Chase Ultimate Rewards Points Can Be Even Better Than Flying an Ultra Low Cost Carrier

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

INSIDER SECRET: With Chase Ultimate Rewards points, you can book travel through Chase’s travel portal at a value of up to 1.5 cents per point. That gives you far more options than earning miles from a single loyalty program.

While planning a recent trip, I ended up booking separate one-ways instead of round-trip tickets for me, my daughter and my mother to fly to Denver. On the outbound flight, it made sense to fly the low-cost carrier Frontier, but for the return, I actually saved money ($222 to be exact) by using my Chase Ultimate Rewards points to fly United.

Ultimate Rewards points have rescued me time and time again, as have other flexible rewards currencies. So it’s no wonder a majority of the best credit cards for travel earn flexible rewards.

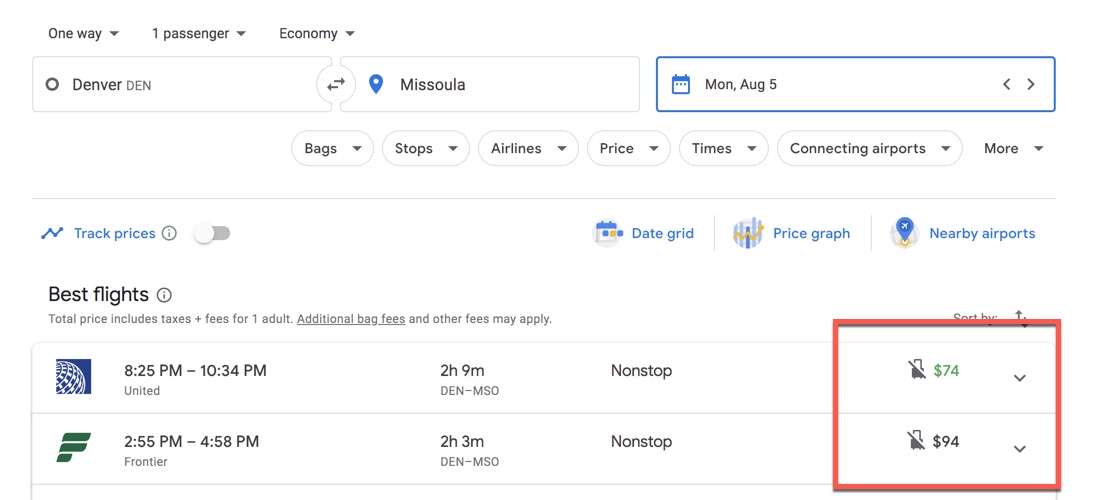

As you can see, a one-way ticket on United was $74 and on Frontier, the flight was $94. The United flight was in basic economy, so for the most part, it carried the same restrictions as the Frontier flight (no carry-on bag, no seat selection, etc.). I felt I was comparing apples to apples.

But having the Chase Sapphire Reserve, I knew I could use my Ultimate Rewards points to book the United flight through Chase’s travel portal and get 1.5 cents per point for my Ultimate Rewards. The $74 seat on United would only end up costing 4,933 Ultimate Rewards points — a great deal considering one-way tickets within the US normally cost 12,500+ United miles.

Here are my favorite cards for earning Chase Ultimate Rewards points:

- Chase Sapphire Preferred Card (Best Ultimate Rewards credit card for beginners)

- Chase Sapphire Reserve (Best Ultimate Rewards credit card for frequent travelers)

- Ink Business Preferred Credit Card (Best Ultimate Rewards credit card for small-business owners)

I also knew that I could outsmart basic economy by using part of the incidentals credit from my The Business Platinum Card® from American Express to cover the cost of a checked bag.

Be sure to check out our list of the best credit cards to avoid baggage fees. Free-checked-bag perks are common with cobranded airline credit cards, but don’t forget about the other cards that can help you avoid charges for checked baggage. American Express offers several cards that include annual statement credits to cover incidental fees for your preferred airline, including:

- The Platinum Card® from American Express: Up to $200 annual statement credit for incidental purchases on one selected airline (enrollment required)

- The Business Platinum Card® from American Express: Up to $200 annual statement credit for incidental purchases on one selected airline (enrollment required)

- Hilton Honors Aspire Card from American Express: Up to $250 annual airline-fee credit with the airline of your choice to cover incidental air travel fees (enrollment required)

The information for the Hilton Aspire card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

These statement credits can cover all sorts of fees like inflight meals, lounge passes and checked baggage fees — but if you want priority boarding you’ll have to choose a cobranded airline credit card.

I can’t emphasize enough how important it is to make earning flexible rewards part of your miles-and-points strategy. If you want to learn more about earning and using Chase Ultimate Rewards points, take a look at these guides:

- Chase Ultimate Rewards Review

- Chase Points Value

- Best Way to Use Chase Points

- Chase Transfer Partners

- How to Earn Chase Ultimate Rewards Points

- How to Setup a Chase Ultimate Rewards Account

- How to Use Chase Ultimate Rewards Points

- Do Chase Ultimate Rewards Points Expire?

For the latest tips and tricks on traveling big without spending a fortune, please subscribe to the Million Mile Secrets daily email newsletter.

Featured image courtesy of stockphoto mania/Shutterstock.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!