Amex Marriott cards added: Earn 10x points at gas stations and restaurants

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

During this era of slowed air travel and social distancing, Chase, Amex and Marriott are doing their part to encourage road-tripping and dining at restaurants. Marriott credit card holders now have some great promotions to rack up bonus points across popular bonus categories.

Marriott Amex cards 10x points bonus categories

Today, American Express has added bonus earning for its Marriott credit cards, bringing up points earnings on those cards to the same level that Chase Marriott cards have been earning since July 15.

You’ll now earn 10x Marriott points on purchases made at gas stations, U.S. restaurants and Marriott Hotels on up to $7,500 in purchases in each category. Since these are Amex Offers, you’ll need to log into your Amex account and manually add the offers to your Marriott credit cards. Eligible Amex Marriott cards include:

- Marriott Bonvoy Brilliant™ American Express® Card

- Marriott Bonvoy Business™ American Express® Card

- Marriott Bonvoy Card from American Express

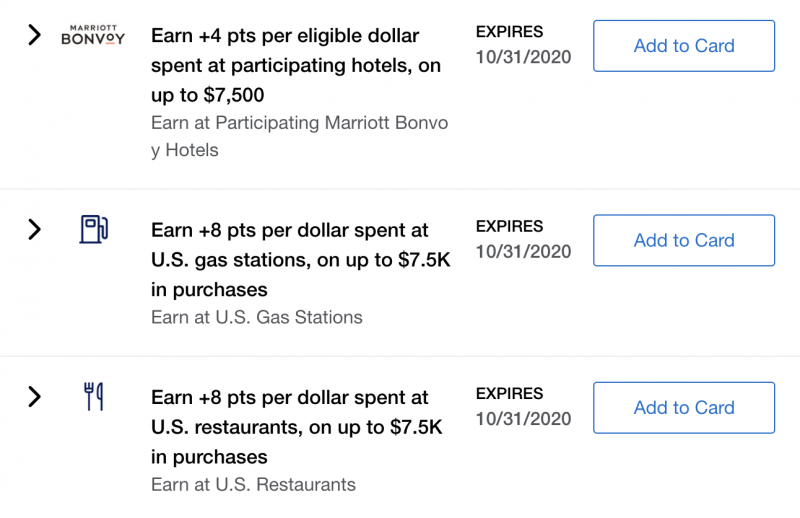

Here are the Amex offers attached to my Marriott Bonvoy Card from American Express (formerly the SPG Amex card). Offers will appear different on each card, but they will effectively add up to 10x points (base points from the card’s normal categories plus bonus points through the Amex offer).

You’ll have from today through October 31, 2020 to earn the bonus points through Amex Marriott cards, that’s six more weeks after the offers on Chase Marriott cards expire.

It also appears that unlike most Amex Offers which only allow you to add one offer to one card even if you see the offer available to multiple cards, you’ll be able to add these offers to each Amex Marriott card you have. If you’re able to maximize this deal on just one category on one card, you’ll end up with 75,000 Marriott points which are worth $600 according to our points valuations.

Marriott Chase cards 10x points bonus categories

Between July 15 and September 15, 2020, you’ll earn 10 Marriott points per dollar at gas stations and restaurants when you swipe a Marriott credit card issued by Chase. That’s a huge improvement over the original earning rate you’ll get with Marriott cards. For example, the Marriott Bonvoy Boundless™ Credit Card offers 2 points per dollar with gas stations and restaurants. This promo will give you 5x the normal rate for your spending!

We estimate the value of Marriott points to be 0.8 cents each. By earning 10 Marriott points per dollar, you’re essentially getting an 8% return on your spending.

Doctor of Credit first reported the news and found the promotion page, which appears to only be for Chase credit cards.

Specifically, the promo page lists these cards as being eligible for the promotion: Marriott Bonvoy Boundless™ Credit Card, Marriott Bonvoy™ Premier Plus Business Credit Card, The Ritz-Carlton™ Credit Card, Marriott Bonvoy™ Credit Card, Marriott Bonvoy™ Premier Credit Card, and Marriott Bonvoy Business™ Credit Card.

You can now register for the deal on Chase’s promotion page, make sure to do this before July 15 so you can start earning bonus points once the deal goes live.

Here’s what you need to know about this deal:

- You’ll earn 10 points per dollar at gas stations and restaurants on up to $3,500 in total combined purchases (a total of 35,000 points)

- Beware that not all gas stations or restaurants may code as such. For example, if you eat at a restaurant inside a hotel, the purchase may code as a hotel purchase (read the Chase FAQ page for more details)

- Purchases submitted through third-party payment accounts, mobile or wireless card readers, online or mobile digital wallets, or similar technology will not qualify in a rewards category if the technology is not set up to process the purchase in that rewards category

- Purchases posted to your account with a transaction date during the offer period are eligible for this offer. Delays by the merchant, such as shipping, could extend the transaction date beyond the offer period

- Bonus points should post within eight weeks of making a qualifying purchases

- “Purchases” do not include balance transfers, cash advances, travelers checks, foreign currency, money orders, wire transfers or similar cash-like transactions, lottery tickets, casino gaming chips, race track wagers or similar betting transactions, any checks that access your account, interest, unauthorized or fraudulent charges, and fees of any kind, including an annual fee, if applicable

Bottom Line

Remember, gas stations sell a lot of things besides gas (think third-party gift cards like Amazon, Starbucks or Visa which can be used anywhere). Even purchases made within their convenience store should count as a gas station purchase. If you’ve got the right strategy, spending $3,500 on a Chase Marriott card by September 15 at gas stations alone shouldn’t be too difficult.

If you have Amex or Chase Marriott credit cards, these are some great deals to take advantage of. If you were going to hit the $3,500 cap with a Chase card, you’ll now have the opportunity for another $7,500 of bonus spend to rack up some serious Marriott points..

Subscribe to our newsletter to be alerted of new ways to rack up miles and points quickly.

Lead photo by by Rawpixel.com/Shutterstock

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!