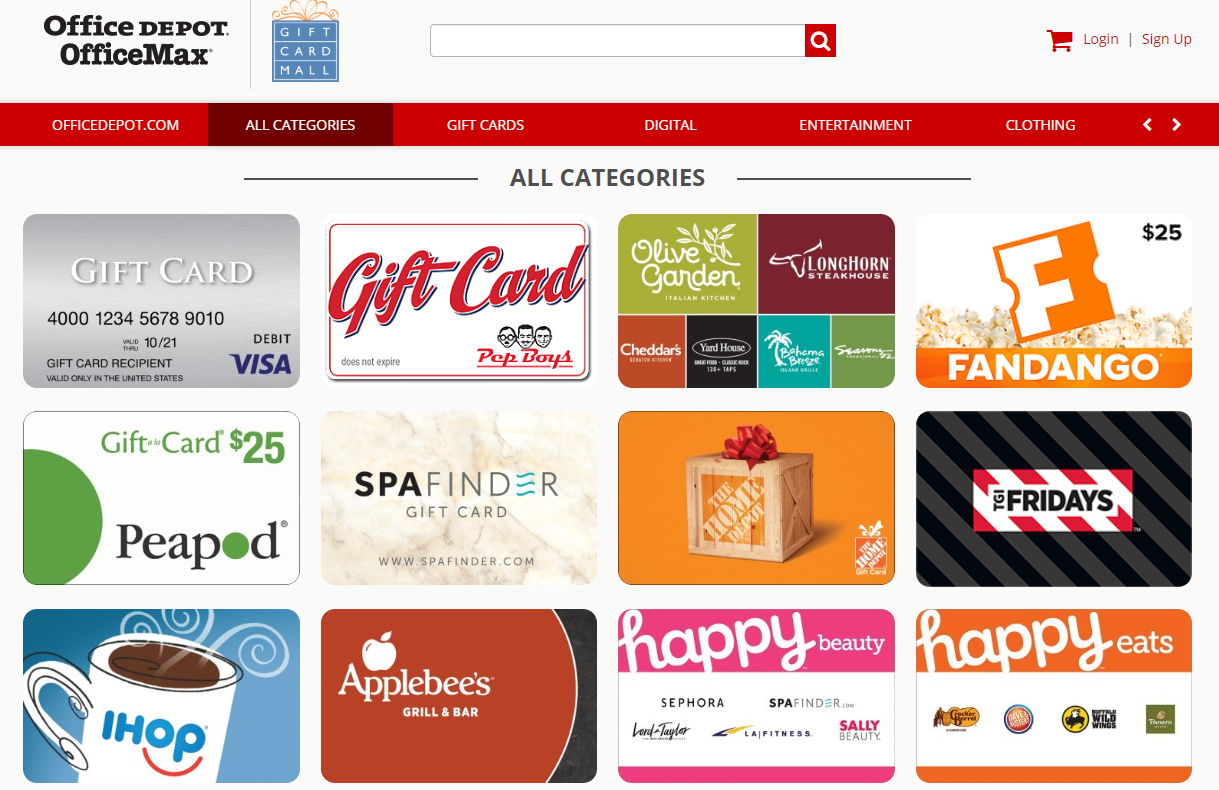

Having office supply stores as a bonus category may not seem appealing, but this feature of the Ink Cash can pay huge dividends. That’s because major office supply stores like Staples, Office Depot and Office Max sell gift cards for hundreds of different stores and retailers. So instead of using your credit card to pay for a purchase that doesn’t earn any bonus points, you can buy a gift card for that merchant through an office supply store and then use the gift card to make the purchase, earning 5% cash back (5x Chase Ultimate Rewards points per $1) in the process.

One great perk of this strategy is that you don’t have to buy the gift card in person at a physical store location. Many office supply stores allow you to purchase gift cards online and will send the gift card to you in an email within minutes of purchasing. This is great for online shopping or when you’re standing in line at a store to make a purchase.

Using the points you earn

The Chase Ink Business Cash card is primarily a cash-back card, meaning your points are worth 1 cent each. You can redeem cash back as a statement credit on your card or request a deposit to your checking or savings account.

But the best point value comes by transferring your Chase Ultimate Rewards points to an annual-fee Chase Ultimate Rewards travel card: either the Chase Sapphire Preferred® Card, Chase Sapphire Reserve®, or Ink Business Preferred® Credit Card.

After transferring points to these other cards, you can then move your points to any of Chase’s travel partners, like Hyatt or Southwest Airlines, to get way more value than if redeemed as a statement credit. You also have the option to redeem points through the Chase Travel Portal at a value of 1.25 cents each for the Sapphire Preferred and Ink Business Preferred, and 1.5 cents each for the Sapphire Reserve.

Things to keep in mind

With the Ink Cash card, you only earn the 5% cash back (5x Chase Ultimate Rewards points per $1) on the first $25,000 spent in combined purchases at office supply stores and on phone, internet, and cable TV services each account anniversary year. After that, you’ll just earn 1% back, which makes this strategy no longer useful.

Additionally, by using your Ink Cash to first purchase a gift card, you won’t have any purchase protection or extended-warranty coverage that you might have with other credit cards. The Ink Cash does have these features, but since you are actually making the final purchase of your items with a gift card, the credit card features don’t apply to the items. So think twice before buying an item that would strongly benefit from additional perks like an extended warranty.

Finally, the Ink Cash is also a great credit card option for other categories. In addition to the 5x bonus for office supply stores, you’ll also get:

- 2% cash back (2x Chase Ultimate Rewards points per $1) on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year

- 1% cash back (1x Chase Ultimate Rewards point per $1) on all other purchases

Bottom Line

With many credit cards, you are stuck earning just 1x point per $1 on your spending in non-bonus categories. But with this strategy, you can use the Chase Ink Business Cash card to purchase gift cards for hundreds of merchants and retailers, all while earning 5x points per $1 spent. You’ll earn the 5x points on up to $25,000 in combined purchases at office supply stores, and on phone, internet, and cable TV services each anniversary year. That means you can earn up to 125,000 Chase Ultimate Rewards points per year with this strategy.

For the latest tips and tricks on traveling big without spending a fortune, please subscribe to the Million Mile Secrets daily email newsletter.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!