New Helpful Capital One Tool for Small Business Owners (Check Your Business Credit Reports for Free)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Whether or not you’re a Capital One customer, Capital One has a new tool to help you keep your small business healthy.

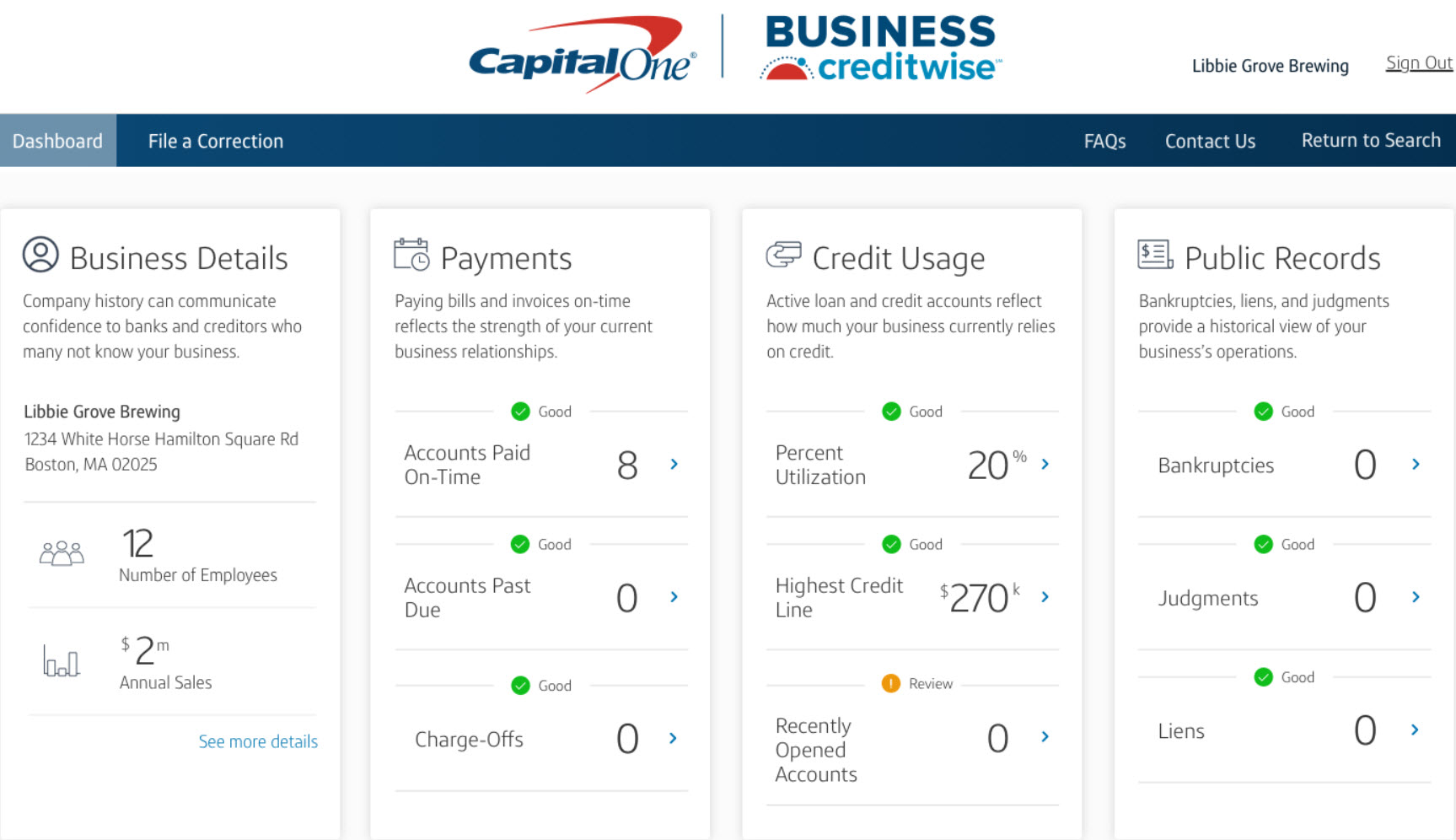

They’ve introduced a credit report monitoring feature called Business CreditWise. Most similar tools will give you a free preview of your business credit report. But Business CreditWise will give you full access, and allow you to fix data inaccuracies for totally free.

You can subscribe to our newsletter for other useful developments in the credit card world.

Capital One Business CreditWise

Capital One shouts from the rooftops that Business CreditWise is the easiest-to-use tool of its kind.

As you might expect, it’s similar to their previously existing CreditWise tool for monitoring your personal credit. Jenn Garbach, the lead of this new tool, says small business owners can use it to manage their financial reputation. With this tool:

[Business owners] are empowered to negotiate the most favorable trade terms and rates as they go out there to grow and manage their business.

She also says Business CreditWise does NOT give you a business credit score. It instead shows the things that are impactful to your business credit score. The most critical parts of your business credit report are:

- Payment history

- Credit utilization

- Public records

Your business credit will not be affected by using this tool. It will help you interpret your business credit report through the eyes of lenders, and if you see any inaccuracies, you can fix them for free, with no hidden fees or gimmicks or pushy ads.

And while it’s great that you don’t need to be affiliated in any way with Capital One to use this tool, keep in mind that Capital One does have a few small business credit cards that can help you travel for free:

- Capital One® Spark® Miles for Business – 50,000 miles (worth $500 in travel) after spending $4,500 on purchases within the 3 months of account opening

- Capital One® Spark® Cash for Business – $500 cash bonus after you spend $4,500 on purchases within 3 months of account opening

- Capital One® Spark® Miles Select for Business – 20,000 miles (worth $200 in travel) after spending $3,000 on purchases within 3 months of account opening

- Capital One® Spark® Cash Select for Business – $200 cash bonus after you spend $3,000 on purchases within 3 months from account opening

The information for the Capital One cards listed has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!