HACK ALERT: Equifax Failed to Keep Your Personal Information Safe

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Yesterday, Equifax announced that their system was hacked, and ~143 million Americans are potentially at risk. That’s nearly 44% of the American population. In other words, an even greater percentage of folks who actually have credit!

Equifax Fumbles Sensitive Information of Millions of Americans

Link: Equifax Cybersecurity Incident Announcement

Link: How to Tell If You’re at Risk

According to the chairman and CEO of Equifax, the site was hacked sometime between mid May and July 2017. The attackers gained access to consumer information like:- Addresses

- Birth dates

- Social Security numbers

- Driver’s license numbers

Additionally, Equifax says the intruders accessed credit card information of ~209,000 consumers, and dispute documents of ~182,000 consumers.

According to the New York Times, one fraud analyst said:On a scale of 1 to 10 in terms of risk to consumers, this is a 10.

Thankfully, folks will NOT be liable for unauthorized charges. But it’s disappointing that Equifax has taken so long to let us know that our privacy has been violated (I’d like to have known sooner so I could have spent more time worrying!).

I find it pretty unnerving that personal information like my credit card information and Social Security Number can be snatched from companies that I have no choice but to depend on.

What to Do About It

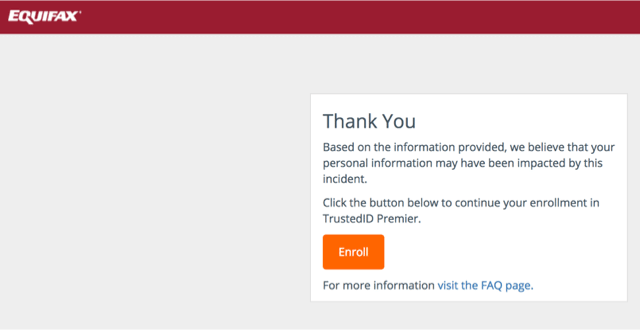

You can check if you’ve been affected by clicking here and entering your last name and the last 6 digits of your Social Security Number. If you’re affected, you will see this:

If Equifax things you’ve been impacted by the attack, you’ll get the opportunity to enroll in a program called TrustedID Premier for free.

It will take a few days to finish enrollment, and you’ll have to take some additional steps to complete the process.

With TrustedID Premier, you’ll get a free year of:

- Credit monitoring of Equifax, Experian, and TransUnion credit reports

- Copies of Equifax credit reports

- Ability to lock and unlock Equifax credit reports

- Identity theft insurance

- Internet scanning for Social Security Numbers

For folks who have questions, you can visit the Equifax Security 2017 website or call 866-447-7559. Their security line is open every day between 7:00 am and 1:00 am Eastern Time.

Note: Thanks to reader John who points out that if you enroll in the Equifax TrustedID Premier, you are waiving your right to participate in the class action lawsuit being waged against Equifax!Bottom Line

Between mid-May and late July 2017, Equifax experienced a security breach. And they waited until yesterday to let us know about it!

Intruders gained access to ~143 million Social Security Numbers, driver’s license numbers, addresses, and more! They were even able to steal ~209,000 credit card numbers.

Click this link and follow the instructions to see if you were affected!Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!