Myth Busted! Here’s How Collecting Credit Card Miles Increased My Friend’s Credit Score By 50+ Points

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

When I tell my friends and family how many credit cards I have the first question I almost always get is – “doesn’t that hurt your credit score?” And my answer is always the same, “no, my credit score has actually gone up since I’ve started collecting credit card miles.”

Recently my friend, Adam, was approved for The Platinum Card® from American Express. As an active duty member of the military, he can earn tons of travel perks with the card and get the annual fee waived (See Rates & Fees) (I’ll explain more about this later). But the icing on the cake is when the card hit his credit report his score jumped from 790 to 847!

Your credit score isn’t guaranteed to go up if you apply for a credit card, you’ll still need to be responsible with your credit, pay your bills on time, and be sure to never carry a balance because credit card interest is an absolute killer.

I’ll explain how your credit score is calculated and why opening a card could give it a nice boost.

How Your Credit Score Is Calculated

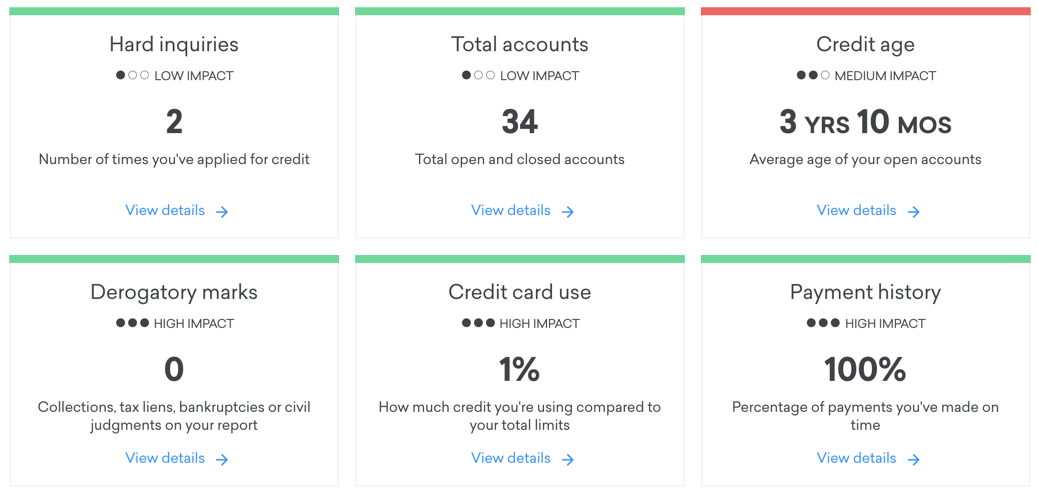

First off, there are different credit scores out there, but by far the most popular one is your FICO score. And they calculate your credit score based on 6 main factors:

- Hard inquiries – How many times banks or other lenders have looked at your credit. A credit card application will result in a hard pull, but opening a bank account usually only results in a soft pull, which won’t impact your score.

- Total number of accounts – This will include credit card accounts, mortgages, students loan, etc.

- Age of accounts – This is the average age of all of your accounts

- Payment history – It’s the percentage of your payments that have been made on time

- Credit usage ratio – How much of your available credit are you currently using

- Derogatory marks – Do you have any bankruptcies, foreclosures, etc. on your report

But these factors are not all weighted evenly. Paying your bills on time, having a clean credit history, and not using much of your available credit has a much bigger impact on your score than hard inquiries or the age of your accounts.

My wife and I both have credit scores over 800, even though we’ve opened lots of credit cards in the past 7+ years, which means we have a lot of accounts and a low average age of accounts.

Your credit utilization ratio has such a high impact on your score that when you have access to more credit it can greatly improve your credit score. Here’s an example, let’s say at the end of your credit card billing cycle you have $1,000 on the card. Even if you pay your bill in full on the due date, that month it will show a $1,000 balance on your credit report.

Now, if you only have a $5,000 credit limit your credit utilization ratio will be high at 20% ($1,000 balance / $5,000 credit limit). Even though you’re paying your bills on time, your credit score might suffer. But if you opened a credit card or two and increased your available credit to $15,000, that same $1,000 balance would only be using ~7% of your available credit. So if you open a new account and see a huge jump in your credit score, this is likely why.

Why the AMEX Platinum Card Is the Best Travel Rewards Card If You’re an Active Duty Military Member

Apply for the AMEX Platinum card

First off, the AMEX Platinum card has a hefty $695 annual fee (See Rates & Fees). Of course with such a large fee comes all sorts of perks like:

- 5 AMEX Membership Rewards points per $1 spent on airfare (booked either directly with the airline or through AMEX Travel)

- 5 AMEX Membership Rewards points per $1 spent on prepaid hotels booked on AMEX Travel

- Up to $200 annual airline incidental fee credit on your selected airline

- Up to $200 in Uber credits per calendar year

- Up to $100 credit for Saks Fifth Avenue per calendar year

- Statement credit every 4 years after you apply for Global Entry ($100) or TSA PreCheck ($85)

- Gold Elite status with Hilton (free breakfast!)

- Gold Elite status with Marriott (no free breakfast, but you’ll get complimentary internet, and access to late-out and basic upgrades is they’re available)

- Access to all sorts of airport lounges (here is a step-by-step guide on how to find which lounges you’ll have access too)

The AMEX Platinum cards (there is also The Business Platinum Card® from American Express) are hands down, the best credit card to get if you want airport lounge access. Not only will you get access to 1,000+ Priority Pass lounges, but you’ll also get free entry into Delta lounges (when you’re flying with Delta), and AMEX Centurion lounges, which are arguably the best airport lounges out there. Enrollment required for select benefits.

All those perks don’t even include the intro bonus you can earn with the card, which is 100,000 Membership Rewards® points after you spend $15,000 on eligible purchases with the Business Platinum Card within the first 3 months of Card Membership. Just to give you an idea of what you can do with those points, you could use them to book 2 round-trip flights to Hawaii. Or you could transfer 55,000 AMEX points to Aeroplan and book a one-way Business Class flight to Europe.

So it’s easy to see how you can justify paying the annual fee. But the best part is, if you are an active duty military member (or a spouse of one if the credit is extended jointly) AMEX will waive the annual fee for you on all of their cards (Amex Business – Rates & Fees). That’s a HUGE deal!

Note: You can submit a request to have your fee waived here.

If you’ve got any friends on active duty, do them a favor and send them this article. You can also read these articles on the ins and outs of how to use the AMEX Platinum card’s perks (it’s not always straight forward):

So that’s it right there. Opening a credit card can increase your credit score and if you’re an active duty military member, you can’t beat American Express travel credit cards.

If you’re interested in learning more about traveling cheaply using miles & points, then please subscribe to our newsletter.

For rates and fees of the Amex Platinum card, please click here.

For rates and fees of the Amex Business Platinum card, please click here.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!