Earn 30,000 Miles (Enough for 12 Short Flights!) With This Best-Ever Spirit Card Offer

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

If you’re in a city served by Spirit Airlines, you might consider getting their credit card to book award flights for as little as 2,500 Spirit miles each way.

Right now, the Bank of America Spirit Airlines card has an offer for up to 30,000 Spirit miles after meeting spending requirements. That’s enough for 12 short-haul flights!

Of course, not everyone is a fan of Spirit Airlines and their short mileage expiration policy of only 3 months. And the card is from Bank of America, so opening this one could prevent you from earning other sign-up bonuses.

Here are the offer details!

30,000 Spirit Airlines Miles Through Bank of America

Apply Here: Bank of America Spirit Airlines Card

Right now, you’ll earn 15,000 Spirit Airlines miles when you open the Bank of America Spirit Airlines card and make a single purchase. And if you spend $500 on purchases in the first 90 days of account opening, you’ll get another 15,000 miles.

This offer of is the highest there’s been! And the card also comes with:

- 2X Spirit Airlines miles on all purchases

- 5,000 bonus miles if you spend $10,000 in a cardmember year and pay the annual fee

- Access to deeply discounted award flights only for credit cardholders

The $59 annual fee is waived the first year.

This is actually a great offer if you know your way around Spirit Airlines’ fees and service quirks. And it’s double the usual bonus!

What Can You Do With 30,000 Spirit Airlines Miles?

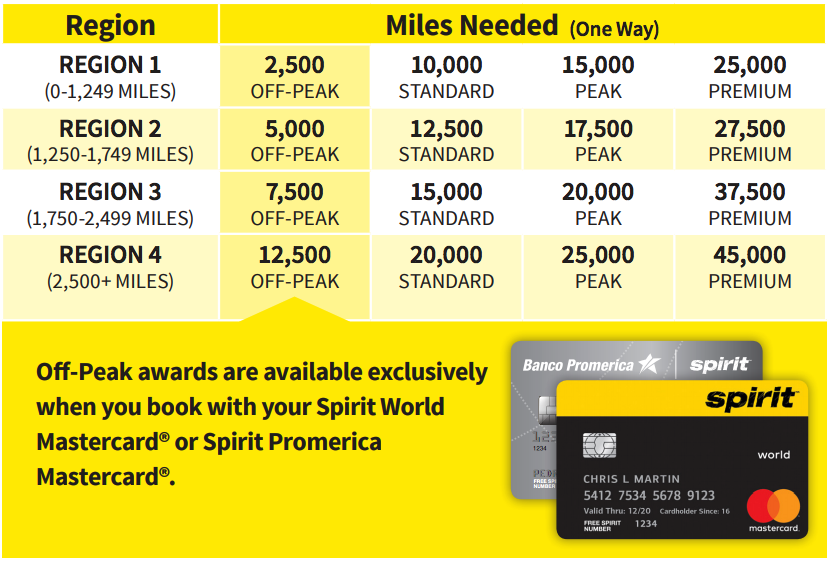

Spirit Airlines has a distance-based rewards program. And they give a hefty discount of 50% off or more if you have their credit card and can travel off-peak.

For example, you’d typically need 10,000 Spirit Airlines miles for a one-way coach flight under 1,250 miles. But if you have their card, that drops to only 2,500 Spirit Airlines miles each way for an off-peak flight!

That means the sign-up bonus on the Bank of America Spirit Airlines Card is enough for 12 short-haul award flights (30,000 / 2,500), which is an incredible deal!

You’ll get the best price if you book further in advance. And some airports, like Fort Lauderdale and Chicago-O’Hare (ORD), have lots of flight options each day.

Depending on your travel style, you might consider having this card, if only to get huge discounts off the normal award prices. And for short flights, flying Spirit Airlines really isn’t so bad.

What to Know Before You Apply

Spirit Airlines miles expire after 90 days of no activity. That’s a short expiration policy. But as long as you put 1 purchase on your card each month, that’s enough to keep all your miles from expiring – even something like your Netflix subscription, for example.

Also, this card is from Bank of America. They will only approve you for 2 cards every 2 months, 3 cards every 12 months, and 4 cards every 24 months. So if you have your eye on other Bank of America cards, keep those rules in mind.

If you’re not into Spirit Airlines, check out our top card offers this month, which include fantastic cards like the Chase Sapphire Preferred Card and Southwest Rapid Rewards® Premier Business Credit Card.

What do you think of the Spirit Airlines card?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!