Get a $500+ Bonus With This Wells Fargo Small Business Card (And It Won’t Appear on Your Credit Report)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

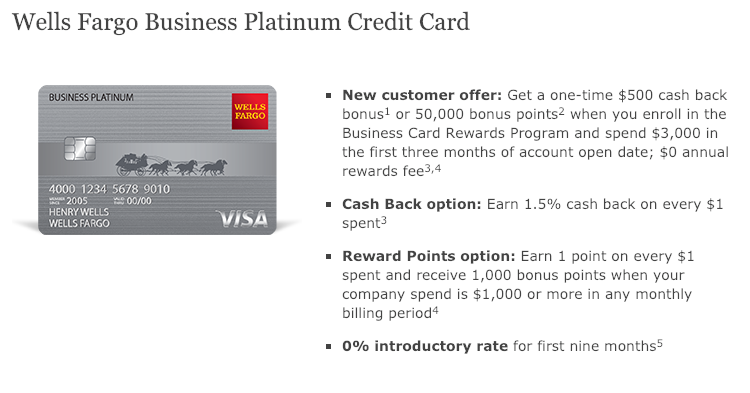

If you’ve had a Wells Fargo checking or savings account for 1+ year, you can apply for the Wells Fargo Business Platinum Credit Card, which comes with a sign-up bonus of either $500 or 50,000 points after meeting the minimum spending requirements, depending on whether you want to earn cash back or points.

That’s a good deal for a card with NO annual fee! Plus, it won’t appear on your personal credit report, which is helpful if you’re trying to stay under 5/24 in order to qualify for Chase cards.

This offer is valid through March 31, 2019. If you have small business income and you’re eligible to apply, this card could get you $500 cash or, if you opt to earn points, a coach ticket worth up to $600!

If you’re not a Wells Fargo customer, be sure to check out our picks for the best small business credit cards.

I’ll explain how the card works!

Wells Fargo Business Platinum Card With $500 or 50,000 Bonus Points

Through March 31, 2019, folks who’ve had a Wells Fargo checking or savings account for 1+ years can apply for an increased bonus on the Wells Fargo Business Platinum Credit Card. When you spend $3,000 in the first 3 months of account opening, you can choose between:

- $500 cash bonus and 1.5% cash back per $1 spent on purchases

- 50,000 points and 1 point per $1 spent on purchases, plus 1,000 bonus points when you spend $1,000+ in any billing period

As a cash back card, the sign-up bonus is worth $500 cash. And you’ll earn a flat 1.5% cash back on purchases. Simple enough.

But as a points-earning card, the sign-up bonus value is variable. You can redeem your points for gift cards, flights, rental cars, or discounts on airfare. For example:

- 10,000 points are worth $100 toward a rental car or airfare

- 25,000 points get you a round-trip coach flight within the mainland US, up to $400

- 45,000 points get you a round-trip coach flight from the US to Canada, the Caribbean, or Mexico, up to $600

- 100,000 points get you a round-trip coach, Business Class, or First Class flight to a destination of your choice, up to $1,500

Points are worth between 1 cent and 1.5 cents each. But be aware, there’s a $24 fee to book airfare, which eats into the value you’ll get. Although you get a 10% bonus when you redeem points online. So the ultimate value depends on how you redeem your points.

That said, if you spend exactly $1,000 in a billing cycle, you’ll earn 2,000 points, thanks to earning 1,000 bonus points. At the low end, that could be worth $200, which could make this closer to a 2% cash back card.

Wells Fargo business cards don’t appear on your personal credit report. So if you’re trying to stay below 5/24 and looking for new cards, this one’s worth considering.

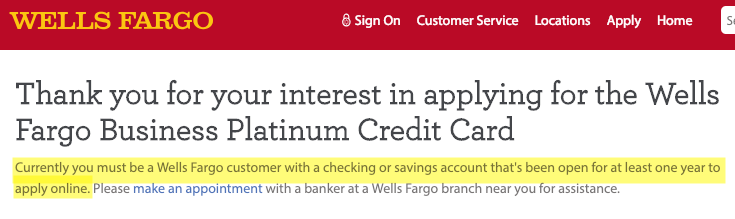

Keep in mind, you can’t even begin the application if you don’t already have a Wells Fargo checking or savings account that’s at least 1 year old.

But if you meet the criteria and have small business income, it’s worth a shot! Folks also report success getting pre-approval offers in-branch, if you have trouble applying online.

The information for the Wells Fargo Business Platinum Credit Card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Other Big Business Card Offers

Link: Which Business Credit Card Is Best? We’ve Done the Research!

As good as this deal is, don’t worry if you have to miss out. Consider these instead:

- Ink Business Preferred℠ Credit Card – 80,000 Chase Ultimate Rewards points after you spend $5,000 on purchases in the first 3 months from account opening

- Ink Business Cash℠ Credit Card – $500 cash back (50,000 Chase Ultimate Rewards points!) after spending $3,000 on purchases in the first 3 months of account opening

- Capital One® Spark® Miles for Business – 50,000 Spark miles after spending $4,500 in the first 3 months of account opening.

- Hilton Honors American Express Business Card – 130,000 Hilton points after making $3,000 in eligible purchases within the first 3 months of account opening

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!