Steal Our Airfare Strategy: Earn 5X Points on One Card + Get Superior Trip Delay Coverage With a Totally Different Chase Credit Card

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

We love to get free flights using travel miles and points. But when buying airfare, it’s smart to have a strategy. I’ll share how some folks on our team get awesome trip delay coverage using a Chase credit card (the Chase Sapphire Reserve®), while at the same time earning 5X points on a totally different credit card — all for the same flight!

This is how you get the best of both worlds — the points you want AND up to $500 for a 6+ hour delay.

Use This Chase Credit Card for Great Trip Delay Insurance

- Chase Sapphire Reserve® gives you peace of mind when flying.

Now check out what’s in the Chase Sapphire Reserve “Guide to Benefits” to unlock the secret. I’ll put the key in italic text.

“Trip Delay Reimbursement covers up to a maximum of $500 dollars for each purchased ticket for reasonable expenses, on a one-time-basis, incurred if your Covered Trip is delayed by a Covered Hazard for more than 6 hours or requires an overnight stay.

To be eligible for this coverage, you need to purchase either a portion or the entire cost of your Common Carrier fare using your Account. Coverage is in excess of any expenses paid by any other party, including applicable insurance.”

So there it is… when you fly, pay for at least part of your flight with the Sapphire Reserve Chase credit card. And then if your flight is delayed 6+ hours for reasons like equipment failure, inclement weather, or a labor strike, you can get reimbursed up to $500 per ticket for stuff like meals, hotel, toiletries, medication, and other personal items that the airline didn’t give you to make up for your misery.

Even if you only put a small amount of the fare on your Chase Sapphire Reserve, you’ll qualify for the trip delay coverage. This is why many folks in our hobby pay the taxes and fees (a portion of the ticket) on award tickets with their Chase Sapphire Reserve. The same principle applies if you’re using another, second method of payment along with the Sapphire Reserve.

And Use This Other Travel Credit Card to Earn 5x Points per $1 on Airfare

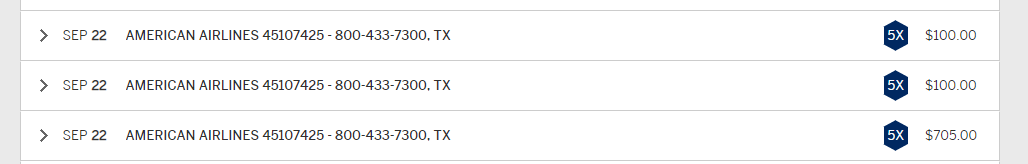

With The Platinum Card® from American Express you earn 5X American Express Membership Rewards points on flights you book directly with airlines or with American Express Travel.

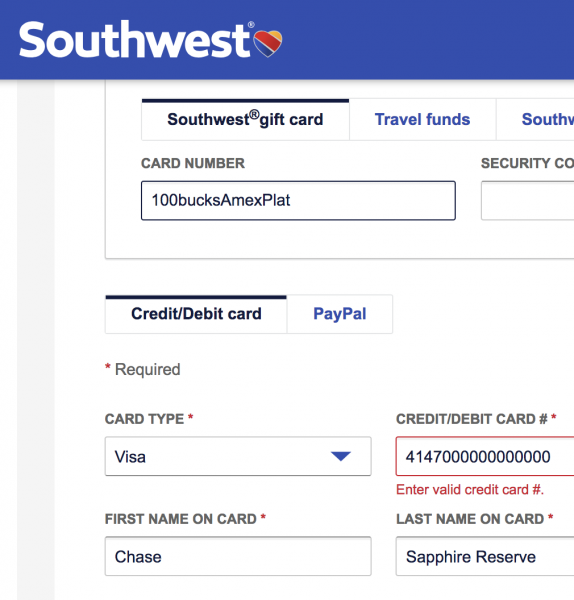

So you would put part of your flight on Chase Sapphire Reserve® and then rest on The Platinum Card® from American Express. But there are very few airlines that will allow you to split payment for a ticket between 2 credit cards, even if you call in.

