Free FICO Scores for Barclaycard Cardholders

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers. [Disclosure: Emily and I get a referral for the links in this post. You don’t have to use our links, but we’re very grateful when you do!]You can get your TransUnion FICO credit score for free, if you’re a Barclaycard Cardholder!

What Is a Credit Score?

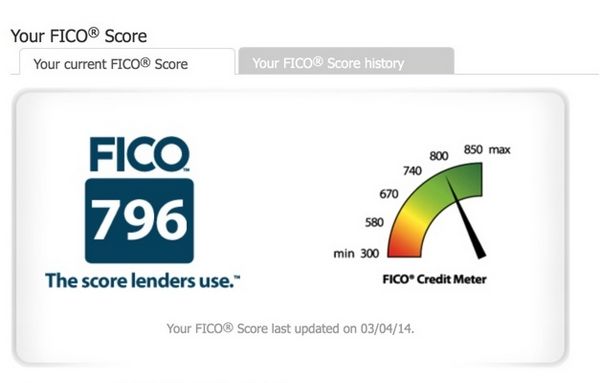

Your credit score is usually a 3 digit number the banks use to predict whether you’ll be paying back loans. Fair Issac Corporation (FICO) issues scores from 300 to 850.

In the US there are 3 main credit bureaus:

- Equifax

- TransUnion

- Experian

What’s a Good Number?

The higher your score, the better…up to certain point.

A score of 675 is better than a score of 575. And a score of 760 gets you access to lower interest rates than a score of 675.

A score of 760 can get you the same low rates as those with a score above 760. So you don’t need a score higher than 760, except to brag. So when applying for credit cards, it’s OK if your credit score temporarily goes down a few points. And usually being approved for new cards increases your score in the long run!

How Is Your Credit Score Calculated?

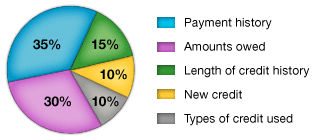

According to the FICO website, your credit score is determined by:

- 35% Payment History

- 30% Amounts Owed

- 15% Length of Credit History

- 10% New Credit

- 10% Types of Credit

Your Payment History (paying your debts on time) is the most important part of your credit score. So it’s a good idea to pay your bills on time.

Amounts Owed is the next most important part of your score. It’s okay to have some debt. But if most of your available credit is being used (known as a high credit utilization), it could mean you have more debt than you should and that you might not pay back your loans.So it is very important NOT to max out your credit cards so you can have a low utilization rate. For example, if my credit limit is $10,000 I try to keep my charges under $1,000 to have a utilization rate of 10% or lower.

Your length of credit history is partially determined by the average age of your accounts. So consider getting no-annual fee cards that you’ll hold for many years.

Free FICO ScoreIf you have one of the following Barclaycard credit cards, you can get your TransUnion FICO score for free:

- Barclaycard Carnival

- Barclaycard Frontier

- Barclaycard Lufthansa

- Barclaycard NFL

- Barclaycard Rewards

- Barclaycard Ring™ Mastercard®

- Barclaycard US Airways

- Wyndham Rewards Visa

The Barclaycard Arrival Plus® World Elite Mastercard® is a cash back travel card with no foreign transaction fees. You earn “miles” but they aren’t transferrable to airline miles. But you can redeem them for statement credits at 0.5 cents per mile (poor value) or 1.1 cents per mile if you redeem for travel.

You earn 2 miles for every $1 you spend so you’re getting 2% cash back for each purchase. And you get an extra 10% of your miles back when you redeem for travel. So you’re earning ~2.2 cents per $1 spent on travel expenses or about 2.2% back when redeemed for travel.You can get 40,000 miles which is worth $440 in travel or a $200 statement credit. Here’s my review of the Barclaycard Arrival Plus® World Elite Mastercard®.

How to Get Your Free TransUnion FICO Score

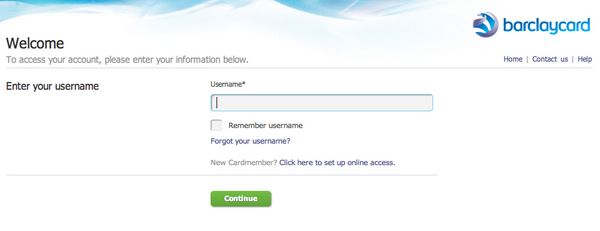

Step 1 – Log in to Your Barclaycard Account

Log in to your Barclaycard Account.

Or you can access your score directly via this link.

Step 2 – Click on “Tools and Education”

Click “Tools and education.”

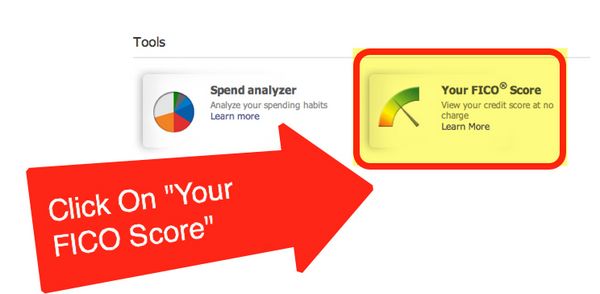

Step 3 – Click on “Free FICO Score”

Click on the “Free FICO Score” button.

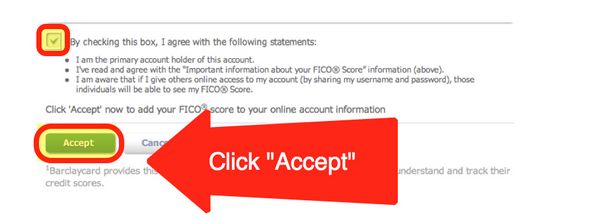

Step 4 – Check the Box and Click “Accept”

Read the terms and conditions, check the box, and click “Accept” to agree.

And your free FICO score will appear. Mine was 796, which did make me grin!

Bottom Line

You can get your free FICO score from TransUnion if you have certain Barclaycards including the Barclaycard Ring™ Mastercard®.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!