But there’s a workaround. Folks report gift cards from certain airlines, including American Airlines, Delta, and Southwest, will earn 5X AMEX Membership Rewards points when you pay with your AMEX Platinum card.

Then, you can use the gift cards to pay for most of your airfare. And just leave a few dollars extra to pay with your Chase Sapphire Reserve to get the trip delay protection!

Note: Putting the entire flight on the Chase Sapphire Reserve® would still be a great deal because with Chase Sapphire Reserve® you earn 3X Chase Ultimate Rewards points on travel. It’s just about which points (Chase or AMEX) you like better.

Using this strategy you can earn AMEX points and feel safe with the Chase Sapphire Reserve® $500 per ticket trip delay benefit. Because AMEX Platinum has $0 per ticket trip delay insurance.

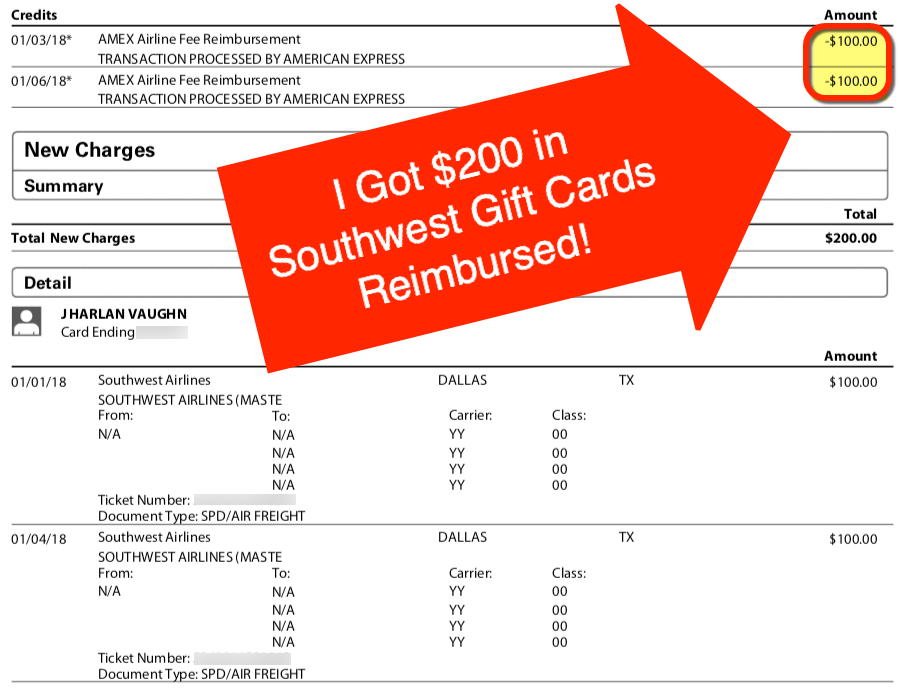

Hot Tip: With The Platinum Card® from American Express you get an Airline Fee Credit of up to $200 a year in baggage fees and more on your selected airline. Technically AMEX says, “This benefit doesn’t offer credit toward airline tickets, mileage points purchases or mileage points transfer fees, gift cards, upgrades, duty-free purchases, or award tickets.”

But…

Folks on our team have been reimbursed for two $100 American Airlines gift cards.

Meghan on our team has used her credits for Delta gift cards. And both Harlan and Keith on our team got two $100 Southwest gift cards reimbursed. As far as I know, these are the only 3 airlines where this trick works.

Bottom Line

Let’s be completely straightforward, the Chase Sapphire Reserve® and The Platinum Card® from American Express each have significant annual fees. So this travel credit card combination is for power points travelers. Each card has awesome perks and point multipliers. We recommend these 2 cards for people who know they’ll make full use of the benefits.

And this trick enables you to get the best of both credit cards at the same time.

But if you’re relatively new to using travel credit card points or unsure how much you’ll travel — we strongly suggest starting with the Chase Sapphire Preferred® Card. While its trip delay insurance kicks in after 12 hours (instead of 6 hours with the Reserve).

Also, if you DO love it (like I do!) you always have the option to “upgrade” it to the Chase Sapphire Reserve later on.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!